1. Project Overview & Value Proposition

In the rapidly maturing Solana ecosystem, few protocols have demonstrated the consistent execution and strategic foresight that Kamino has shown over the past three years. As a research analyst focused on DeFi infrastructure, I see Kamino not just as a yield optimization tool, but as an emerging on-chain credit layer that bridges retail efficiency with institutional requirements.

Kamino started in 2022 as an automated liquidity provider on Solana, addressing the pain of manual position management in concentrated liquidity DEXs. Over time, it expanded into a comprehensive platform that integrates lending, borrowing, and leveraged strategies, all under one roof. This unification allows users to move seamlessly between products, compounding efficiently in ways that fragmented protocols cannot match.

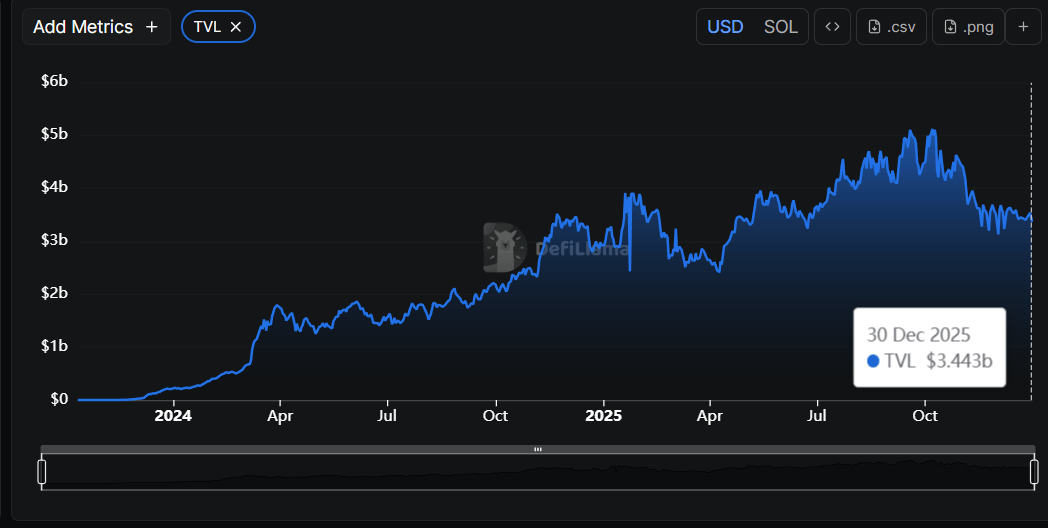

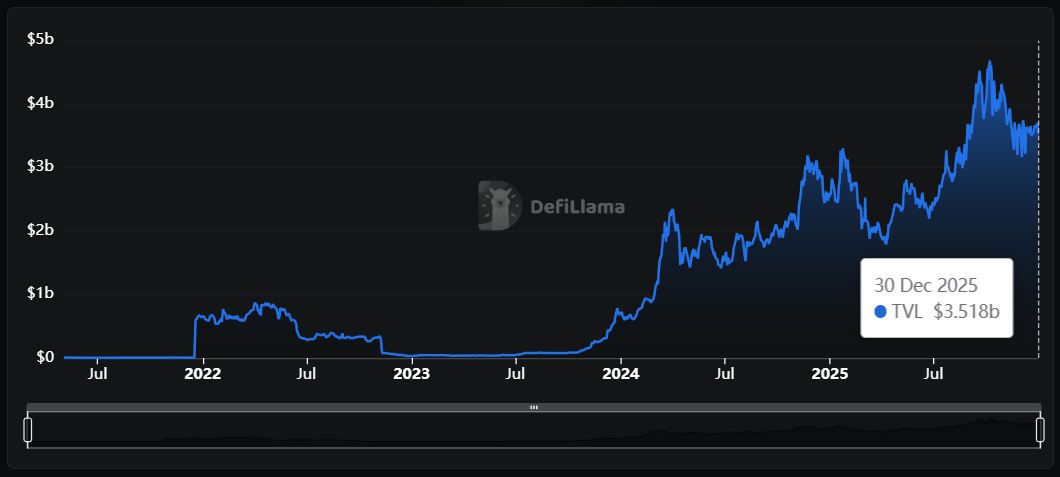

The protocol's growth speaks to its product-market fit. At its peak earlier in 2025, Kamino had over $5.4 billion in assets under management. Even in the current market environment, it maintains a robust $3.4 billion in Total Value Locked (TVL), with $1.2 billion actively borrowed, reflecting strong capital utilization.

