Dear Readers,

Welcome to the 16th edition of the Fiat Bridge Newsletter.

I’m changing the format of the newsletter from this week onwards to accommodate the top stories of the day. So instead of covering the top 4 stories in detail, we will be looking at the top 10 stories of the day briefly. This will help cover a broader range of topics and make it easier for us to stay up to date with what's happening in the ecosystem.

Bitcoin's holding steady around $90,000 after a 0.25% bump, while Ethereum's up about 1% to $3,100 amid a broader market cap push past $3.1 trillion.

On Crypto Twitter, the buzz is all over privacy coins exploding, Monero's smashing records, plus intense arguments about X's algorithm burying real discussions, and hot takes on memecoins and staking yields.

Today, I'll unpack the top 10 stories from the ecosystem, from regulatory green lights that could flood billions into crypto to privacy plays and macro signals. These aren't just headlines; they're actionable insights to fine-tune your portfolio or spot new trades.

Let’s dive in.

Market Pulse

Total Crypto Market Cap: ~$3.1 Trillion (down 0.15% since Friday)

Bitcoin Dominance: ~56.9% (BTC market share against the rest of the market)

Bitcoin Price: ~$90,734 (up 0.25% since Friday)

Ethereum Price: ~$3,116 (up 1% since Friday)

Solana Price: ~$139 (up 2.9% since Friday)

