Hello,

Welcome to the 22nd edition of the Fiat Bridge Daily Crypto Newsletter.

Today, we are emphasizing token launches, governance changes, and market shifts that could offer real value or alpha for investors.

Over the last 24 hours, the total crypto market capitalization decreased by 2.3% to $3.15 trillion, while BTC fell by 2.3% to $90,865, ETH dropped by 3.6% to $3,089, and SOL declined by 3.7% to $128.

These moves were largely driven by global trade tensions, including U.S. tariff threats tied to geopolitical issues like Greenland, which spurred a risk-off mood across markets.

Let's dive in.

Today’s edition of the Fiat Bridge newsletter is brought to you by The Daily Upside.

Smart Investors Don’t Guess. They Read The Daily Upside.

Markets are moving faster than ever — but so is the noise. Between clickbait headlines, empty hot takes, and AI-fueled hype cycles, it’s harder than ever to separate what matters from what doesn’t.

That’s where The Daily Upside comes in. Written by former bankers and veteran journalists, it brings sharp, actionable insights on markets, business, and the economy — the stories that actually move money and shape decisions.

That’s why over 1 million readers, including CFOs, portfolio managers, and executives from Wall Street to Main Street, rely on The Daily Upside to cut through the noise.

No fluff. No filler. Just clarity that helps you stay ahead.

Now let’s go to the Market Pulse and the best-performing assets of the last 7 days.

Market Pulse

Total Crypto Market Cap: ~$3.15 Trillion (down 2.3% in the last 24h)

Bitcoin Dominance: ~57.5% (BTC market share against the rest of the market)

Bitcoin Price: ~$90,865 (down 2.3% in the last 24h)

Ethereum Price: ~$3,089 (down 3.6% in the last 24h)

Solana Price: ~$128 (down 3.7% in the last 24h)

Total Stablecoin Supply: ~$311 Billion

DeFi TVL: ~$125 Billion (down 1.3% in the last 24h)

24h Trading Volume: ~$109 Billion

Fear & Greed Index: 32 (fear)

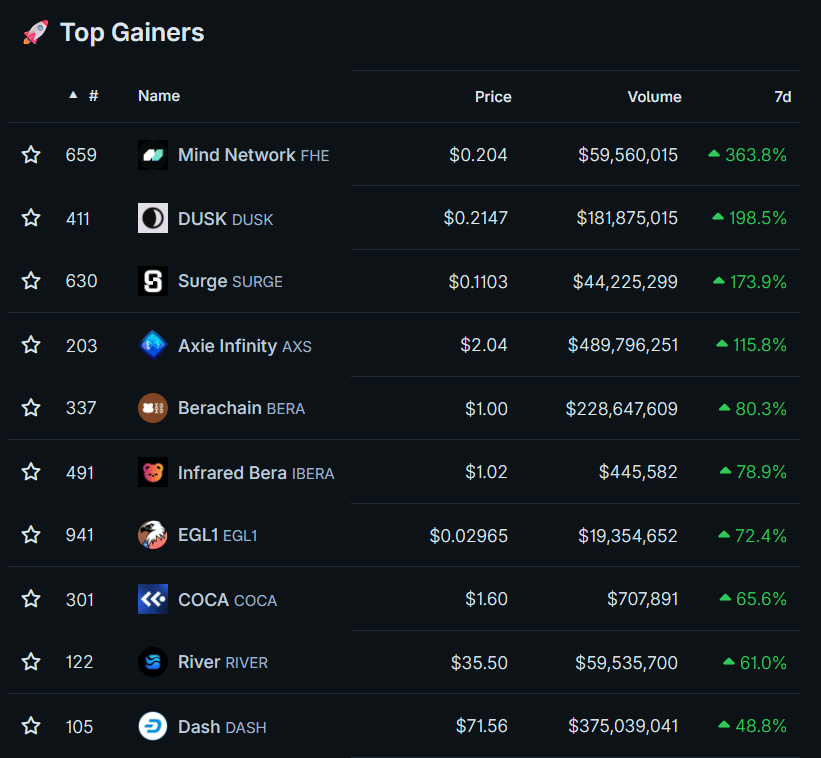

Top 10 best performing cryptos in the last 7 days:

This edition is also supported by 1440 Media.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Now let’s get to the top stories of the day.