Image: Kamino TVL

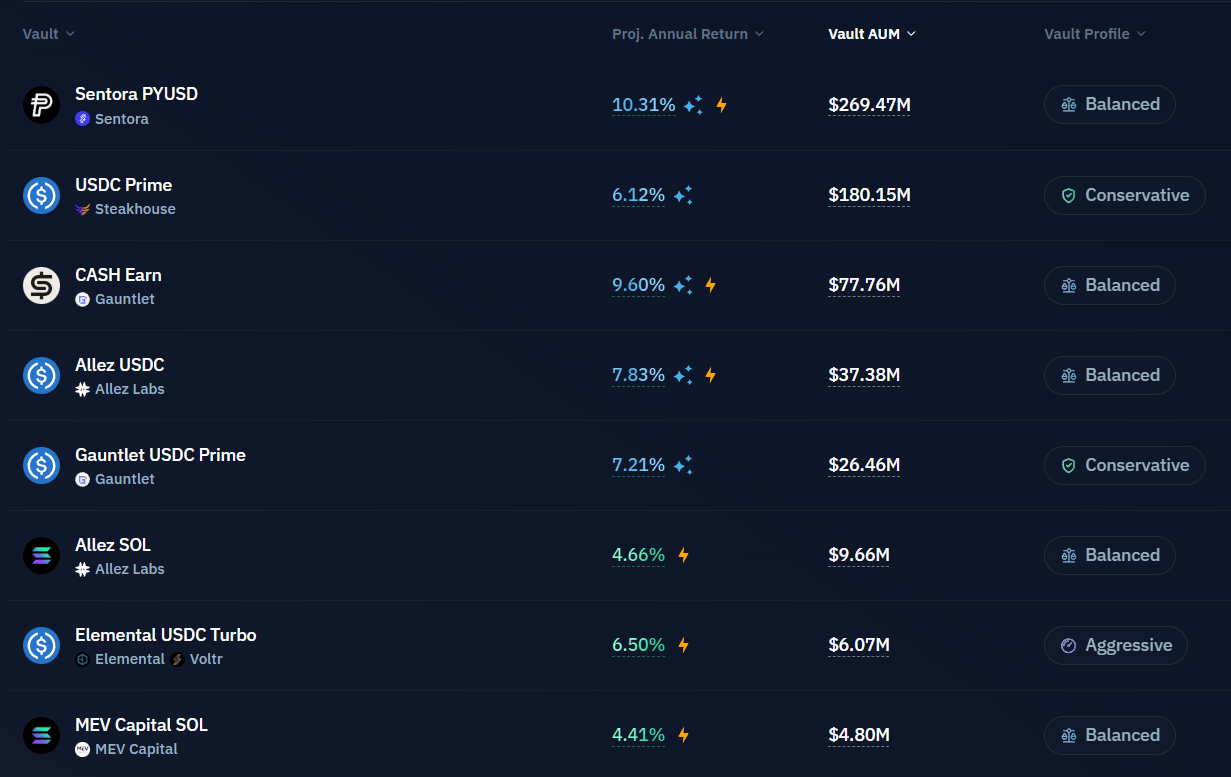

What sets Kamino apart for institutional allocators is its deliberate design choices that prioritize transparency, automation, and professional risk management. Features like curated Earn vaults, managed by specialist firms such as Steakhouse Financial, Gauntlet, Sentora, Allez Labs, and MEV Capital, function as on-chain equivalents to managed yield strategies.

Image: Top Earn Vaults

These vaults diversify across stablecoins, liquid staking tokens (LSTs, which allow staked SOL to remain usable while earning rewards), and tokenized real-world assets (RWAs, on-chain versions of traditional securities or credit).

This institutional tilt became explicit with the December 2025 "Next Chapter" governance announcement, where the team outlined plans to introduce fixed-rate borrowing, private credit vaults, and support for off-chain collateral. These features directly solve institutional hurdles: predictable costs, access to real-world yields, and compatibility with existing custody setups.

In short, Kamino is well-positioned to benefit from two converging trends: Solana's rise as a high-performance settlement chain and the migration of tokenized assets on-chain. For allocators seeking Solana exposure with reduced operational overhead, it represents a compelling, battle-tested option.

2. Protocol Analysis

Building on its strategic positioning, Kamino's technical architecture reveals why it has achieved such resilience and scale. The protocol's V2 upgrade introduced a modular structure that cleanly separates isolated lending markets from automated vault strategies. This design choice enhances both security, by containing risks, and composability, allowing components to interact efficiently on Solana's fast, low-cost blockchain.

