Dear Readers,

Welcome to the third edition of the Fiat Bridge Crypto Newsletter.

This issue examines key developments as 2025 concludes: Russia's upcoming regulatory framework opening crypto trading, easing IMF-El Salvador tensions amid continued Bitcoin adoption, record merger and acquisition activity signaling institutional confidence, and the market's response to robust U.S. economic growth alongside seasonal pressures.

Let’s dive in.

Market Pulse

Total Crypto Market Cap: ~$3.02 Trillion (down 1.1% in the last 24 hours)

Bitcoin Dominance: ~57.5% (BTC market share against the rest of the market)

Bitcoin Price: ~$86,762 (down 0.8% in the last 24 hours)

Ethereum Price: ~$2,918 (down 1.5% in the last 24 hours)

Solana Price: ~$121 (down 2.3% in the last 24 hours)

Total Stablecoin Supply: ~$308 Billion (down 0.1% in the last 24 hours)

DeFi TVL: ~$117 Billion (down 1.9% in the last 24 hours)

24h Trading Volume: ~$98 Billion

Fear & Greed Index: 24 (extreme fear)

Top Stories of the Day

Russia Legalizes Crypto Trading for 2026

IMF Praises El Salvador's Economic Progress

Record $8.6 Billion in Crypto Mergers and Acquisitions in 2025

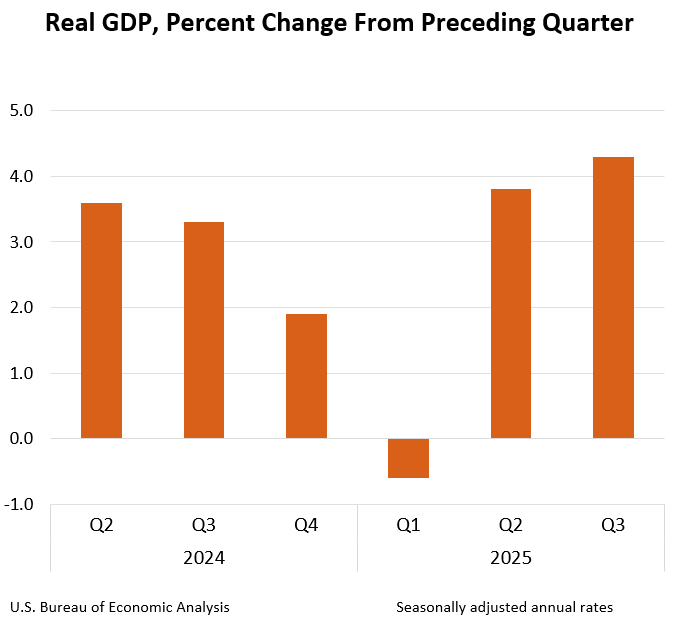

Strong U.S. Q3 GDP Growth at 4.3% Amid Year-End Factors

1. Russia Legalizes Crypto Trading for 2026

Russia’s central bank has unveiled a comprehensive regulatory framework that will legalize cryptocurrency trading for individuals and institutions starting in 2026.

Under the new rules, ordinary citizens (non-qualified investors) can buy and sell digital assets through licensed platforms, subject to an annual limit of 300,000 rubles (~$3,300) per intermediary and after passing a risk-awareness test.

Qualified investors, typically those meeting income or asset thresholds similar to accredited investor standards in many jurisdictions, face no volume caps but must complete a knowledge assessment.

Privacy-focused cryptocurrencies (those designed to obscure transaction details) will be banned, and while crypto can be bought and sold, it cannot be used for domestic payments. The framework also recognizes stablecoins (cryptocurrencies pegged to fiat currencies or assets to minimize volatility) as tradable monetary assets and imposes mandatory tax reporting.

This marks a significant policy shift for Russia, moving from restrictive measures toward regulated access. For traditional finance audiences, it signals growing global acceptance of digital assets as an investable class, potentially opening new markets for cross-border flows while emphasizing investor protection and transparency.

2. IMF Praises El Salvador's Economic Progress

The International Monetary Fund (IMF) has praised El Salvador’s recent economic performance, projecting 4% real GDP growth for 2025 and a positive outlook for 2026.

Notably, the IMF’s latest statement omitted previous calls to limit the country’s Bitcoin accumulation, a point of contention since El Salvador became the first nation to adopt Bitcoin as legal tender in 2021.

El Salvador continues to add to its Bitcoin holdings (now nearly 7,500 BTC, valued at around $660 million), even during recent market dips. Discussions with the IMF focus on improving transparency, safeguarding public funds, and mitigating risks rather than outright reversal of the Bitcoin strategy.

Negotiations for selling the government’s Chivo wallet (a state-issued crypto wallet app) are advanced, supporting El Salvador’s ongoing $3.5 billion IMF loan program.

This development reduces perceived sovereign risk around crypto adoption and demonstrates that pragmatic dialogue can coexist with bold digital asset policies.

For institutional investors monitoring emerging markets, it underscores Bitcoin’s evolving role in national balance sheets without derailing traditional macroeconomic support.

3. Record $8.6 Billion in Crypto Mergers and Acquisitions in 2025

The cryptocurrency sector recorded its highest-ever deal volume in 2025, with mergers, acquisitions, and investments totaling $8.6 billion across 267 transactions, an 18% increase year-over-year and roughly four times the 2024 figure.

Standout deals included Coinbase’s $2.9 billion acquisition of derivatives platform Deribit, Kraken’s $1.5 billion purchase of NinjaTrader, and Ripple’s $1.25 billion deal for Hidden Road.

The surge is largely attributed to a more supportive regulatory environment in the United States under the current administration, including new legislation, the establishment of national crypto reserve initiatives, and the SEC dropping several high-profile enforcement actions. These “regulatory tailwinds” have encouraged greater participation from traditional financial institutions.

This record activity reflects deepening convergence between legacy finance and digital assets. For readers in private equity, venture capital, or corporate development, it highlights strategic consolidation and maturing infrastructure, trends likely to persist into 2026 as barriers to entry continue to fall.

4. Strong U.S. Q3 GDP Growth at 4.3% Amid Year-End Factors

The U.S. third-quarter GDP growth was revised upward to 4.3% annualized, well above expectations, signaling robust economic health and reducing near-term odds of Federal Reserve rate cuts.

Bitcoin initially rallied toward $88,000 on the news, as sustained growth lowers recession risks and supports risk assets broadly. However, the broader crypto market has since softened, with Bitcoin trading lower and related stocks experiencing sharper declines.

Seasonal tax-loss harvesting (selling losing positions to offset capital gains taxes) and thin holiday liquidity can be considered as primary drivers. Crypto-related equities, including those of companies holding digital asset treasuries, have been hit hardest.

Meanwhile, Bitcoin has underperformed gold significantly in 2025, with the precious metal benefiting from central bank buying and its established safe-haven status during periods of equity volatility.

Looking ahead, reduced leverage in derivatives markets and upcoming options expiries suggest potential for a quiet period until liquidity returns in January. While short-term caution prevails, the macro backdrop remains constructive for risk assets over the medium term.

Meme Corner

Closing Note

As the year comes to a close, regulatory clarity and institutional activity underscore crypto's ongoing maturation, which is balanced against seasonal market pressures. These trends suggest continued structural advancement into 2026.

I prioritized these stories for their focus on policy, institutional capital, and macro links over niche topics like individual trades or protocol issues.

Thank you for reading. Your feedback helps me fine-tune future editions.