Top Stories of the Day

1. NYSE to Enable 24x7 Stock Trading

The New York Stock Exchange (NYSE) is building a blockchain-based platform for tokenized securities, allowing round-the-clock trading and instant settlements.

Tokenization means converting real-world assets like stocks or ETFs into digital tokens on a blockchain for faster, cheaper transactions.

This could open doors for everyday investors to trade tokenized versions of traditional assets at any time. For crypto enthusiasts, it's a sign that Wall Street is embracing blockchain, potentially boosting liquidity for related tokens.

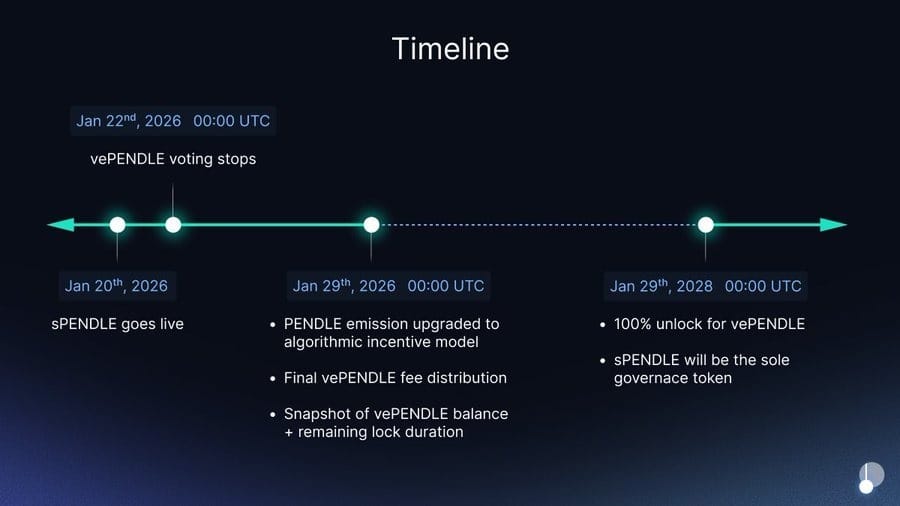

2. Yield Trading Platform Pendle Introduces New Token

Pendle, a DeFi (decentralized finance) protocol for trading yield-bearing tokens, introduced sPENDLE. This lets users access rewards without long lockup periods, times when tokens are frozen to earn yields.

Previously, users had to commit tokens for months. Now, sPENDLE simplifies this, making it more accessible for non-experts.

Pendle is also replacing its underused governance token, which helps holders vote on protocol decisions. This could attract more users to Pendle, driving up its native token value as DeFi grows.

3. Pump Fun Unveiled Pump Fund to Back Memecoin Creators

Pump.fun, a popular platform for launching memecoins, fun, viral tokens often based on internet memes, unveiled Pump Fund.

This $3 million investment arm will fund 12 projects through a "Build in Public" hackathon.

Memecoins like Dogecoin have exploded in popularity due to community hype. This fund could lead to new token launches, offering early entry points for speculators.

With memecoin trading volumes surging 106% recently, this is alpha for those eyeing quick gains, but remember the high risks of volatility.