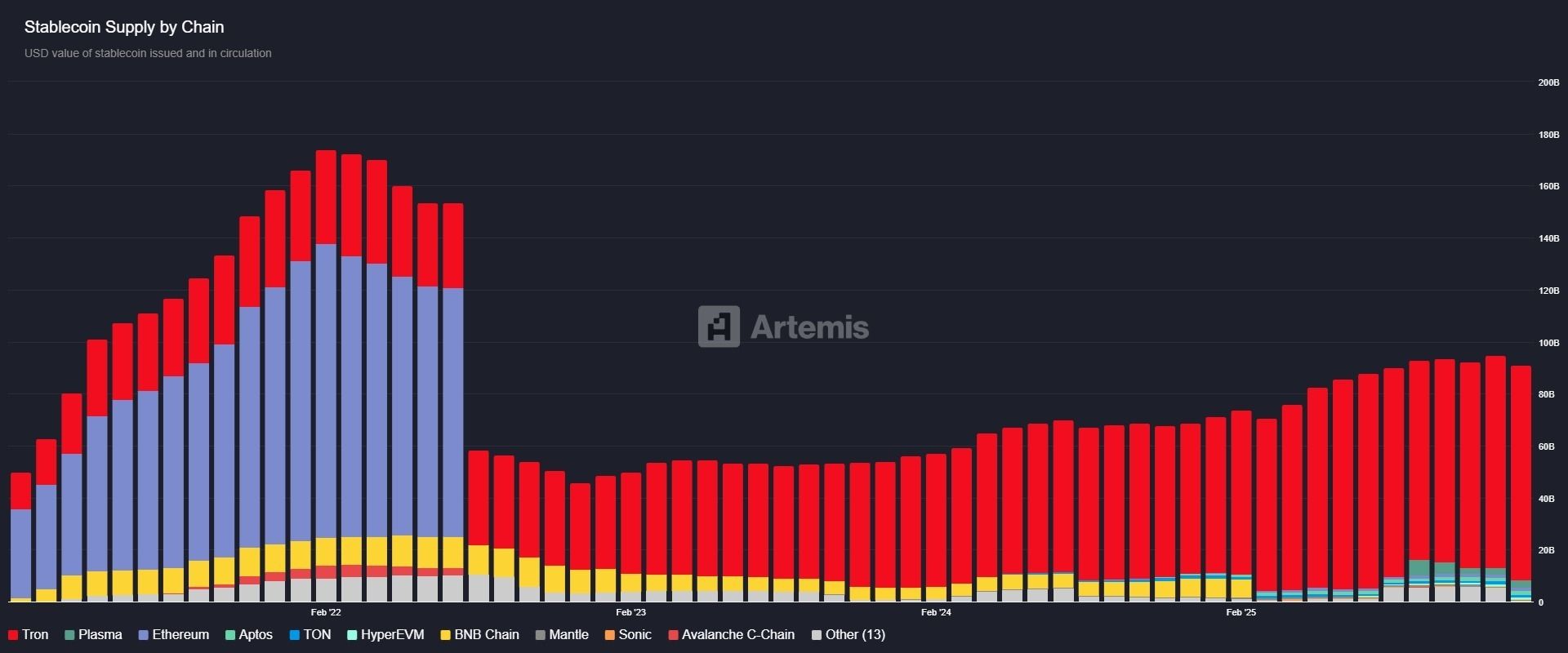

Total Stablecoin Supply: ~$307 Billion

DeFi TVL: ~$125 Billion (up 1.4% since Friday)

24h Trading Volume: ~$92 Billion

Fear & Greed Index: 41 (neutral)

Top Stories of the Day

1. South Korea Lifts 9-Year Corporate Crypto Ban

South Korea is ending its 2017 ban on corporate crypto investments, allowing listed firms to allocate up to 5% of equity capital into the top 20 coins on major exchanges.

This could inject tens of billions of dollars into the ecosystem. It's like opening the floodgates for institutional money, boosting liquidity and prices.

Alpha: Watch Korean exchanges for volume spikes; consider exposure to BTC or ETH via ETFs as adoption ramps up. Could accelerate national stablecoins and spot BTC ETFs too.

2. Vitalik Buterin Pushes for Smarter Decentralized Stablecoins

Ethereum co-founder Vitalik Buterin warns decentralized stablecoins have flaws, such as over-reliance on the USD, vulnerable oracles, and competition from staking yields.

With the stablecoin market at $300+ billion, centralized ones like USDT at 60% market share. This signals Ethereum's push for independence from fiat currencies, key to sovereignty in volatile economies.

Alpha: Eye decentralized options like USDe ($6.3B cap) or Dai ($4.2B); tweak portfolios toward ETH if upgrades boost yields, but hedge against oracle risks.

