Hello everyone,

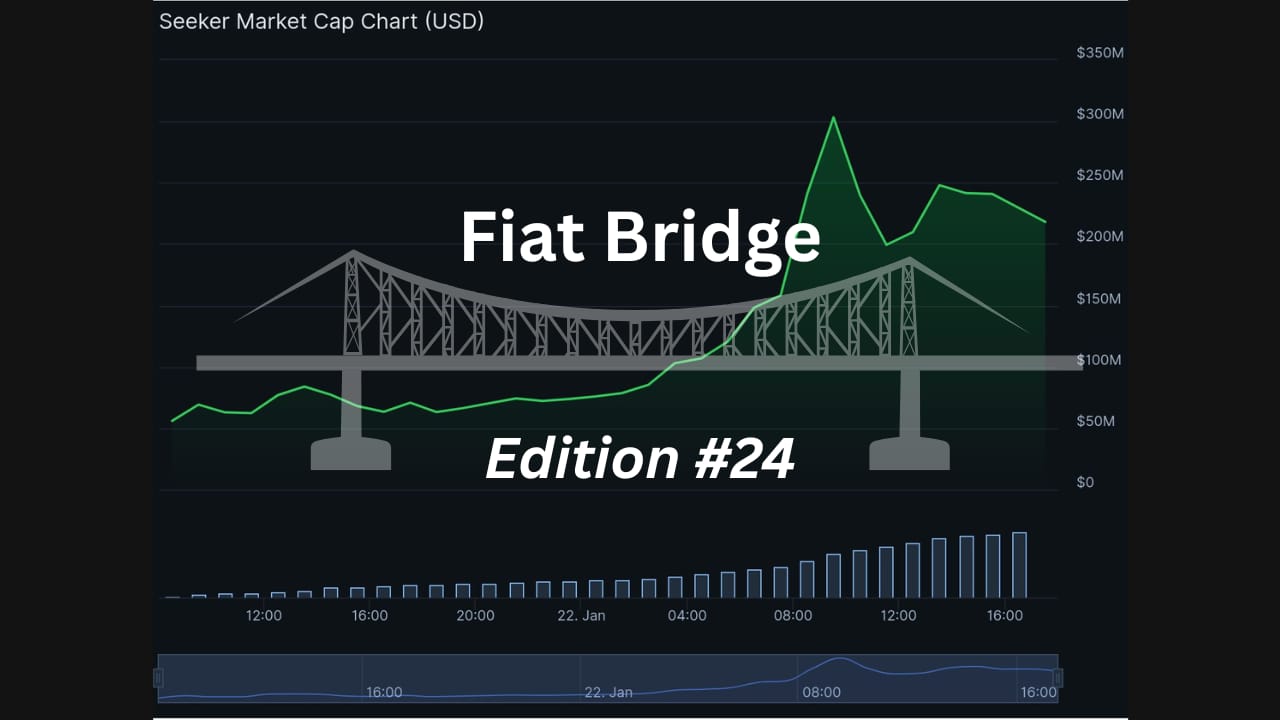

Welcome to the 24th edition of the Fiat Bridge Daily Crypto Newsletter.

Today, we are looking into the state of the ecosystem via Market Pulse and Top 10 Best Performing Tokens in the Last 7 Days, along with the Top Three News Stories and investment insights of the day.

Let’s begin.

Market Pulse

Total Crypto Market Cap: ~$3.1 Trillion (up 1.7% in the last 24h)

Bitcoin Dominance: ~57.4% (BTC market share against the rest of the market)

Bitcoin Price: ~$90,016 (up 0.9% in the last 24h)

Ethereum Price: ~$2,999 (up 1.3% in the last 24h)

Solana Price: ~$130 (up 1.8% in the last 24h)

Total Stablecoin Supply: ~$309 Billion

DeFi TVL: ~$121 Billion (up 1.3% in the last 24h)

24h Trading Volume: ~$149 Billion

Fear & Greed Index: 20 (extreme fear)

Ad Break!

Please, check out my sponsor for the day: 1440 Media.

