Hey there,

Welcome to the 20th edition of the Fiat Bridge.

Today's edition delves into some key moments: with Bitcoin hovering near $95,000 amid regulatory debates, traditional institutions like banks and exchanges are deepening their involvement in crypto. This could signal more stability ahead, but also indicate short-term fluctuations.

Let’s dive in.

Market Pulse

Total Crypto Market Cap: ~$3.32 Trillion (down 1.4% in the last 24h)

Bitcoin Dominance: ~57.5% (BTC market share against the rest of the market)

Bitcoin Price: ~$95,589 (down 1.6% in the last 24h)

Ethereum Price: ~$3,307 (down 1.6% in the last 24h)

Solana Price: ~$143 (down 1.8% in the last 24h)

Total Stablecoin Supply: ~$310 Billion

DeFi TVL: ~$129 Billion (down 0.7% in the last 24h)

24h Trading Volume: ~$127 Billion

Fear & Greed Index: 49 (neutral)

Today’s edition of the Fiat Bridge newsletter is brought to you by The Daily Upside.

The Briefing Leaders Rely On.

In a landscape flooded with hype and surface-level reporting, The Daily Upside delivers what business leaders actually need: clear, concise, and actionable intelligence on markets, strategy, and business innovation.

Founded by former bankers and veteran business journalists, it's built for decision-makers — not spectators. From macroeconomic shifts to sector-specific trends, The Daily Upside helps executives stay ahead of what’s shaping their industries.

That’s why over 1 million readers, including C-suite executives and senior decision-makers, start their day with it.

No noise. No jargon. Just business insight that drives results.

Now, let’s get to the top stories of the day.

Top Stories of the Day

1. U.S. Senate Delays Key Crypto Regulation Bill After Industry Pushback

The U.S. Senate postponed a vote on the Clarity Act, a proposed law to create clear rules for cryptocurrencies, following objections from Coinbase, America's largest crypto exchange.

Coinbase's CEO, Brian Armstrong, criticized the bill on social media, saying it would harm consumer products like stablecoins and give too much power to regulators.

The bill aimed to classify digital assets as either securities (like stocks, regulated by the SEC) or commodities (like gold, overseen by another agency).

Involved parties include Senate leaders, Coinbase, and banks lobbying for changes.

This delay highlights Coinbase's growing influence in Washington, backed by its $130 million in political spending last year.

Short-term market uncertainty could lead to price swings in major cryptos like Bitcoin, but it might prevent rushed rules that stifle innovation, potentially fostering long-term growth once resolved.

2. CME Group Launches Futures Contracts for Cardano, Chainlink, and Stellar

CME Group, the world's biggest derivatives exchange (where investors trade contracts based on future asset prices), announced futures for three popular cryptocurrencies: Cardano (a blockchain platform for smart contracts), Chainlink (a service providing real-world data to blockchains), and Stellar (a network for fast, low-cost cross-border payments).

These contracts, in small and large sizes, start trading on February 9, 2026, if approved. They allow institutions to hedge risks or speculate on price changes in a regulated environment.

Cardano's market value is $14.5 billion, Chainlink's is $9.8 billion, and Stellar's is $7.4 billion.

CME already offers similar products for Bitcoin and others, with record trading volumes in 2025. This boosts credibility for these altcoins, potentially attracting more traditional investors and increasing liquidity, which could stabilize prices and pave the way for exchange-traded funds.

3. Interactive Brokers Adds Round-the-Clock USDC Funding for Accounts

Interactive Brokers, a major online brokerage firm, now lets clients fund accounts anytime with USDC, a stablecoin pegged to the U.S. dollar issued by Circle.

Users send USDC from their crypto wallets; it's converted to dollars instantly via partner ZeroHash, with a small 0.3% fee. This works 24/7, even on holidays, speeding up access to stocks, options, and other investments.

Next week, they'll add support for Ripple's RLUSD (another dollar-backed stablecoin) and PayPal's PYUSD. The move builds on their crypto push, including services for U.S. clients.