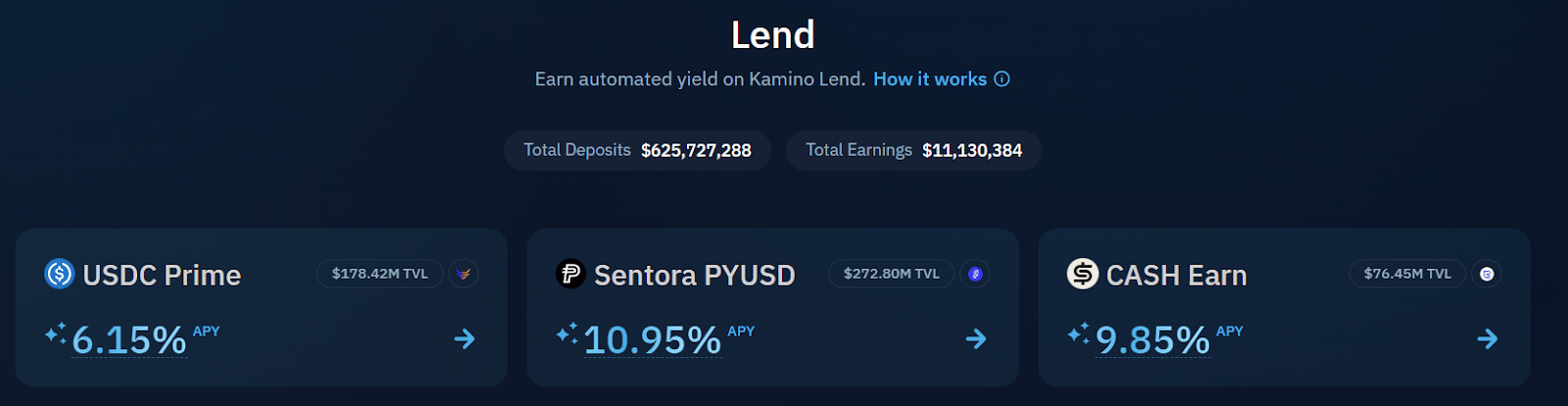

At the heart of the system is Kamino Lend, which uses isolated markets rather than a single shared pool. Each asset pair (e.g., JitoSOL-USDC or PYUSD-USDC) operates independently, preventing issues in one market from affecting others. Lenders earn variable yields based on real-time utilization rates, while borrowers can access higher loan-to-value ratios through features like Elevation Mode for closely correlated assets.

A key innovation is the use of kTokens; yield-bearing receipts issued upon deposit. Unlike static receipts, kTokens continue accruing rewards and can be used directly as collateral elsewhere in Kamino or in external protocols. This composability eliminates the common DeFi friction of having to unwind positions to redeploy capital.

Leveraged products, such as Multiply vaults, maximize this composability further. They execute looping strategies atomically using flash loans (short-term, uncollateralized borrows repaid in the same transaction). A user selects a target leverage level, and the vault automatically borrows, swaps, and redeposits until the desired exposure is reached, all in one seamless step.

Liquidity vaults extend the automation theme by managing concentrated positions on underlying DEXs. The protocol continuously adjusts price ranges to optimize fee capture, compounds rewards, and filters out brief price anomalies.

Risk management is layered and proactive. Auto-deleverage mechanisms gradually reduce positions during volatility to avoid sudden liquidations. Borrow premiums adjust dynamically based on individual position risk and market depth. Suppliers can opt for protected collateral modes that shield them from borrower defaults.

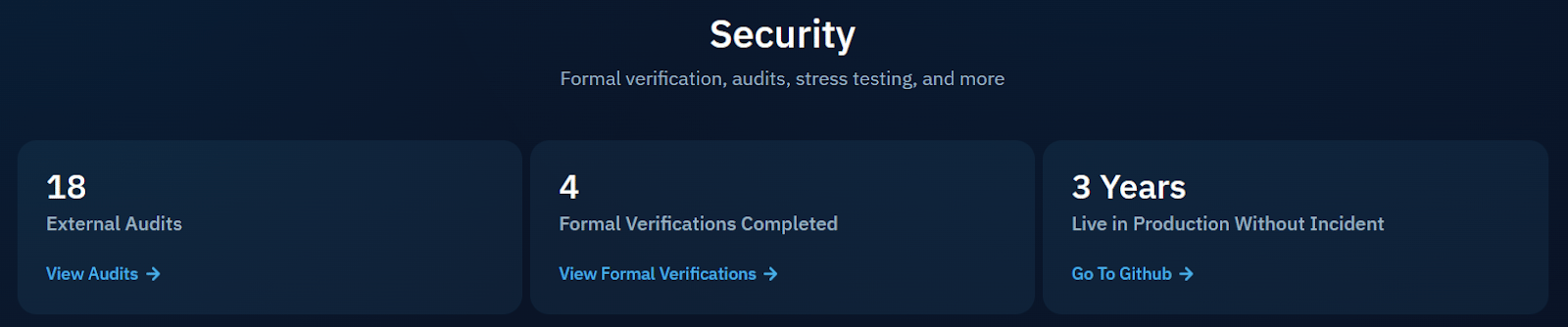

This framework has proven itself in practice: Kamino has originated over $16 billion in loans and processed $183 million in liquidations while recording zero bad debt to lenders. Security is reinforced by 18 independent audits, 4 formal verifications, and an active $1.5 million bug bounty program, with no critical incidents in three years of production.