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

… back to the article 👇

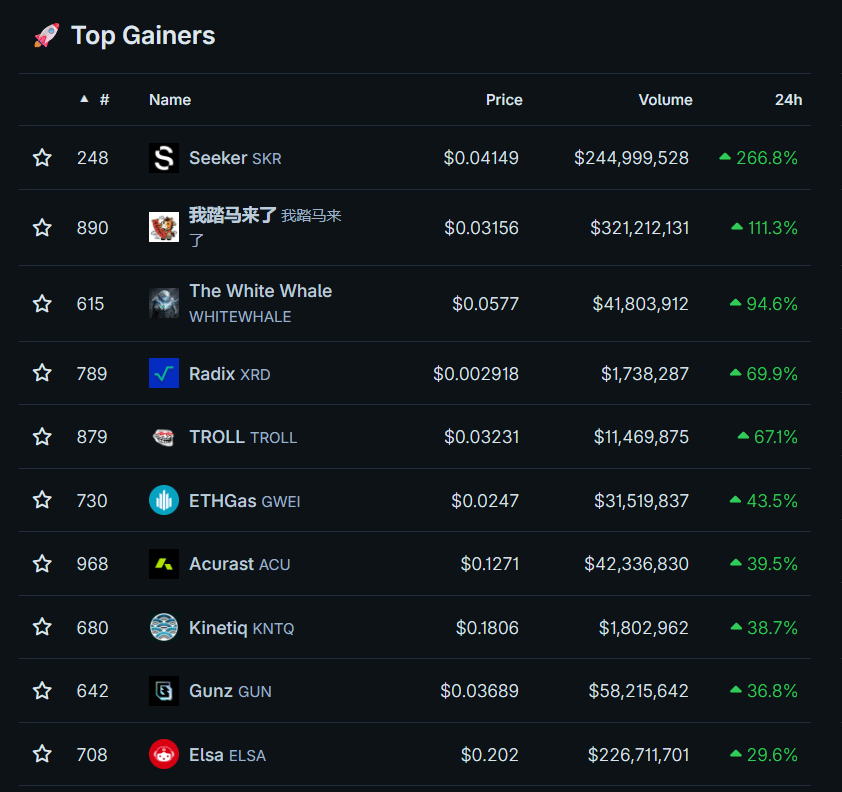

Top 10 Best Performing Tokens in the Last 7 Days:

Top Stories of the Day

1. BitGo’s NYSE Debut Marks Watershed Moment

BitGo Holdings, one of the industry's most trusted cryptocurrency custody platforms, priced its initial public offering (IPO) at $18 per share, above its initially indicated range of $15 to $17. This premium pricing reflects strong institutional demand and signals confidence in the sector's trajectory.

What does this mean?

BitGo is raising approximately $212.8 million in gross proceeds from 11.8 million Class A common shares, with the company's stock beginning trading on the New York Stock Exchange under the ticker "BTGO."

For context, custody refers to the safekeeping of digital assets on behalf of institutional clients; think of it as a crypto bank vault managed by professional security protocols. BitGo pioneered multi-signature wallets (multiple authorization requirements for fund movements) and threshold signature schemes, making it possible for institutions to hold crypto securely.

This IPO is the industry's first major custody provider to achieve public market status, confirming that institutional-grade infrastructure is no longer speculative but rather mainstream financial infrastructure. The oversubscribed pricing suggests traditional finance investors view crypto infrastructure as a long-term growth opportunity rather than a temporary trend.

Why does it matter for your portfolio?

Custody solutions are foundational to institutional adoption. As more wealth managers, pension funds, and corporations enter crypto markets, demand for custodians will accelerate. BitGo's IPO de-risks perception around crypto infrastructure companies.

2. Nomura’s Laser Digital Launches Tokenized Bitcoin Fund

Nomura's digital asset arm, Laser Digital, announced the launch of the Bitcoin Diversified Yield Fund (BDYF), a tokenized investment product designed to generate income alongside Bitcoin exposure.

What does this mean?

Unlike traditional "vanilla long-only" Bitcoin ETFs that simply track price appreciation, the BDYF employs what's called "market-neutral strategies", which are sophisticated trading techniques that aim to generate returns independent of whether Bitcoin rises or falls. Think of it like a bond that also holds Bitcoin.

The fund is tokenized (issued on blockchain via the Kaio platform) and custodied by Komainu, ensuring institutional-grade security and transparency. It's available exclusively to institutional and accredited investors, signaling serious institutional capital at work.

Laser Digital described the product as the "natural evolution of crypto asset management," particularly relevant after recent market volatility demonstrated investor appetite for returns beyond speculation.

Why does it matter for your portfolio?

This is alpha, the investment industry term for "excess returns beyond market performance." The shift toward yield-bearing structures signals maturation. For institutional investors, holding crypto without additional return mechanisms is increasingly seen as inefficient capital allocation. Expect more yield products to proliferate in 2026.

