Dear Readers,

Welcome to the 7th edition of Fiat Bridge.

The integration between traditional finance and digital assets has reached new heights of maturity. Institutional adoption is no longer speculative; it's delivering measurable yields through tokenized securities, fueling corporate treasuries with Bitcoin and Ethereum, and prompting central banks to enhance their digital currencies with interest-bearing features. Yet, alongside these advances, risks like sophisticated scams remind us that security remains paramount in this evolving landscape.

These developments signal a structural shift: blockchain is enabling faster settlement, programmable yields, and 24/7 access, while mirroring familiar products such as money market funds or treasury bills. This edition examines four key stories, focusing on practical implications for portfolios and operations as we head into 2026.

Let’s dive in.

Market Pulse

Total Crypto Market Cap: ~$3.03 Trillion (down 2.8% in the last 24 hours)

Bitcoin Dominance: ~57.16% (BTC market share against the rest of the market)

Bitcoin Price: ~$87,135 (down 3.1% in the last 24 hours)

Ethereum Price: ~$2,937 (down 3% in the last 24 hours)

Solana Price: ~$123 (down 3.4% in the last 24 hours)

Total Stablecoin Supply: ~$307 Billion (down 0.1% in the last 24 hours)

DeFi TVL: ~$117 Billion (down 1% in the last 24 hours)

24h Trading Volume: ~$109 Billion

Fear & Greed Index: 23 (extreme fear)

Top Stories of the Day

Impersonation Scam Targets Coinbase Users, Stealing Over $2 Million

Tokenized Real-World Assets Hit Milestones in Stocks and Treasuries

Corporate Treasuries Load Up on Bitcoin and Ethereum Amid Rising Network Security

Regulatory Shifts and 2026 Outlook: From Interest-Bearing Digital Yuan to Institutional Predictions

Today’s edition of the Fiat Bridge newsletter is brought to you by Masterworks.

3 Tricks Billionaires Use to Help Protect Wealth Through Shaky Markets

“If I hear bad news about the stock market one more time, I’m gonna be sick.”

We get it. Investors are rattled, costs keep rising, and the world keeps getting weirder.

So, who’s better at handling their money than the uber-rich?

Have 3 long-term investing tips UBS (Swiss bank) shared for shaky times:

Hold extra cash for expenses and buying cheap if markets fall.

Diversify outside stocks (Gold, real estate, etc.).

Hold a slice of wealth in alternatives that tend not to move with equities.

The catch? Most alternatives aren’t open to everyday investors

That’s why Masterworks exists: 70,000+ members invest in shares of something that’s appreciated more overall than the S&P 500 over 30 years without moving in lockstep with it.*

Contemporary and post war art by legends like Banksy, Basquiat, and more.

Sounds crazy, but it’s real. One way to help reclaim control this week:

*Past performance is not indicative of future returns. Investing involves risk. Reg A disclosures: masterworks.com/cd

Now let’s get back to the top stories of the day.

1. Impersonation Scam Targets Coinbase Users, Stealing Over $2 Million

A stark reminder of persistent risks in digital assets emerged this week with the exposure of an alleged Canadian scammer who posed as Coinbase customer support to steal more than $2 million in cryptocurrency over the past year.

The perpetrator employed classic social engineering tactics: building trust through fake assistance calls, emails, and Telegram interactions. A leaked video even showed the scammer on a phone call with a victim, offering bogus help desk support. Victims were tricked into granting access or revealing sensitive information, allowing funds to be drained.

The scam was uncovered by prominent blockchain investigator ZachXBT, who traced the suspect through careless operational security, social media posts flaunting a lavish lifestyle, traceable wallet transactions, purchases of rare usernames, and other digital footprints. The stolen funds were reportedly spent on gambling, bottle service, and luxury items.

For those less familiar with crypto: "Social engineering" here means psychological manipulation rather than technical hacks. Exchanges like Coinbase never solicit private keys (the master passwords to wallets) or initiate unsolicited support requests. This incident highlights why multi-factor authentication, hardware wallets, and official-channel verification are essential safeguards.

As digital asset custody grows among institutions, such cases underscore the need for robust user education and insurance mechanisms, areas where traditional finance's experience with fraud prevention can bridge the gap.

2. Tokenized Real-World Assets Hit Milestones in Stocks and Treasuries

Tokenization, the process of issuing traditional assets like stocks or government bonds as digital tokens on blockchains, continues to demonstrate real-world scalability and appeal to institutional investors.

The market for tokenized stocks (often called onchain equities) has now reached a $1.2 billion market capitalization. This growth has accelerated in recent months, driven by platforms offering benefits such as 24/7 trading, fractional ownership of shares, and near-instant settlement, advantages that address pain points in conventional markets.

Key players include Backed Finance (with integrations on exchanges like Kraken and Bybit), Securitize, Ondo Finance (planning tokenized US stocks and ETFs on Solana in early 2026), and even traditional giants like Coinbase and Nasdaq, the latter viewing tokenization as a strategic priority for mainstream adoption.

