Hey there,

Welcome to the 17th edition of the Fiat Bridge Newsletter.

If you're dipping your toes into crypto without being a full-time trader, today's edition is tailored for you. The market's in a holding pattern, with Bitcoin hovering around $92,000, up 1.7% in the last 24 hours, but stuck in a tight range between $90,000 support and $94,000 resistance.

Volatility is on the horizon with the US CPI data release tomorrow, which could influence Fed rate cuts and pressure riskier assets, such as crypto.

Over on Crypto Twitter, the buzz about regulatory delays shaking confidence, Eric Adams' messy NYC Token launch sparking rug-pull memes, and Monero's privacy surge stealing the spotlight.

We'll unpack the top stories with alpha insights, think new token plays, portfolio tweaks, and macro signals, to help you spot opportunities early on.

Let's dive in.

Market Pulse

Total Crypto Market Cap: ~$3.2 Trillion (up 1.4% in the last 24h)

Bitcoin Dominance: ~57.1% (BTC market share against the rest of the market)

Bitcoin Price: ~$92,170 (up 1.7% in the last 24h)

Ethereum Price: ~$3,135 (up 0.7% in the last 24h)

Solana Price: ~$141 (up 1.4% in the last 24h)

Total Stablecoin Supply: ~$307 Billion

DeFi TVL: ~$124 Billion (up 0.1% in the last 24h)

24h Trading Volume: ~$115 Billion

Fear & Greed Index: 41 (neutral)

Today’s edition of the Fiat Bridge newsletter is brought to you by beehiiv.

Stop Planning. Start Building.

End of the year? Or time to start something new.

With beehiiv, this quiet stretch of time can become your biggest advantage. Their platform gives you all the tools you need to make real progress, real fast.

In just days (or even minutes) you can:

Build a fully-functioning website with the AI website builder

Launch a professional-looking newsletter

Earn money on autopilot with the beehiiv ad network

Host all of your content on one easy-to-use platform

If you’re looking to have a breakthrough year, beehiiv is the place to start. And to help motivate you even more, we’re giving you 30% off for three months with code BIG30.

Now let’s get to the top stories of the day.

Top Stories of the Day

1. Senate Delays Crypto Market Structure Bill Markup to Late January

The Senate Agriculture Committee pushed back the markup of its crypto market structure bill to the last week of January, needing more time for bipartisan buy-in after weekend talks.

Chairman John Boozman cited "meaningful progress" but emphasized broad support. This bill clarifies SEC and CFTC roles, potentially boosting market clarity.

Alpha: Delays could stall altcoin rallies, but passage might unlock DeFi growth. Watch for amendments on ethics and stablecoins. Draft bill here.

2. Clarity Act Draft Bans Idle Stablecoin Yields But Allows Activity Rewards

The Digital Asset Market Clarity Act (CLARITY Act) draft prohibits yields on stablecoins just for holding but greenlights activity-based rewards like staking or liquidity provision. This compromise addresses bank concerns over unregulated deposits while fostering crypto innovation. DeFi gets protections for developers, shielding them from intermediary rules.

Alpha: Stablecoin farmers, pivot to active strategies; there are many yield opportunities. Regulatory green light might draw TradFi inflows; tweak portfolios toward compliant DeFi tokens like UNI or AAVE.