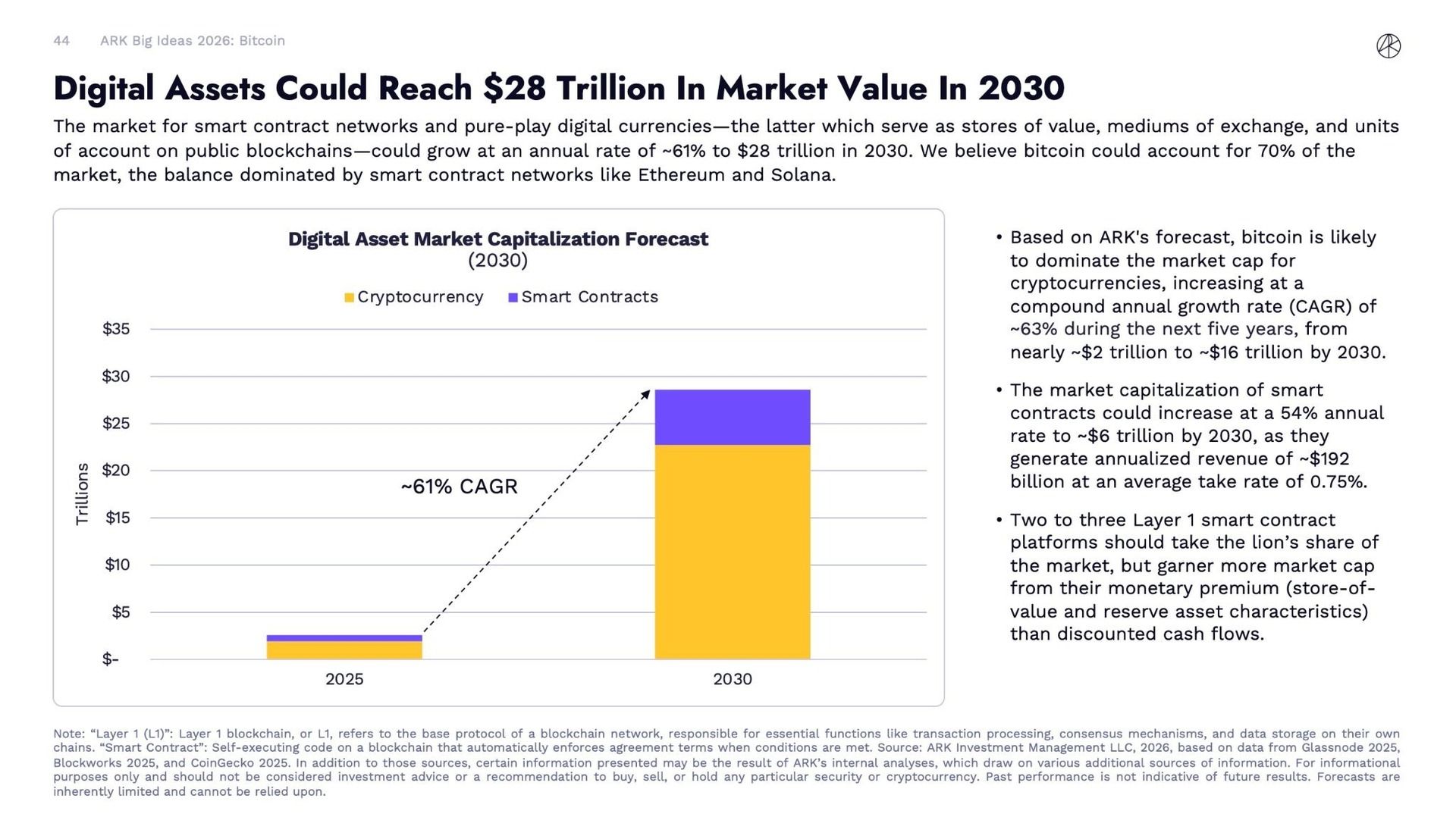

3. Cathie Wood Projects $28 Trillion Crypto Market by 2030

Cathie Wood's ARK Invest published its "Big Ideas 2026" report, projecting the global crypto market will expand to $28 trillion by 2030, a compound annual growth rate of 61%.

What does this mean?