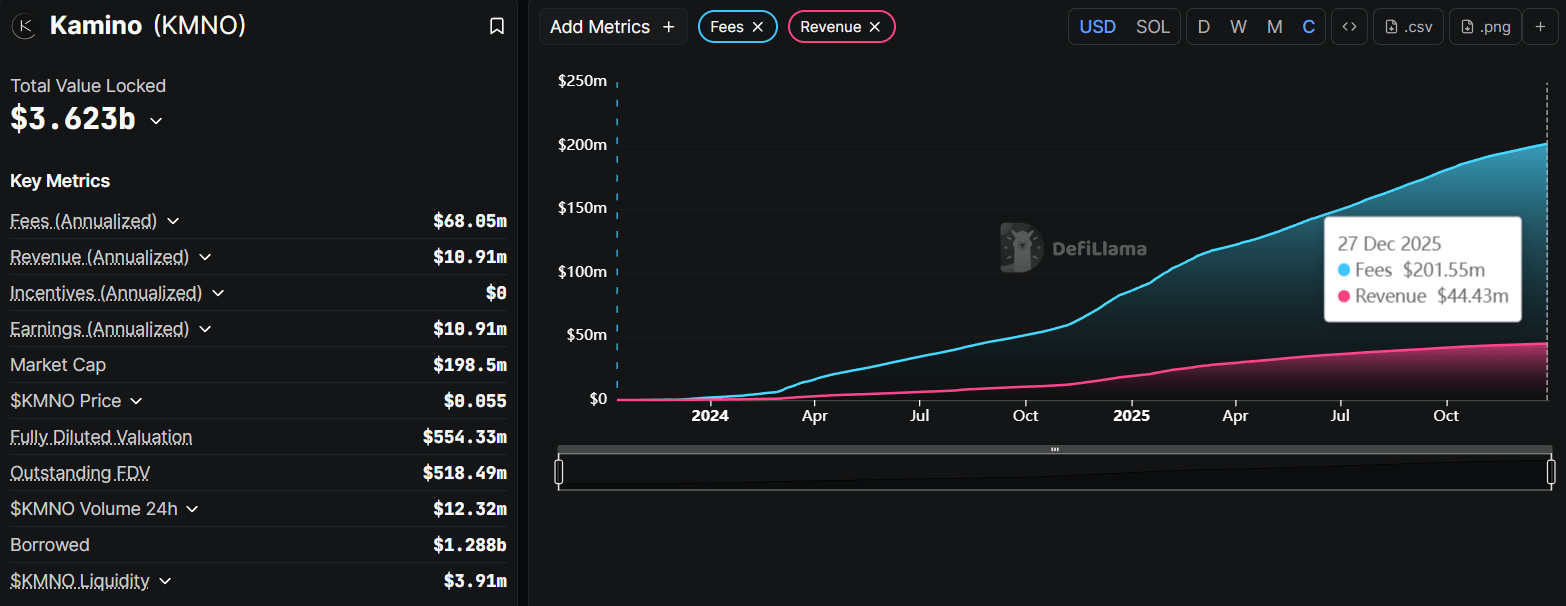

Supporting metrics highlight economic vitality: $68 million in annualized fees and $10.9 million in annualized protocol revenue, built on cumulative fees of $201 million.

These technical strengths: modularity, automation, and rigorous risk controls, create a platform that is not only efficient for retail users but increasingly suitable for institutional-scale deployment.

3. Tokenomics & Economic Model

The protocol's ability to generate substantial fees, without heavy reliance on token emissions, creates a favorable setup for long-term sustainability. However, the KMNO token's role in capturing that value remains primarily incentive-focused today, with governance and potential revenue-sharing mechanisms still in development. This transitional stage is common in maturing DeFi protocols, offering alignment through points boosts while leaving room for stronger accrual as the DAO activates.

