Dear Readers,

Welcome to the 15th edition of the Fiat Bridge Newsletter.

Bitcoin is still hovering around $90,000, a key level that reflects both resilience and caution in trading volumes.

In today's edition, we are covering insights into stablecoin innovations, exchange-traded fund (ETF) updates, traditional finance's growing crypto footprint, and key market drivers, including upcoming economic data that could sway prices.

Let’s dive in.

Market Pulse

Total Crypto Market Cap: ~$3.1 Trillion (up 0.4% in the last 24h)

Bitcoin Dominance: ~56.8% (BTC market share against the rest of the market)

Bitcoin Price: ~$90,313 (up 0.5% in the last 24h)

Ethereum Price: ~$3,083 (down 0.3% in the last 24h)

Solana Price: ~$137 (up 2.9% in the last 24h)

Total Stablecoin Supply: ~$307 Billion

DeFi TVL: ~$122 Billion (down 1.8% in the last 24h)

24h Trading Volume: ~$108 Billion

Fear & Greed Index: 41 (neutral)

Top Stories of the Day

Stablecoins: Fueling the Next Wave of Adoption

ETF Shifts: New Opportunities Amid Outflows

Traditional Finance Deepens Crypto Ties

Market Insights: Staking, Prices, and Macro Risks

1. U.S. Pushes Forward with Stablecoin Innovations

Stablecoins are becoming a cornerstone of crypto payments. This week, Rain, a US-based stablecoin infrastructure provider and Visa network member, raised $250 million in a Series C funding round, valuing the company at $1.95 billion.

Led by Iconiq, with investors like Galaxy Digital's venture arm and Bessemer Venture Partners, the funds will expand Rain's platform across regions, enabling businesses to issue compliant stablecoin cards accepted wherever Visa is.

Rain supports major stablecoins like USDT and USDC on blockchains such as Ethereum and Solana, and its card base grew 30-fold in 2025.

This raise aligns with broader projections: Bloomberg Intelligence estimates stablecoin payment flows could hit $56.6 trillion by 2030, up from $2.9 trillion in 2025.

Growth is driven by institutional use and demand in inflation-prone economies. Stablecoins are digital cash that bridges traditional and blockchain worlds, potentially streamlining global transactions.

2. Governance Shakeups and Regulatory Warnings in Crypto

Exchange-traded funds (ETFs) offer a familiar way for investors to gain crypto exposure without directly holding assets; they trade like stocks on exchanges. Grayscale, a major player, registered trusts in Delaware for potential ETFs tied to BNB (Binance Coin, the token powering the Binance ecosystem) and HYPE (from Hyperliquid, a decentralized platform for perpetual contracts, like ongoing bets on asset prices).

This preparatory step could lead to SEC filings, expanding options beyond Bitcoin and Ether. It's part of Grayscale's push for diversified products, amid optimism for clearer regulations in 2026.

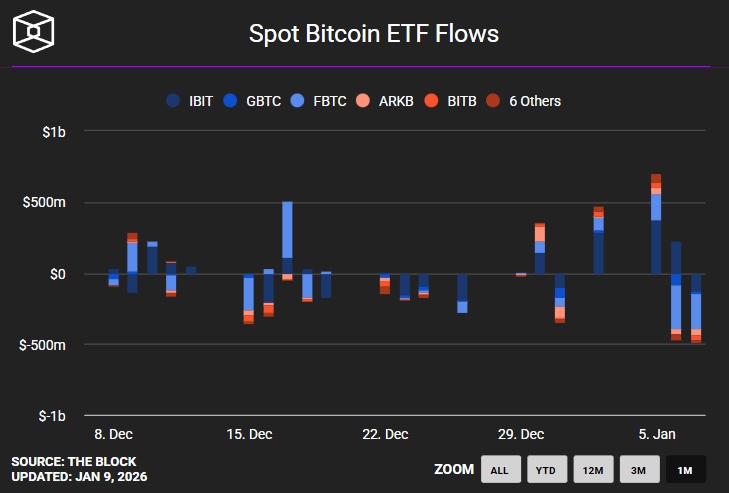

However, spot Bitcoin and Ether ETFs faced headwinds, with Bitcoin ETFs seeing $1.13 billion in outflows over three days in early January, erasing early-month gains.