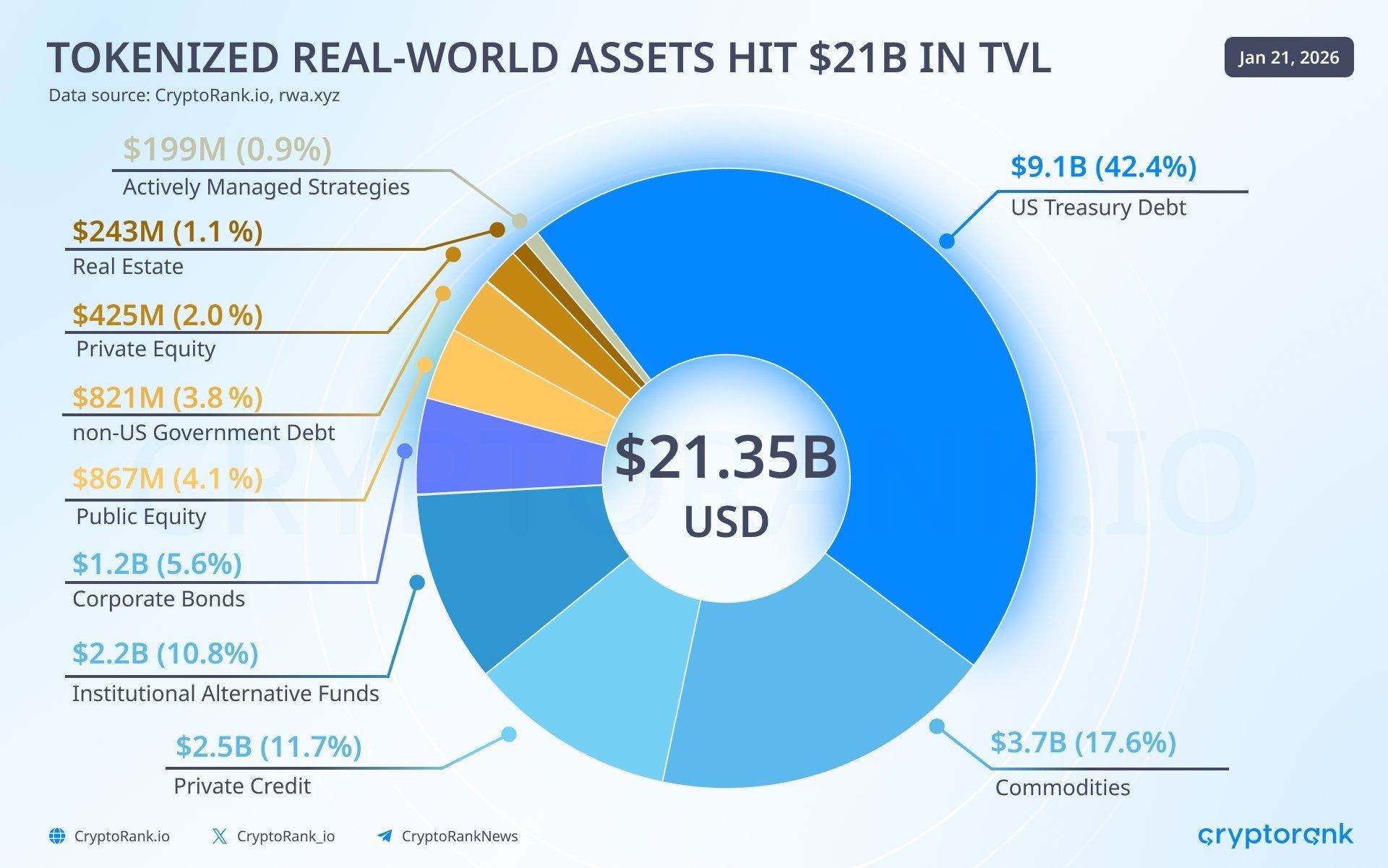

ARK estimates Bitcoin will represent 70% of this market, suggesting a single Bitcoin price range of $950,000 to $1 million by 2030 (compared to today's ~$90K). The remaining 30% comes from smart contract platforms (Ethereum, Solana), growing at a projected 54% CAGR to reach $6 trillion in market cap, plus tokenized real-world assets (RWAs) hitting $11 trillion.

The report notes Bitcoin's maturation as an "institutional asset class", Bitcoin ETFs and corporate Bitcoin holders increased their holdings from 8.7% to 12% of Bitcoin's total supply in 2025 alone, a bullish signal of institutional accumulation.

Why does it matter for your portfolio?

ARK's projections are conservative relative to earlier price targets (Wood previously forecast Bitcoin at $1.5 million) but are backed by methodical research. The fundamental driver is increased institutional adoption, regulatory clarity, and the emergence of "smart contract utility" as these networks generate $192 billion in annualized revenue (with 0.75% average take rate). This creates a valuation framework beyond speculation; these are productive assets generating real cash flows.

Meme Corner

Closing Note

While short-term volatility persists (driven by macroeconomic uncertainty around tariffs and Fed policy), institutional players are betting aggressively on structural adoption.

If you want to support my work, you can buy me a coffee here. Thank you.