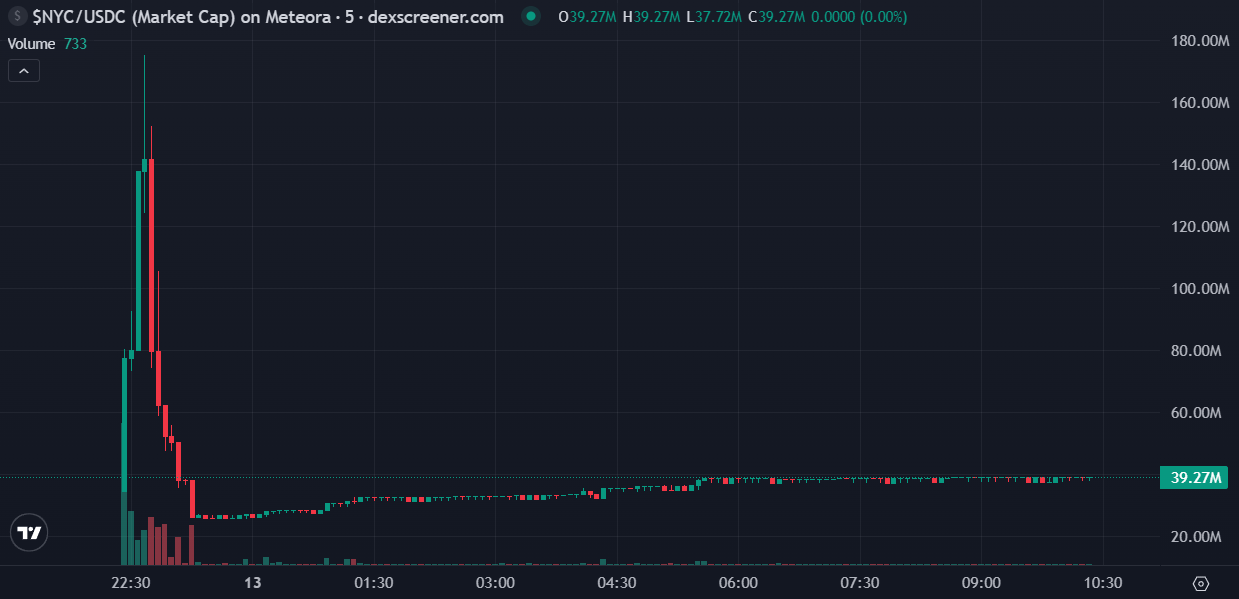

3. Eric Adams Launches NYC Token Amid Rug-Pull Allegations

Former NYC Mayor Eric Adams dropped the Solana-based NYC Token to fund anti-hate initiatives and scholarships, with 1B total supply and 70% in reserves.

Price tanked 80% post-launch, with $3.4M liquidity allegedly pulled by a deployer wallet, sparking rug-pull claims. The top 5 wallets hold 92%, super centralized.

Alpha: High-risk memecoin play; avoid unless you're scalping volatility. For safer bets, eye established tokens, but steer clear of hype-driven launches.

4. Vitalik's Ethereum 'Walkaway Test' Pushes for Self-Sustainability

Ethereum co-founder Vitalik Buterin says ETH must pass a 'walkaway test', survive without ongoing developer input, like a hammer that works forever. Quantum resistance, ZK-EVM scaling for 1,000s of TPS, and robust gas models would be some of the fixes.

Alpha: This could solidify ETH as a long-term hold, reducing trilemma risks. If you're underweight ETH, consider adding on dips, and aim for decentralized stablecoins to hedge.