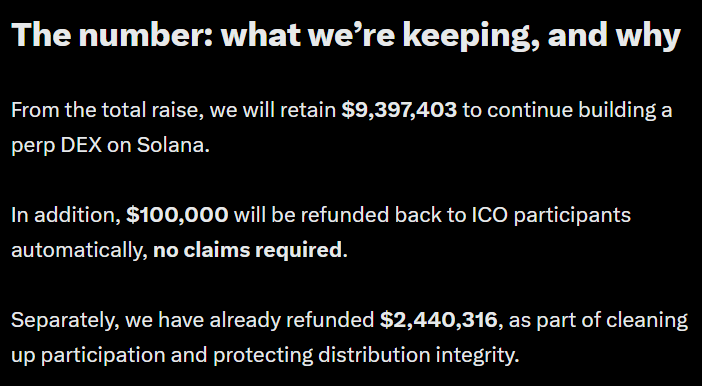

4. Trove’s Token Dropped 95% After Launch

Trove, a DeFi project, faced backlash after its token crashed post-launch.

Investors accused the team of keeping ~$9 million while pivoting to the Solana blockchain hours before the token generation event (TGE), the initial release of a token.

This highlights rug pulls, where teams abandon projects after raising funds. Trove's fallout deepened with the token's value plummeting, causing heavy losses.

For new investors, this is a reminder to research team transparency before jumping into TGEs.

5. Injective's Community Votes to Slash INJ Token Supply

Injective, a layer-1 blockchain for fast DeFi apps, is letting holders vote on reducing its INJ token supply. This governance proposal could burn (permanently remove) tokens, potentially increasing scarcity and value.

Governance tokens like INJ give users a say in protocol changes. If approved, this could boost INJ's price as supply tightens.

Watch for the vote outcome; it's a classic way tokens gain momentum through community-driven decisions.

6. Memecoin Mania Heats Up: Volume Explodes by 106%

Memecoin trading volumes jumped 106% in a week, showing renewed interest in these speculative tokens.

Platforms like Pump.fun are fueling this, with quick launches drawing crowds. While risky, memecoins can deliver massive returns if they go viral.

Recent examples like White Whale slid 60% after a big holder sold, underscoring the volatility. For alpha seekers, scan social media for emerging memes, but use small positions.

7. $1B+ Worth of Token Unlocks are Coming in This Week

This week brings major token unlocks (scheduled releases of previously locked tokens) for projects like Bitget (BGB), LayerZero (ZRO), and River (RIVER).

Over $1 billion worth could hit the market, potentially pressuring prices if sellers dominate.

Unlocks are common in crypto to align incentives, but they can cause short-term dips. These events often create buying opportunities after initial sell-offs.

