Dear Readers,

Welcome to the eighth edition of the Fiat Bridge newsletter.

As 2025 comes to a close, cryptocurrency markets show quiet strength amid low holiday trading volumes. Bitcoin holds steady near $88,000, while the total market cap sits at $3.06 trillion, proof that digital assets have become a lasting part of global finance.

This final edition of the year looks at key developments shaping the outlook for 2026: cautious signals from the Federal Reserve, smart moves by large investors, new ways to access decentralized AI, and continued corporate adoption of Bitcoin. These stories highlight how crypto is building stronger ties with traditional finance.

Let’s dive in.

Market Pulse

Total Crypto Market Cap: ~$3.06 Trillion (up 0.9% in the last 24 hours)

Bitcoin Dominance: ~56.5% (BTC market share against the rest of the market)

Bitcoin Price: ~$88,231 (up 1.2% in the last 24 hours)

Ethereum Price: ~$2,965 (up 0.7% in the last 24 hours)

Solana Price: ~$125 (up 1.2% in the last 24 hours)

Total Stablecoin Supply: ~$307 Billion (no change in the last 24 hours)

DeFi TVL: ~$117 Billion (no change in the last 24 hours)

24h Trading Volume: ~$96 Billion

Fear & Greed Index: 23 (extreme fear)

Top Stories of the Day

Fed's Divided 2026 Outlook: Limited Cuts, Mixed Crypto Signals

Bitcoin Whale Sells $330M ETH, Opens $748M Longs on BTC, ETH, SOL

Grayscale Files for First U.S. Bittensor ETP as Decentralized AI Gains Traction

Metaplanet Ends 2025 with Big BTC Buy, Holdings Top 35,000 BTC

1. Fed's Divided 2026 Outlook: Limited Cuts, Mixed Crypto Signals

The Federal Reserve enters 2026 with internal divisions on monetary policy, creating uncertainty for risk assets like cryptocurrencies. Recent FOMC (Federal Open Market Committee) minutes and projections reveal policymakers split on the pace of interest rate reductions, with the December 2025 "dot plot" showing equal support for zero, one, or two cuts in 2026.

The median forecast points to the federal funds rate ending 2026 at 3.4%, implying just one 25-basis-point cut from the current range of 3.5%-3.75% (following three cuts in 2025). Factors such as persistent inflation, potentially exacerbated by tariffs, and a robust labor market are cited as reasons for caution, with some officials advocating no changes for some time.

For crypto markets, lower rates typically boost demand for higher-yielding or risk-on assets, as traditional fixed-income options like bonds become less appealing. Analysts suggest that even one or two cuts could catalyze inflows, particularly from retail investors, by improving liquidity conditions.

However, a higher-for-longer stance risks keeping Bitcoin range-bound near $85,000-$90,000 early in the year, with thin trading volumes and downside pressure if macroeconomic data disappoints. Market probabilities reflect skepticism: only 15%-20% chance of a January cut and around 45%-52% for March.

This outlook underscores crypto's sensitivity to central bank policy, reminiscent of past cycles where easing fueled rallies.

2. Bitcoin Whale Sells $330M ETH, Opens $748M Longs on BTC, ETH, SOL

A prominent large holder, known as a whale (an entity controlling significant asset volumes capable of influencing prices), has executed notable trades amid year-end positioning. Controlling approximately $11 billion in Bitcoin, the whale sold $330 million worth of Ethereum (ETH) while establishing leveraged long positions, bets on price increases, totaling $748 million across Bitcoin (BTC), ETH, and Solana (SOL). The largest portion, $598 million, is a long on ETH entered at $3,147, with potential liquidation (forced closure) if ETH drops below $2,143.

Such moves often signal conviction in select assets. Despite the ETH sale, the substantial ETH long suggests the whale views the dip as a buying opportunity, while allocations to BTC and SOL indicate broader optimism in layer-1 networks (base blockchains supporting applications). Solana, known for high-speed transactions and low costs, has gained traction in DeFi and NFTs (non-fungible tokens, unique digital assets).

Whale activity is closely watched in crypto markets, as it can precede trends or amplify volatility. This rotation from spot ETH holdings to leveraged exposure across top tokens may reflect portfolio rebalancing ahead of anticipated 2026 liquidity improvements.