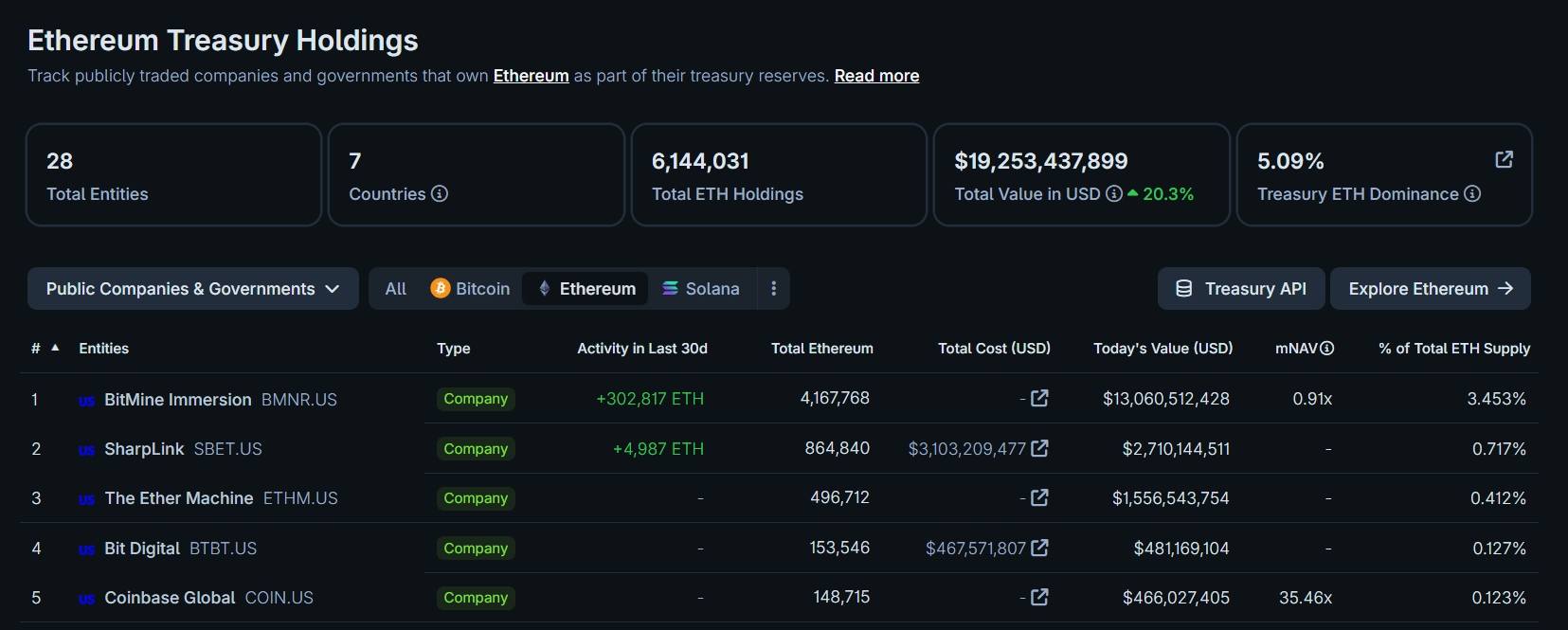

5. Bitmine Bulks Up ETH Treasury to 4.17M Tokens

Bitmine added 24,266 ETH last week, pushing holdings to 4.17M (3.4% of supply) valued at ~$13B, plus 193 BTC and $988M cash. Chairman Tom Lee eyes a 6M ETH target and more staking (1.26M ETH staked).

Alpha: Corporate ETH hoarding signals confidence, could spark a rally if staking yields rise. Dip into ETH ETFs or stake via platforms like Lido for passive income without full custody hassles.