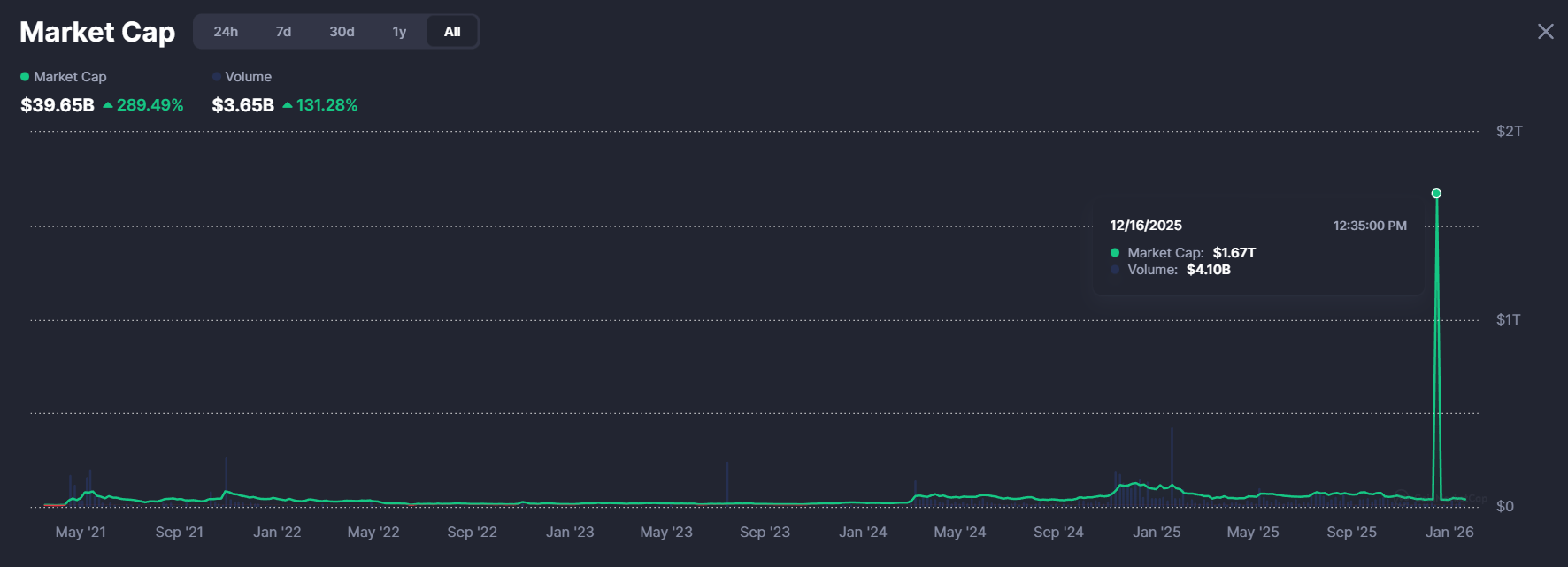

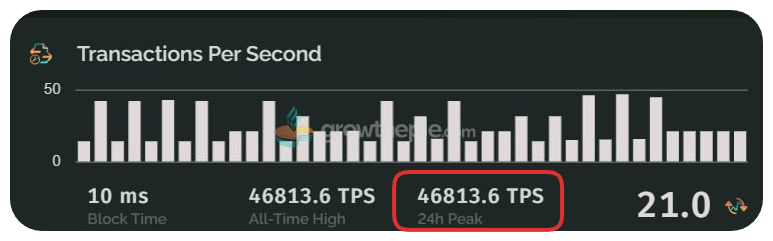

8. MegaETH's Speed Surge: 47K TPS on Testnet

MegaETH, an Ethereum layer-2 (L2) solution for scaling, handling more transactions cheaply, hit 47,000 transactions per second (TPS) in tests.

L2s build on Ethereum for better performance. This beats many rivals, positioning MegaETH for DeFi and gaming apps.

A potential token launch could follow if the mainnet succeeds. For investors, L2 tokens often rally on tech milestones. Keep an eye on this one.

9. Coinbase and Circle Team Up for Tokenized Bermuda's Economy

Bermuda is partnering with Coinbase and Circle to create the world's first fully on-chain national economy. This includes USDC stablecoin payments, tokens pegged 1:1 to the U.S. dollar for stability.

Merchants are already accepting USDC, with plans for widespread tokenization. This could inspire other nations and boost related tokens.

It's alpha for stablecoin holders, as real-world adoption grows.

10. Crypto IPO Wave: Kraken, Consensys Lead 2026 Listings

2026 is shaping up for major crypto IPOs, including exchange Kraken (valued at $20B) and Consensys (behind MetaMask wallet). Others like BitGo and Ledger are preparing.

IPOs let companies go public, often spiking related tokens. This follows 2025's M&A boom, with stablecoins as key players.

For token hunters, these could create buzz and new investment avenues.

Meme Corner

Closing Note

Today's stories highlight token innovation and market shifts, from Pendle's user-friendly updates to the NYSE's tokenization push and upcoming IPOs.

Key takeaways: Focus on projects with strong governance and real-world utility for long-term alpha, but always manage risks in volatile markets.

As trade tensions ease, watch for rebounds in BTC and ETH.

Stay informed. Subscribe to Fiat Bridge for daily insights, and share with your friends.

Let's navigate crypto together!