Shares rose 3% on the news, hitting a record high. Easier crypto-to-fiat (traditional currency) transfers could draw more international investors, bridging crypto and stock markets, and reduce costs, potentially increasing overall trading volume in both worlds.

4. State Street Introduces Platform for Tokenizing Traditional Assets

State Street, a giant bank managing $5.4 trillion in assets, rolled out a digital platform to help businesses turn real-world assets like funds or deposits into tokenized versions, digital representations on blockchain for faster, more efficient trading.

It includes custody (safekeeping) of digital assets, tokenization of money market funds (low-risk investments), ETFs, and stablecoins. This connects traditional finance to crypto, allowing 24/7 liquidity.

Partnerships include Galaxy Asset Management and Ondo Finance for a tokenized fund on Solana. State Street has ramped up crypto efforts in 2025. Tokenization could unlock trillions in illiquid assets, making finance more accessible and efficient, potentially boosting crypto adoption among banks and lifting related blockchain tokens' values.

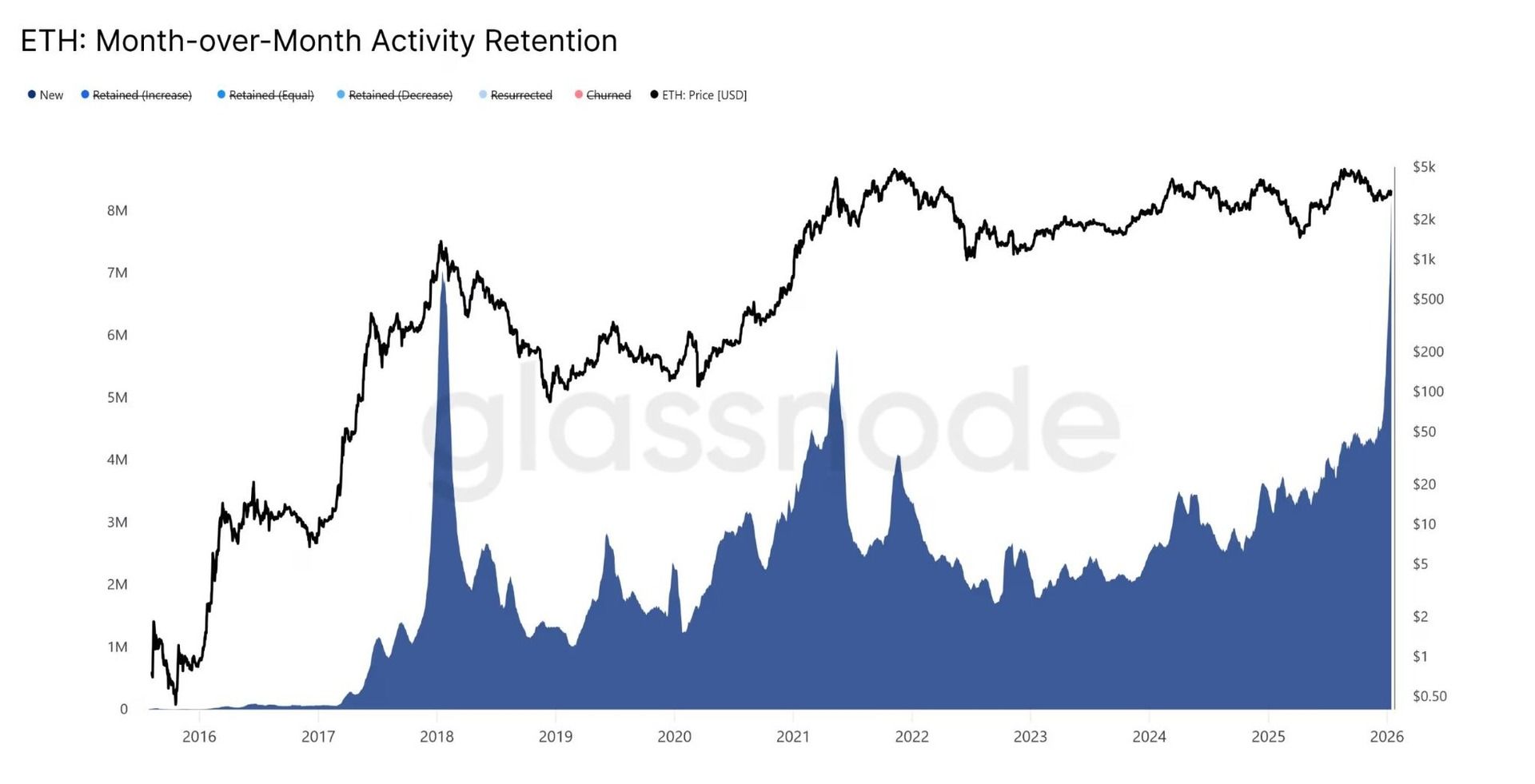

5. Ethereum Network Activity Doubles with Influx of New Users

Ethereum, the second-largest blockchain after Bitcoin, saw network activity double in the past month, driven by a surge in first-time users creating wallets.

Data firm Glassnode reported more new addresses interacting with the chain, fueled by decentralized finance (DeFi, peer-to-peer lending and trading without banks), stablecoin transfers, and NFTs.

Ether's price stabilized around $3,300 amid better market sentiment. This follows a volatile 2025 end, with usage often trailing price rallies as newcomers onboard.