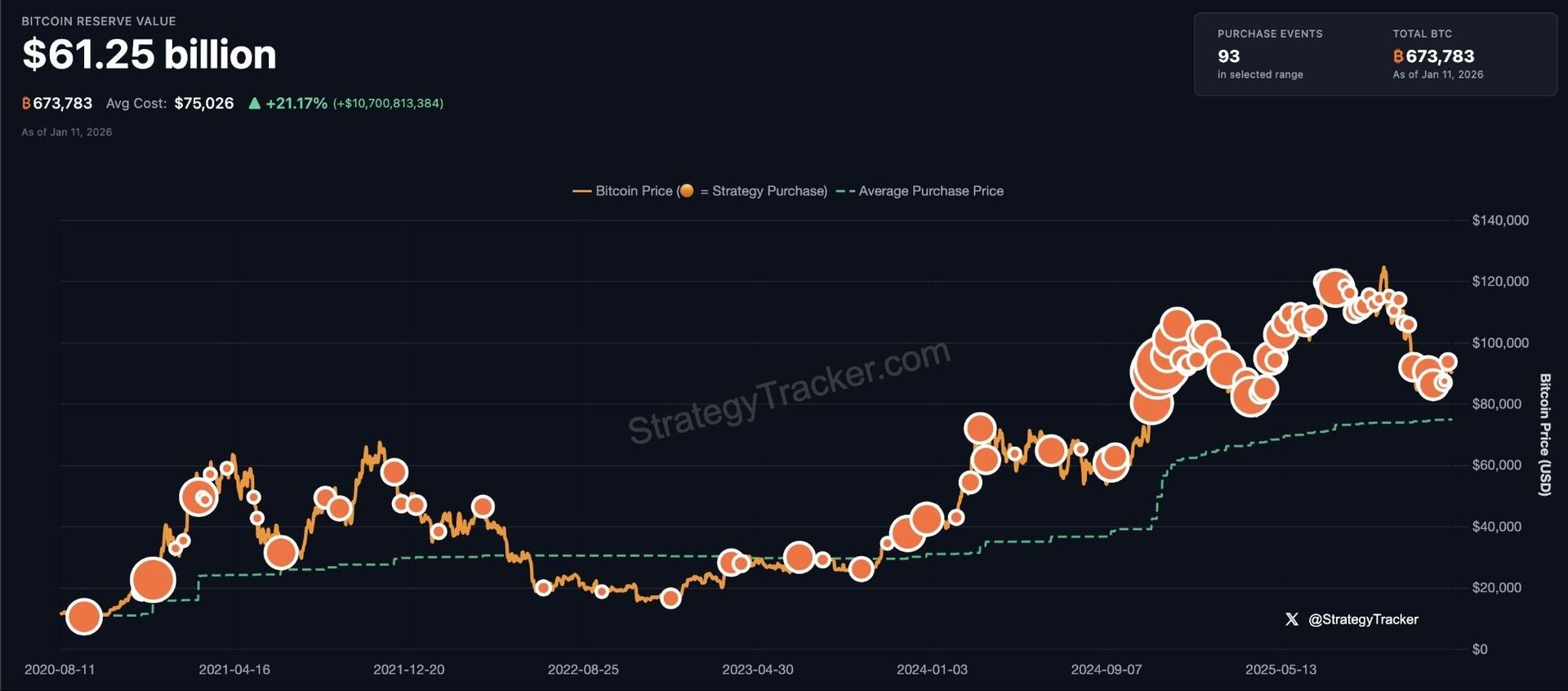

6. MicroStrategy Snaps Up 13,627 BTC for $1.25B

MicroStrategy bought 13,627 BTC at $91,519 average, boosting holdings to 687,410 BTC (cost basis $51.8B). Funded via equity sales, this cements their BTC treasury play.

Alpha: Track $MSTR stock as a BTC proxy. For your portfolio, if BTC's range-bound, consider averaging in below $90K, pair with gold for diversification amid macro uncertainty.

7. BitGo Files for $201M IPO at $1.96B Valuation

Crypto custodian BitGo launched its IPO, offering 11M shares at $15-17 each to raise up to $201M, valuing at $1.96B. With $90B under custody, it'll list as BTGO on NYSE.

Alpha: Custody boom ahead signals maturing market. Buy dips in custody-linked tokens like FIL; tweak portfolios toward secure storage plays if you're expanding crypto exposure.

21Shares' BOLD ETP launched on LSE, blending BTC and gold in a risk-weighted portfolio. Physically backed, it's returned 122.5% since 2022.

Alpha: Perfect hybrid for hedging, lower volume than pure BTC. UK/EU folks, add to diversify; US equivalents like GBTC + GLD could mimic for similar alpha.

9. Monero Hits New ATH Above $648 Amid Privacy Surge

Monero (XMR) spiked 16% to $686, topping a new all-time high as privacy coins rally on regulatory scrutiny fears. ZEC is also up 2% to $404.

Alpha: DOJ probe into Fed's Powell boosts non-sovereign assets like XMR. If you're privacy-focused, allocate 5-10%, trade the momentum, but watch delisting risks.

10. World Liberty Financial Rolls Out Crypto Lending with USD1 Stablecoin

Trump-linked WLFI launched lending on World Liberty Markets using USD1 ($3.4B backed) as collateral for ETH, BTC, USDC, etc. Plans include RWAs and prediction markets.

Alpha: Airdrop farming potential here, lend stablecoins for yields. Macro tie-in could amplify if Trump pushes crypto-friendly policies.

Meme Corner

Closing Note

That's the wrap on today's alpha-packed stories. If these insights sparked ideas, tweak your portfolio, maybe add some ETH staking or privacy plays. Drop me a line on X @chetankale_ with your thoughts, and subscribe for more insights.

Stay sharp out there!