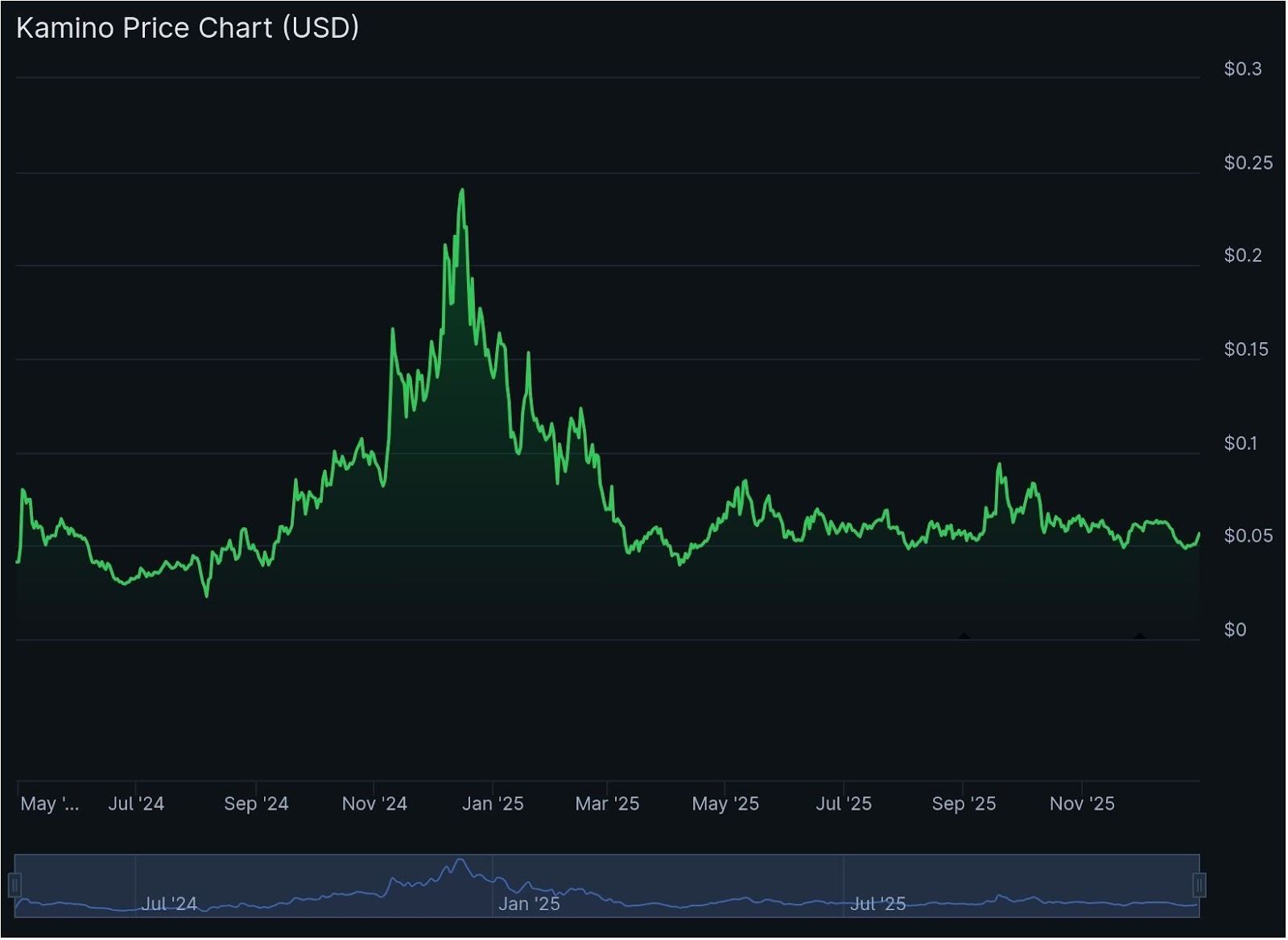

KMNO launched on April 30, 2024. The token has a fixed total supply of 10 billion. As of late December 2025, KMNO trades at approximately $0.05, resulting in a market capitalization of $203 million and a fully diluted valuation (FDV) of $566 million.

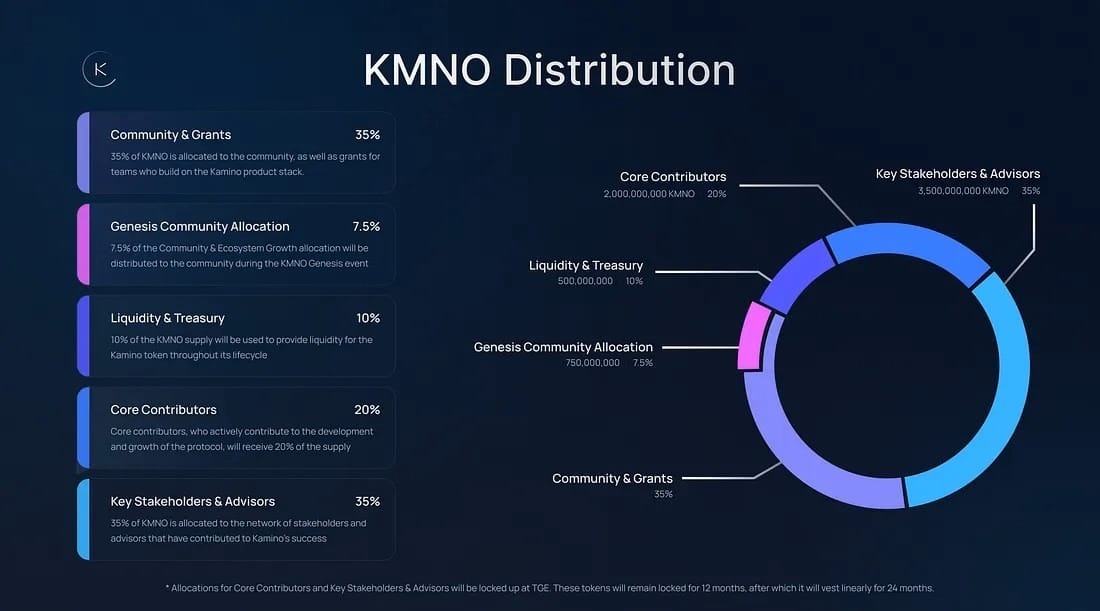

Key allocations, prioritize community and operational needs:

7.5% distributed through the genesis event (750 million tokens, immediate unlock), a portion from the 35% allocation to the community, and grants.