More organic growth from new participants could signal sustainable demand, reducing reliance on speculation and supporting Ether's price stability, while benefiting apps built on Ethereum.

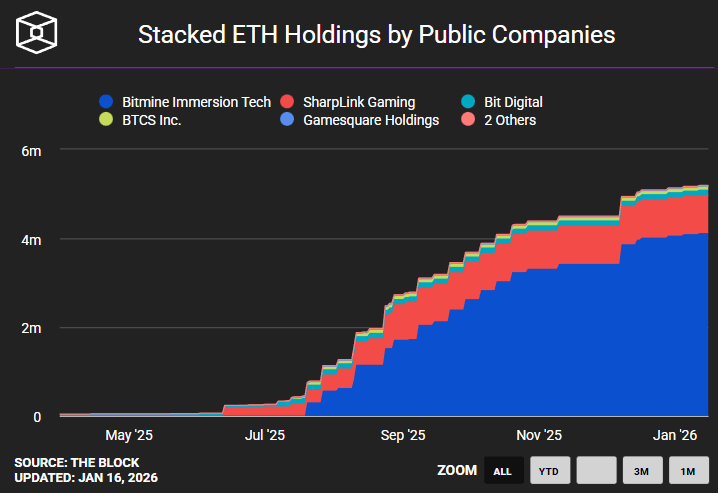

6. Bitmine Invests $200 Million in MrBeast's Media Empire

Bitmine Immersion Technologies, a firm holding large Ethereum reserves, committed $200 million to Beast Industries, the company behind YouTube star MrBeast (Jimmy Donaldson).

The deal, closing around January 19, 2026, aims to blend crypto with pop culture, targeting young audiences via MrBeast's massive reach. Bitmine's chairman called it a top creator platform.

The investment supports growth and explores decentralized finance integrations for future products. Bitmine also projects $400 million from its ether holdings. This high-profile tie-up could mainstream crypto through entertainment, attracting retail investors and potentially multiplying returns if MrBeast's ventures succeed, while highlighting crypto firms' diversification strategies.

7. Galaxy Digital Issues $75 Million Tokenized Loan on Avalanche Blockchain

Galaxy Digital, a crypto investment firm, completed a $75 million collateralized loan obligation (CLO), a bundle of loans turned into investable securities, tokenized on Avalanche.

Backed by Bitcoin and Ether collateralized consumer loans from Arch Lending, it's anchored by $50 million from the Grove protocol. Tokens are issued via the INX platform for approved investors, with real-time tracking by the Anchorage custodian.

The safest tranche pays interest at SOFR (a benchmark rate) plus 5.7%, maturing in December 2026. This merges debt markets with blockchain for efficiency and transparency.