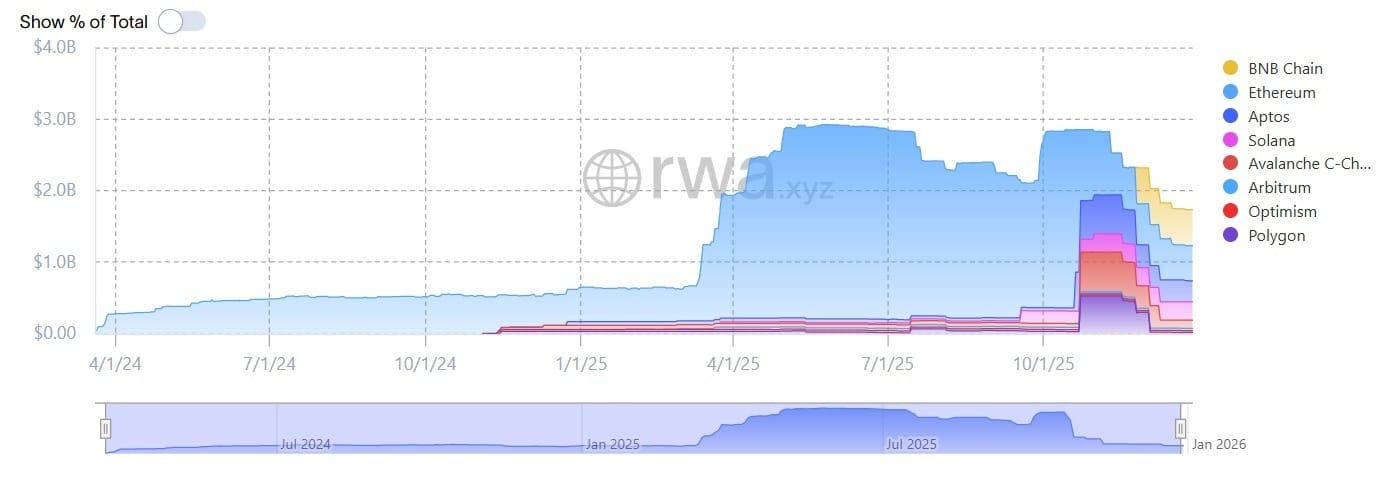

In a parallel milestone, BlackRock's BUIDL fund, a tokenized money market fund investing primarily in US Treasury bills, repurchase agreements, and cash equivalents, has distributed $100 million in cumulative dividends since its March 2024 launch.

Issued by Securitize and pegged 1:1 to the US dollar, BUIDL has expanded across multiple blockchains, including Ethereum, Solana, Aptos, Avalanche, and Optimism. Assets under management peaked above $2.8 billion in October, illustrating how blockchain enables transparent, programmable yield distribution while replicating traditional fund mechanics.

These examples show tokenized real-world assets (RWAs) moving beyond experimentation into production-scale products that deliver TradFi-like reliability with onchain efficiencies.

3. Corporate Treasuries Load Up on Bitcoin and Ethereum Amid Rising Network Security

Corporate adoption of digital assets as treasury reserves remains aggressive, with notable purchases underscoring Bitcoin's role as a strategic store of value and Ethereum's appeal for yield generation.

MicroStrategy, widely known in markets as Strategy, resumed its Bitcoin accumulation after a brief pause, acquiring 1,229 BTC for approximately $109 million (average price ~$88,568 per BTC) between December 22 and 28.

Funded via stock sales, this brings the company's total holdings to 672,497 BTC, acquired at an average cost of about $74,997 per coin. MicroStrategy's consistent strategy positions Bitcoin as a core balance-sheet asset, akin to corporate bond holdings but with inflation-hedge properties.

On the mining side, Bitcoin's network difficulty reached a record 148.2 trillion, up 35% from 109.8 trillion at the start of 2025. This metric adjusts automatically to maintain ~10-minute block times and reflects surging miner participation, deploying more efficient hardware despite the April 2025 halving event that reduced rewards.

Shifting to Ethereum, BitMine Immersion Technologies added 44,463 ETH last week, pushing its treasury to 4,110,525 ETH, over 3.4% of the circulating supply, valued at more than $12 billion. The firm has begun staking (locking ETH to secure the network and earn rewards) over 408,000 tokens, preparing for a US-based validator network launch in 2026.

These moves highlight how corporations are treating crypto not just as speculative holdings but as diversified reserves with potential yields, supported by increasingly robust network security.

4. Regulatory Shifts and 2026 Outlook: From Interest-Bearing Digital Yuan to Institutional Predictions

Global regulators continue shaping the fiat-crypto bridge, with notable developments in central bank digital currencies (CBDCs) and forward-looking theses from venture investors.

Starting January 1, 2026, just days away, China's digital yuan (e-CNY) will transition to interest-bearing deposits. Banks will pay interest on verified e-CNY wallets per existing deposit rate frameworks, with full insurance coverage via the national system.

This shifts e-CNY from pure electronic cash to a deposit-like instrument, giving banks more operational flexibility while non-bank payment firms hold 100% reserves. With 3.48 billion transactions recorded by November 2025, the PBOC (People’s Bank of China) is also piloting cross-border use with partners like Singapore and Hong Kong.

Elsewhere, Russia tests limited retail crypto access under strict caps, and US political shifts fuel debates on SEC enforcement.

Looking ahead, Dragonfly Capital's Managing Partner Haseeb Qureshi forecasts Bitcoin exceeding $150,000 by end-2026, with declining dominance as activity spreads. Key themes include sharp stablecoin growth (especially dollar-denominated for emerging markets), consolidation in DeFi trading venues, deeper corporate blockchain integration (e.g., Fortune 100 firms and tech giants launching wallets), and prioritized tokenization focused on durable distribution. Ethereum and Solana are expected to lead the infrastructure, while prediction markets expand culturally.

These regulatory enhancements and bullish institutional outlooks suggest 2026 could accelerate fiat-digital convergence.

Meme Corner

Closing Note

This year has proven that digital assets are evolving into serious tools for traditional finance, delivering yields, enhancing treasuries, and prompting regulatory innovation. As tokenization scales and institutions deepen involvement, the fiat bridge feels sturdier than ever.

If these trends resonate with your investment strategy or business operations, we'd welcome a conversation on how to navigate them effectively. Reply to this newsletter or reach out directly.

Thank you for reading, and I will see you tomorrow.