3. Memecoin Mayhem: Record Failures in 2025

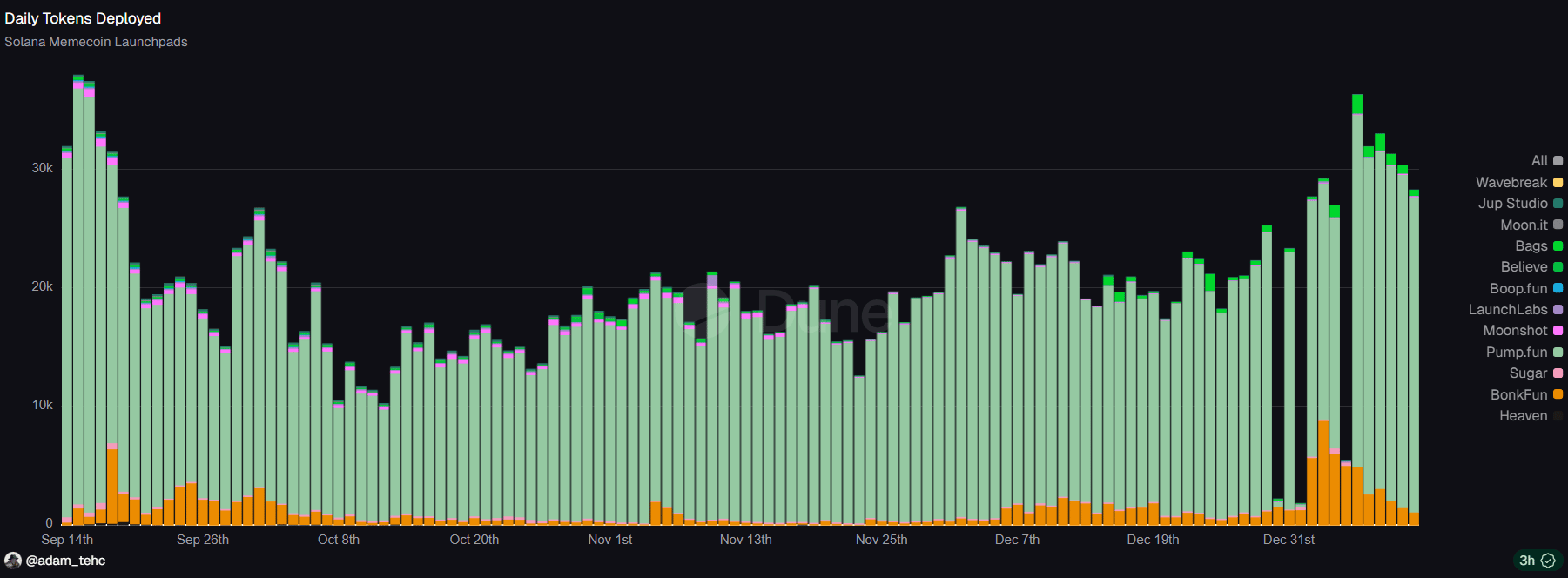

2025 saw 11.6 million crypto tokens flop, with memecoins hardest hit, 7.7 million failed in Q4 alone after an October crash wiped $19B in leverage. Listings ballooned to 20 million, thanks to Solana's pump.fun.

Alpha: Skip low-effort launches; focus on utility tokens. If farming airdrops, stick to established ecosystems like Solana, but cap exposure.

Today’s edition of Fiat Bridge is brought to you by beehiiv.

A big 2026 starts now

Most people treat this stretch of the year as dead time. But builders like you know it’s actually prime time. And with beehiiv powering your content, world domination is truly in sight.

On beehiiv, you can launch your website in minutes with the AI Web Builder, publish a professional newsletter with ease, and even tap into huge earnings with the beehiiv Ad Network. It’s everything you need to create, grow, and monetize in one place.

In fact, we’re so hyped about what you’ll create, we’re giving you 30% off your first three months with code BIG30. So forget about taking a break. It’s time for a break-through.

Now let’s get back to the top stories of the day.

4. Coinbase Threatens to Ditch Clarity Act Over Rewards Ban

Coinbase might pull support for the US Clarity Act if it bans stablecoin rewards on non-bank platforms. Stablecoins earned Coinbase $247M in Q4. The bill's markup is this week, but midterms might delay it to 2027.

Alpha: Rewards (e.g., 3.5% on USDC) are passive income gold; restrictions could cool retail interest. If passed, shift to banking-chartered platforms; trade volatility around Senate votes, bullish if rewards survive.

X is launching "Smart Cashtags" next month, letting $ symbols pull real-time crypto/stock prices, smart contracts, and news. It could potentially include buy/sell buttons.

Alpha: Boosts visibility for tokens, watch for pumps on mentions. If you're in memecoins or new launches, this could amplify Twitter-driven trades.

6. India Beefs Up Crypto KYC Rules

India is mandating live selfies, geolocation, IP timestamps, and bank verifications for crypto onboarding to fight tax evasion. Currently, crypto gains are taxed at 30%, with no loss offsets.

Alpha: For global investors, tighter rules mean safer exchanges, favor compliant ones. If eyeing Indian projects, anticipate slower growth; pivot to privacy plays elsewhere.

Today’s newsletter is also supported by The Daily Upside.

Wall Street’s Morning Edge.

Investing isn’t about chasing headlines — it’s about clarity. In a world of hype and hot takes, The Daily Upside delivers real value: sharp, trustworthy insights on markets, business, and the economy, written by former bankers and seasoned financial journalists.

That’s why over 1 million investors — from Wall Street pros to Main Street portfolio managers — start their day with The Daily Upside.

Invest better. Read The Daily Upside.

Now, let’s continue with the top stories of the day.