10% reserved for providing and maintaining liquidity across trading venues.

20% for core contributors, locked for 12 months, then linear vesting over 24 months.

35% to key stakeholders and advisors, locked for 12 months, then linear vesting over 24 months.

Current utility centers on ecosystem participation rather than direct economic rights:

Staking for Points Boosts: Holders stake KMNO natively on the platform to amplify points earnings in ongoing seasons. For every $1 worth of KMNO staked, users gain an additional 3x points per day. Longer staking periods can compound boosts up to 200%, encouraging retention and productive activity.

Future Governance: The token is designed to enable decision-making once full protocol governance launches. Staked KMNO would grant voting rights on parameters, treasury deployment, and upgrades.

No active revenue-sharing, buyback, or burn mechanisms are currently implemented. Protocol treasury accumulation, from lending spreads, vault fees, and other sources, provides significant dry powder for future proposals. Governance activation could unlock pathways to direct value accrual, such as fee diversions to stakers or token repurchases.

Ongoing seasons continue to distribute KMNO rewards based on points, with vesting curves designed to reduce immediate sell pressure. This incentive structure has effectively driven TVL growth, but it also means token supply expansion remains a factor until emissions taper.

For institutional investors holding or considering KMNO exposure, the tokenomics present a balanced profile: limited near-term yield from revenue, offset by low-emission alignment and meaningful treasury leverage. As Kamino executes its institutional and RWA roadmap, governance proposals could strengthen capture, turning accumulated fees into more direct holder benefits.

4. Competitive Landscape & Market Positioning

Kamino's integration of automation, professional risk curation, and early RWA support has secured its position as the leading lending protocol on Solana. While newer entrants have gained ground rapidly, capitalizing on Solana's efficient user acquisition, the overall lending sector remains concentrated, with Kamino capturing the majority share through depth and reliability.

Solana's lending market has matured significantly in 2025, driven by higher utilization rates and inflows into LSTs and tokenized assets. Total sector TVL sits around $4-5 billion, representing meaningful growth year-over-year amid broader DeFi expansion.

The competitive field is defined by a handful of focused players, each targeting different user segments:

Kamino excels in full-suite composability and institutional-grade features, such as curated vaults and modular market creation. This has attracted sustained deposits, particularly from professional managers seeking transparent strategies.