Tokenized CLOs could expand private credit access, drawing institutions to crypto and enhancing liquidity in the $1 trillion CLO market, signaling broader tokenization trends.

8. Polygon Labs Cuts Staff to Focus on Payments and Stablecoins

Polygon Labs, developers of the Polygon blockchain (a layer-2 network speeding up Ethereum transactions), laid off an estimated 30% of staff amid restructuring after acquiring Coinme and Sequence for $250 million.

CEO Marc Boiron said the cuts eliminate overlapping roles, keeping headcount stable overall. The shift prioritizes an "Open Money Stack" for on-chain payments using stablecoins and regulated tech to move money digitally.

Polygon aims to integrate payments expertise for broader adoption.

While layoffs reflect efficiency drives, the payments focus could strengthen Polygon's role in real-world finance, potentially stabilizing its token price amid competition, but short-term sentiment dips are possible.

9. X Platform Bans Reward Posts, Causing Token Crashes for AI Projects

X (formerly Twitter) banned apps rewarding users for AI-generated posts to curb spam, revoking API access for "infofi" (information finance) tools. This hit Kaito.ai, which shut down its "Yaps" feature offering points and tokens for engagement, and Cookie DAO, winding down "Snaps."

Kaito's token dropped 17.7% to $0.57, Cookie's 15.5% to $0.038, with the infofi sector losing 13% to $359.5 million market cap.

Unusually high unstaking of Kaito tokens raised insider trading concerns. The crackdown could clean up social media but hurt niche crypto projects, leading to volatility in AI-related tokens and pushing innovation to other platforms.

10. Bitcoin Usage Spikes in Iran Amid Protests and Economic Turmoil

As protests erupted in Iran from late December 2025 over a collapsing economy and the rial's record lows (nearly worthless against the dollar), Bitcoin and crypto activity surged to $7.8 billion in 2025.

Chainalysis noted increased withdrawals from exchanges to personal wallets, with citizens using Bitcoin for value preservation. Iran's government-linked groups handled half the activity.

About seven million Iranians (of 92 million) use crypto. Bitcoin's resistance to censorship aids in restricted environments. This underscores crypto's role in crises, potentially boosting global adoption in unstable regions, but highlights risks like sanctions, influencing Bitcoin's perception as a safe-haven asset.

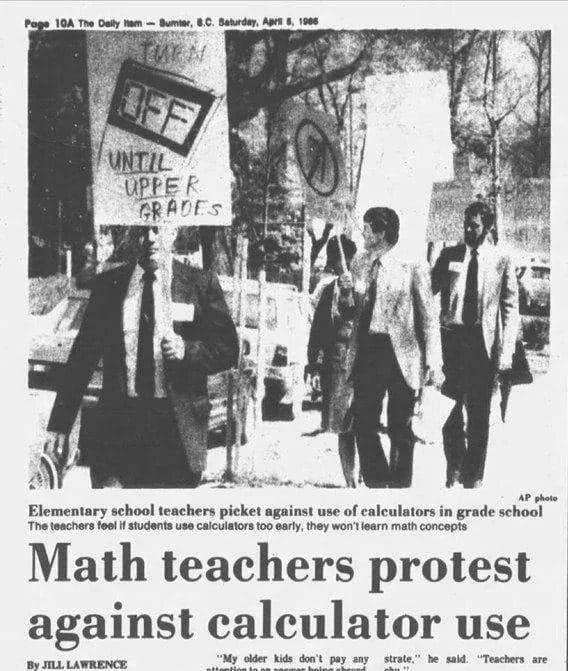

Meme Corner

Closing Note

Today's stories reveal accelerating ties between crypto and traditional finance, through tokenization, institutional tools, and regulatory debates, while networks like Ethereum grow and real-world uses emerge in places like Iran.

Delays in U.S. rules add uncertainty, but moves by giants like CME and State Street suggest steady progress. For non-crypto natives, this means more accessible digital finance ahead.

Subscribe to Fiat Bridge for daily editions, follow @chetankale_ on X for discussions, and share your thoughts. What story intrigues you most?

Stay informed as we bridge the fiat and crypto worlds.