7. Bitmine Hits 1M Staked ETH Milestone

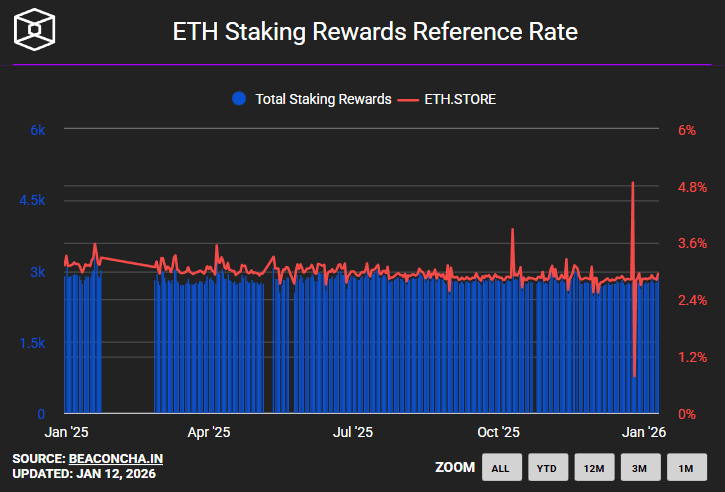

Bitmine staked another 86,400 ETH ($268.7M), totaling 1.08M ETH ($3.3B), yielding ~$94.4M annually at 2.81%. Shows corporate treasuries chasing yields.

Alpha: Staking secures networks while earning, think of dividends on crypto. If holding ETH, consider staking for passive gains; watch queue times. Boosts ETH's scarcity, bullish for prices; diversify into staking pools.

8. Dubai Bans Privacy Tokens in Regulatory Reset

Dubai's DFSA (Dubai Financial Services Authority) banned privacy tokens and tightened stablecoins to fiat-pegged only, no algorithmic ones like Ethena. Reasons are AML compliance under FATF (Financial Action Task Force), where one can not hide transactions.

Alpha: Sell privacy holdings if exposed; shift to compliant stablecoins. For portfolios, this signals a global crackdown; hedge with BTC as a safe haven.