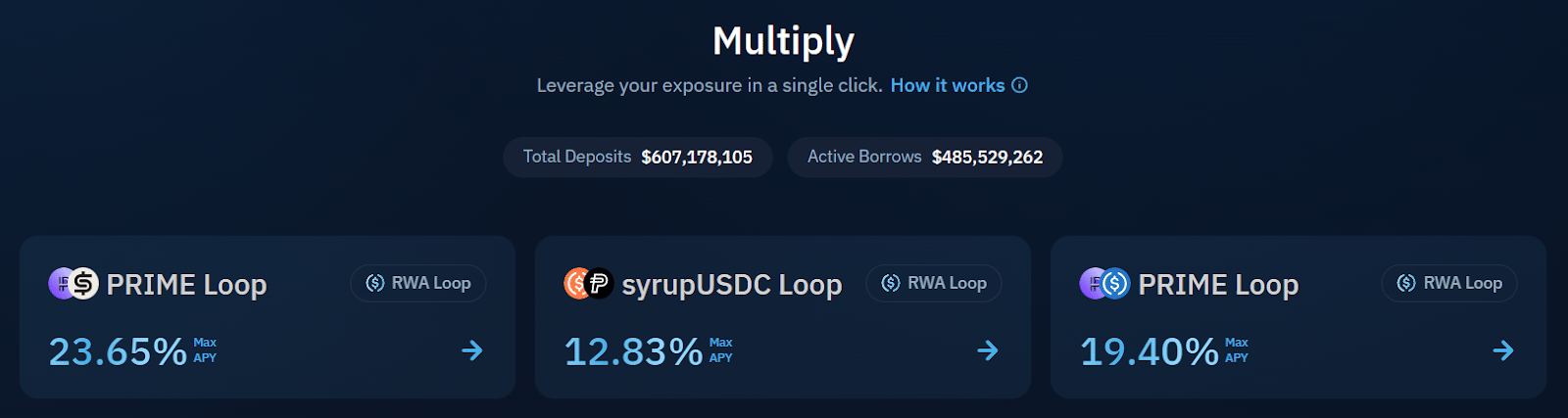

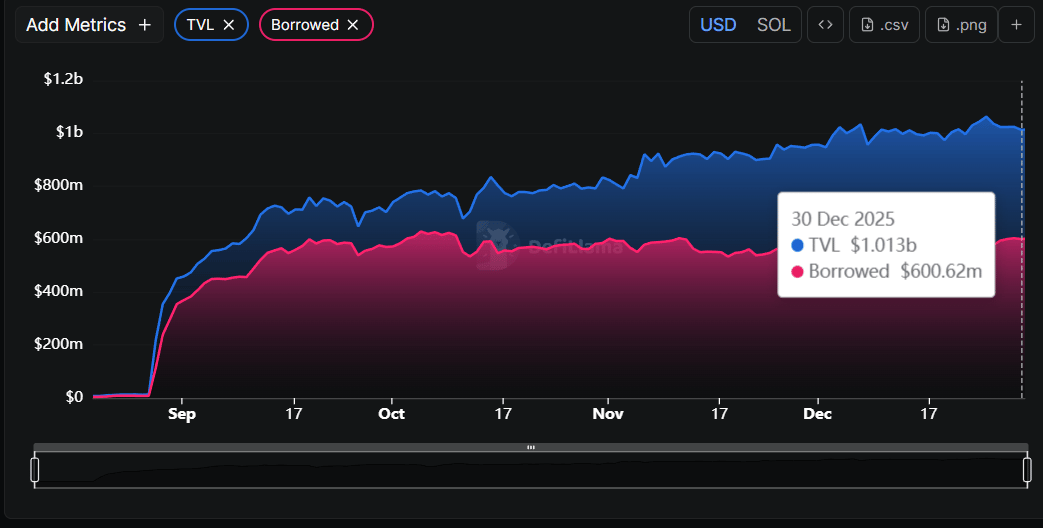

The most notable challenger is Jupiter Lend, launched in August 2025. Powered by Jupiter's dominant aggregation layer, it offers seamless integration for borrowing, swapping, and trading, all within one interface. Its emphasis on high LTVs (Loan-to-Value), low liquidation penalties, and aggressive incentives enabled explosive early growth.

Image: Jupiter Lend

Legacy protocols like Marginfi and Save (formerly Solend) maintain niches: Marginfi (TVL ~$100 million) for advanced risk parameters and exotic assets, Save (TVL ~$124 million) for straightforward passive lending. Both have seen relative share erosion as users migrate toward more integrated or higher-yield venues.

At a glance, the landscape as of late December 2025 appears as follows:

Protocol | Approx. TVL | Market Share | Key Differentiator |

Kamino | ~$2 billion | ~60% | Full automation, curated vaults, RWA depth |

Jupiter Lend | ~$1 billion | ~28% | Super-app integration, high yields/LTVs |

Marginfi | ~$100 million | ~2.8% | Isolated banks for riskier assets |

Save | ~$124 million | ~3.5% | Simplicity and longevity |

Others (Loopscale, etc.) | <$100 million | ~5.7% | Niche features (e.g., hybrids) |

Kamino's advantages: first-mover trust, zero bad debt history, and alignment with institutional trends like fixed rates and private credit, provide a defensive moat.

Ultimately, the market remains underpenetrated relative to Ethereum, leaving room for multiple winners. Kamino's go-to-market execution and deep ecosystem ties position it favorably to consolidate further as RWAs and institutional flows accelerate.

5. Go-to-Market Strategy & Ecosystem Integration

Kamino's approach to growth has always been pragmatic, blending viral retail incentives with increasingly sophisticated institutional channels. While early adoption relied heavily on points-based seasons to drive deposits and activity, the current strategy emphasizes composability, targeted partnerships, and plug-and-play infrastructure to expand reach without proportional reliance on emissions.

Retail acquisition continues through user-friendly entry points, such as one-click Multiply vaults and curated Earn strategies, which convert passive holders into active participants. Staking KMNO for points boosts remains a core alignment tool, rewarding longer-term engagement and helping sustain organic flows even as dedicated seasons wind down.

The more transformative shift, however, is toward institutional and builder distribution. The "Next Chapter" initiative outlines a clear infrastructure-led playbook: deliver specialized credit tools that institutions actually need, fixed rates for cost certainty, off-chain collateral for custody compatibility, and private credit routing for real-world yield access, then make them easily embeddable.

This is executed through:

Kamino Buildkit: An SDK and API suite allowing wallets, fintechs, and applications to integrate Kamino yield and borrowing directly. Integrators earn revenue share from generated activity, while embedded Privy wallets reduce onboarding friction.

Targeted Institutional Partnerships:

FalconX as the pilot borrower for Fixed Rates.

Anchorage Digital enabling off-chain collateral mirroring, with the Solana Company as the day-one borrower.

Chainlink for oracle pricing and attestation in RWA and off-chain workflows.

These collaborations lower barriers for tokenized asset issuers and allocators, providing integrated liquidity, pricing, and credit in one venue rather than fragmented solutions.

Broader ecosystem ties reinforce depth: seamless routing via Jupiter, LST composability with Jito and Sanctum, and RWA pilots that attract professional capital seeking compliant on-chain exposure.

By combining battle-tested automation for retail stickiness with revenue-shared infrastructure for builders and tailored features for institutions, Kamino is engineering multiple acquisition channels. This multi-pronged strategy positions the protocol to scale efficiently as Solana attracts larger, more regulated flows.