3. Grayscale Files for First U.S. Bittensor ETP as Decentralized AI Gains Traction

Grayscale Investments has taken a significant step toward mainstreaming decentralized artificial intelligence (AI) by filing with the SEC for the Grayscale Bittensor Trust (ticker: GTAO), the first U.S. exchange-traded product (ETP) offering direct exposure to Bittensor's native token, TAO.

This follows the project's first halving event in mid-December 2025, a programmed reduction in new token issuance, similar to Bitcoin's mechanism, which halved TAO rewards and contributed to price stabilization around $222.

Bittensor is a blockchain network designed to decentralize machine learning development. Unlike centralized AI platforms dominated by big tech, it uses crypto-economic incentives: participants contribute computing power, models, or data to specialized subnets (application-specific chains) and earn TAO rewards.

This creates an open marketplace for AI resources, fostering innovation without reliance on single entities. Its importance lies in addressing AI centralization risks, enabling global, permissionless collaboration, potentially transformative for fields like data verification and model training.

The filing reflects growing institutional interest in AI-crypto intersections, packaging emerging narratives into regulated vehicles. Approval would provide traditional investors with easier access, mirroring the impact of spot Bitcoin ETFs in 2024-2025.

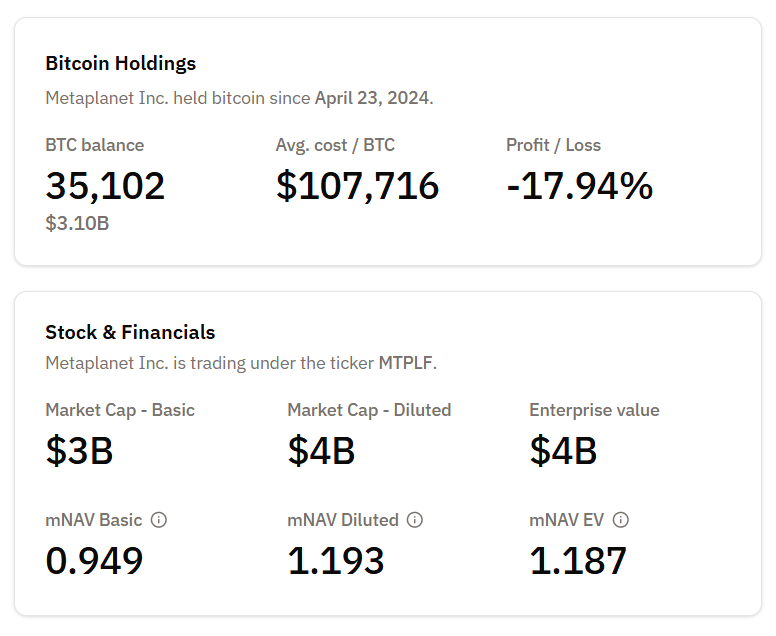

4. Metaplanet Ends 2025 with Big BTC Buy, Holdings Top 35,000 BTC

Japanese public company Metaplanet, often compared to MicroStrategy for its Bitcoin treasury strategy, concluded 2025 with aggressive accumulation. In late December, it purchased 4,279 BTC for approximately $451 million (average price ~$105,412), elevating total holdings to 35,102 BTC, valued at around $3 billion and ranking fourth among public companies globally.

This caps a standout year: Metaplanet's Bitcoin Yield (a metric tracking percentage growth in BTC per diluted share, adjusting for equity issuance) reached 568.2%, driven by consistent acquisitions despite price volatility (portfolio currently down ~19% in fiat terms).

A separate Bitcoin Income Generation unit produced ~$54 million in revenue through options strategies, converting volatility into cash flow without touching core holdings, demonstrating sophisticated treasury management.

Metaplanet's approach treats Bitcoin as a superior reserve asset, hedging against yen depreciation and inflation. With a long-term target of 210,000 BTC by 2027, it exemplifies corporate adoption bridging traditional finance and crypto balance sheets.

Meme Corner

Closing Note

Digital assets are becoming reliable tools for traditional finance, serving as hedges against inflation, generating yields, strengthening corporate treasuries, and opening doors to new technologies like decentralized AI.

With institutional adoption growing and regulatory paths clearing, the connection between fiat and crypto is stronger than ever.

If these developments align with your portfolio goals, treasury plans, or business needs in 2026, I’d be glad to discuss them further. Feel free to reply to this newsletter or contact me directly.

Thank you for reading. Here’s to a successful and rewarding 2026.