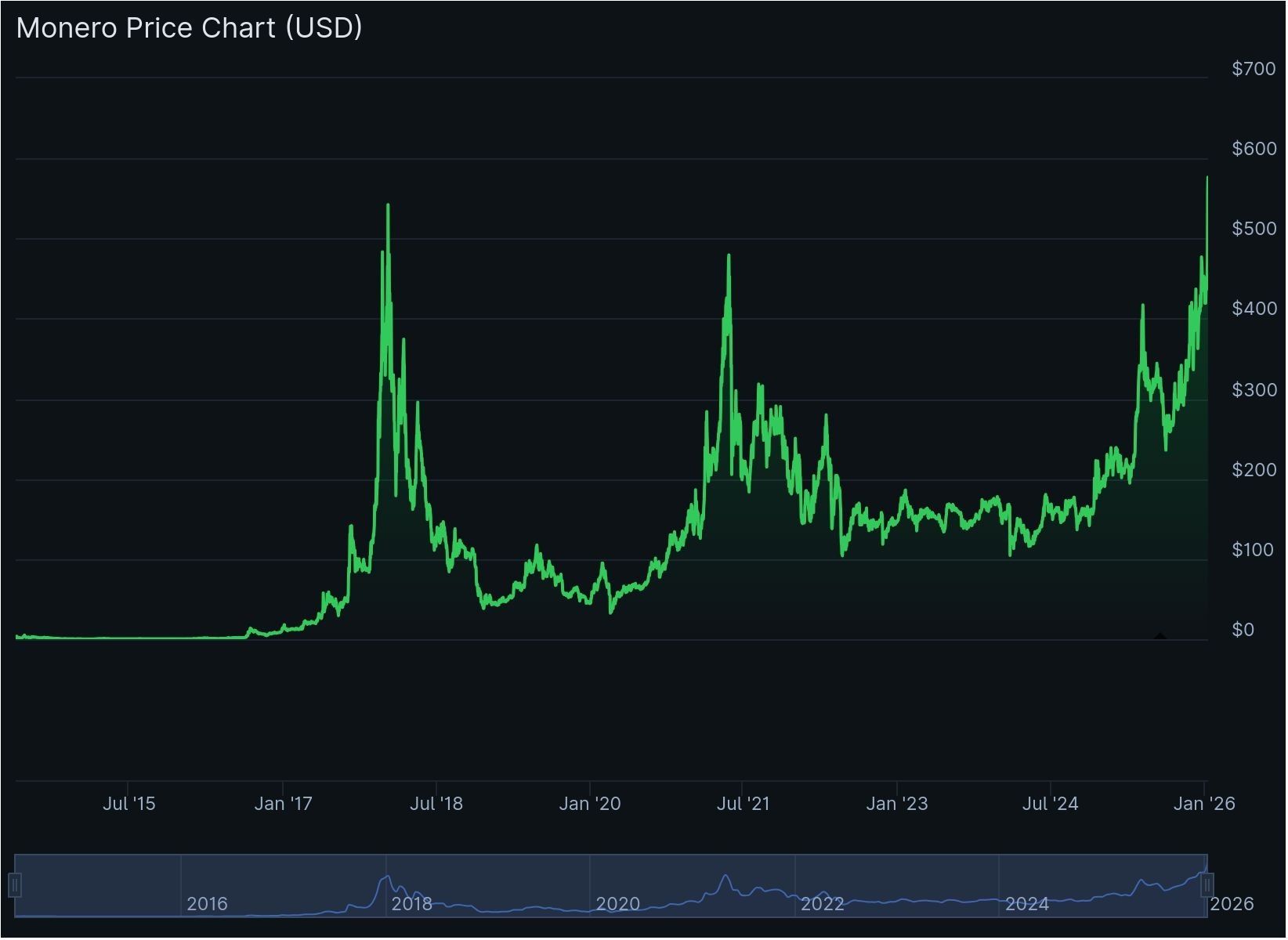

9. Privacy Tokens Rally, XMR Smashes ATH

Privacy coins surged: XMR hit $596, breaking its 2021 peak; ZEC up 10%. Driven by upgrades, liquidity, and short squeezes. Amid Dubai's ban, it's a backlash play.

Alpha: For privacy seekers, XMR's momentum could hit $1,000 if regulations tighten elsewhere, trade the rally, but watch volatility. Privacy shields transactions; add small exposure for diversification, but DYOR on bans.

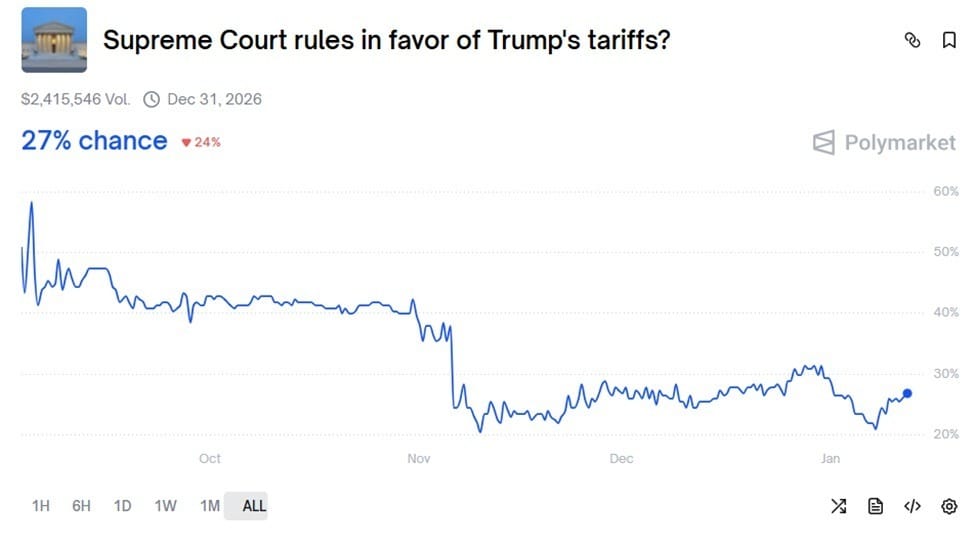

10. Upcoming US Inflation Data Looms Over Crypto

December CPI drops on Tuesday (expected 2.7% YoY), PPI on Wednesday (2.7%). Supreme Court tariff ruling Wednesday adds the spice, 27% chance of strike-down eases inflation, bullish for risk assets.

Alpha: Brace for ups and downs, watch tomorrow's inflation data closely, and if it's positive for risk assets, scoop up BTC on any dip near $90K. And don't put everything in crypto; a bit of gold can act as a safety net.

Meme Corner

Closing Note

These shifts, from Asia's inflows to privacy boom, signal a maturing market ripe for selective plays. Review your allocations: Trim memecoin risks, lean into staking, and monitor regulations.

If this sparked ideas, drop me a line or subscribe to daily alphas.

Stay sharp out there, let's make 2026 count.

Thank you for reading, and I will see you tomorrow.