6. Risks & Opportunities

Kamino's leadership position and institutional roadmap present meaningful upside, but the protocol operates in a fast-moving environment where several risks could affect near and medium term performance.

Risks:

Execution and Technical Risk: Expanding into off-chain collateral, complex pricing mechanisms, and new borrowing primitives introduces additional complexity. While the protocol's security history is strong, any implementation shortfall or vulnerability in these features could temporarily impair confidence.

Competitive Dynamics: The lending sector on Solana remains highly contested. Challengers offering higher yields or tighter integrations could erode market share, particularly if public disagreements over risk practices persist.

Token Supply Pressure: Scheduled vesting releases and incentive distributions continue to add to the circulating supply. Without accelerated revenue capture or governance-activated retention mechanisms, this can contribute to short-term price volatility.

Network and Oracle Dependencies: Performance remains correlated with Solana's operational stability. Periods of congestion or oracle latency, observed during high-activity windows in 2025, can elevate liquidation risks in leveraged positions.

Regulatory Evolution: Greater emphasis on institutional and RWA products increases exposure to regulatory scrutiny, especially around leveraged lending and off-chain linkages. Unfavorable clarity could slow adoption among regulated entities.

These risks are not insignificant, yet many are mitigated by the protocol's isolation design, professional risk oversight, and proven operational history.

Opportunities:

Tokenized Asset Convergence: Solana is gaining traction as a settlement layer for real-world assets, with RWA circulation growing rapidly across chains. Kamino's planned fixed-rate borrowing, off-chain collateral support, and private credit routing directly address institutional requirements for predictability and custody compatibility. A successful rollout could establish Kamino as the preferred credit venue for large-scale tokenized markets.

Institutional Product Differentiation: Curated vaults managed by professional risk firms, combined with modular market creation, offer allocators transparent exposure without operational complexity. Partnerships with established players lend credibility and accelerate adoption.

Network Effects from Buildkit: The upcoming SDK/API for embedding Kamino functionality creates a distribution moat, enabling revenue shared integrations across wallets and applications.

7. Investment Thesis & Key Takeaways

Kamino Finance offers institutional allocators a balanced way to gain exposure to the Solana ecosystem. It combines current utility through reliable yield and leverage products with meaningful optionality from its shift toward institutional and tokenized asset infrastructure.

The protocol has proven its resilience over multiple market cycles, maintaining leadership in Solana lending while generating consistent treasury revenue and preserving a clean operational record.

Its modular design, professional risk curation, and automation provide efficient access today. The roadmap, focused on fixed-rate borrowing, off-chain collateral, and embeddable credit tools, targets clear institutional needs as real-world assets move on-chain.

Three scenarios help frame the potential outcomes:

Bull Case (High Probability)

Successful delivery of new institutional features coincides with broader Solana growth and RWA adoption. Deeper liquidity attracts regulated capital, permissionless markets expand product breadth, and treasury revenue supports stronger token alignment through governance. TVL approaches ambitious internal targets, and KMNO benefits from increased protocol relevance and potential value-accrual mechanisms.

Base Case (Most Likely)

Kamino maintains lending leadership through steady organic growth and retail automation strengths. New products launch on schedule and gain moderate traction among institutions. Revenue continues to build the treasury, providing optionality for future holder benefits. Risks remain contained, delivering solid but not explosive upside tied to Solana's overall performance.

Bear Case (Low Probability)

Delays or issues in new feature rollouts, intensified competitive pressure, or broader Solana challenges slow the momentum. Token vesting adds supply pressure without offsetting accrual improvements. TVL growth stalls, and returns are limited or negative in severe drawdowns, though isolation and risk controls cap downside relative to less mature protocols.

Risks: competition, execution, token dynamics, network dependencies, and regulatory evolution are real and require monitoring. However, Kamino's defensive qualities (market depth, security history, revenue generation) provide meaningful protection compared to earlier-stage alternatives.

Key Takeaways:

Kamino provides reliable, curated exposure to Solana DeFi today.

The institutional-focused roadmap offers a differentiated growth driver.

Treasury buildup creates future optionality for token holders.

Risks are identifiable and partially mitigated by design and track record.

8. Data & Sources

All data and statements in this memo are based on publicly available, verifiable sources.

Total Value Locked (TVL), Borrowed Amounts, Fees, and Revenue: DeFiLlama

KMNO Token Price, Market Cap, FDV, and Circulating Supply: CoinGecko

Security Audits, Formal Verifications, Bug Bounty, and Track Record: Kamino

"Next Chapter" Roadmap, Cumulative Metrics, and Governance Details: Governance

Product Mechanics, Staking Boosts, Token Utilities, and Allocations: Docs

Live Dashboard Metrics, Vault APYs, and Curated Strategies: Kamino

All charts, tables, and screenshots recommended in the memo can be reproduced directly from the above sources.