Ether ETFs lost $258 million since Wednesday. These redemptions reflect investor caution after a brief rebound, possibly tied to market deleveraging from late 2025.

Outflows mean money leaving the funds, which can pressure prices in the short term but don't negate long-term institutional interest.

3. Market Dips and Upgrades Signal Caution Ahead

Major banks are increasingly blending traditional finance (TradFi) with crypto, making the space more accessible. Morgan Stanley plans a digital asset wallet launch in the second half of 2026, supporting cryptocurrencies and tokenized real-world assets (RWAs), like digitized stocks or real estate on blockchain, for easier trading.

This builds on their SEC filings for Bitcoin, Solana, and Ether ETFs, and crypto trading on ETrade starting early 2026. Initially, for high-net-worth clients, it's now open wider, with advised allocations up to 4%.

Meanwhile, Bank of America upgraded Coinbase stock to "buy," projecting 38-40% upside to $340. Reasons include Coinbase's expansion beyond crypto trading into stocks, prediction markets (betting on events like elections), and tokenizing assets via its Base layer-2 network (a faster, cheaper Ethereum extension). This positions Coinbase as an "everything exchange," appealing to investors eyeing diversified growth.

4. Fresh Funding and Partnerships Strengthen Crypto Infrastructure

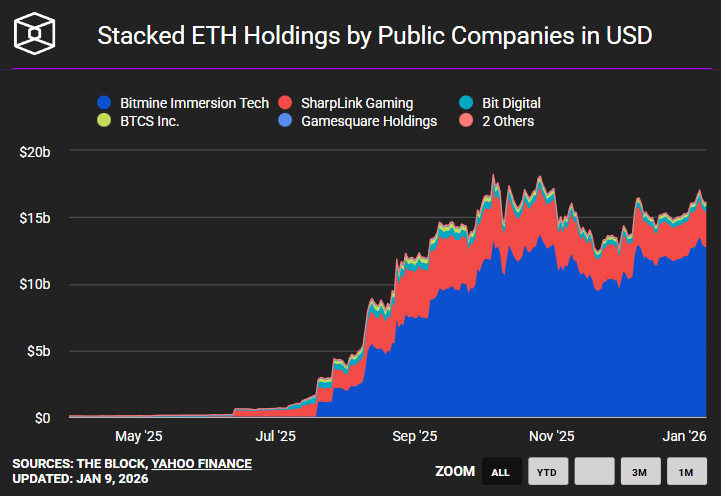

Ethereum treasury firm SharpLink staked $170 million in ETH on Linea, a layer-2 network built by Consensys for faster, cheaper transactions on Ethereum.

Staking involves locking crypto to support network security and earn yields; here, it combines native rewards with restaking (reusing staked assets for extra income). This "first-of-its-kind" structure highlights institutional strategies for optimizing returns.

Bitcoin holds near $90,000 with shrinking volumes, while altcoins like Polygon rose 7.8% on business pivots. Thin liquidity amplifies swings.

Looking ahead, today's US jobs report (expected 55,000 additions, unemployment at 4.5%) and Supreme Court ruling on tariffs could spark volatility. Weak jobs might prompt Fed rate cuts, boosting crypto; a tariff rejection (75% Polymarket odds) could ease trade tensions.

Meme Corner

Closing Note

From stablecoin expansions to TradFi integrations, 2026 is shaping up as a year of maturation for crypto investments. If you're building your portfolio, these trends point to growing accessibility and potential.

Subscribe to Fiat Bridge for weekly updates, it's free and tailored for learners like you.

Share this edition with friends exploring the space, and let's bridge the fiat-crypto divide together.

Thank you for reading, happy weekend.