Dear Readers,

Welcome to the 11th edition of the Fiat Bridge Newsletter.

At the beginning of the year, the crypto markets are showing early signs of resilience, echoing the spirit of Bitcoin's Genesis Day on January 3, the 17th anniversary of the mining of its first block, known as the Genesis Block.

This foundational event in 2009, created by pseudonymous inventor Satoshi Nakamoto, embedded a headline from The Times about bank bailouts during the financial crisis, symbolizing Bitcoin's origins as a decentralized alternative to traditional finance.

Amid this milestone, the U.S. national debt has surged past $38.5 trillion, highlighting concerns over fiat currency debasement and underscoring Bitcoin's appeal as a fixed-supply asset (capped at 21 million coins) that could hedge against inflation.

In today's edition, we'll dive into four key stories shaping the crypto landscape: the market's rebound led by volatile memecoins, Solana's remarkable growth in trading volume, surging institutional interest through ETFs and stablecoin activity, and the implications of upcoming token unlocks alongside venture capital outlooks for the year.

These developments offer insights for investors navigating this intersection of technology and finance, with a focus on risk management and long-term trends.

Let’s dive in.

Market Pulse

Total Crypto Market Cap: ~$3.2 Trillion (up 3.8% since Friday)

Bitcoin Dominance: ~57.2% (BTC market share against the rest of the market)

Bitcoin Price: ~$92,543 (up 3% since Friday)

Ethereum Price: ~$3,160 (up 1.2% since Friday)

Solana Price: ~$135 (up 2.3% since Friday)

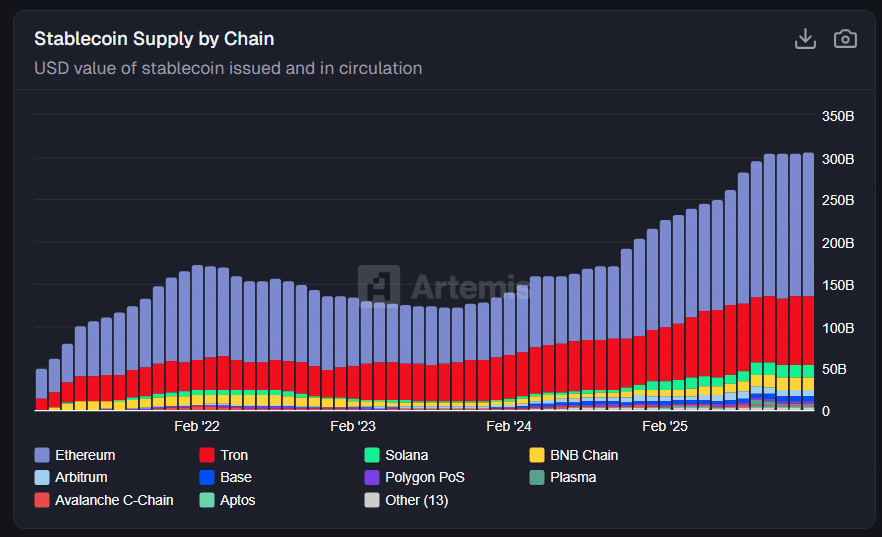

Total Stablecoin Supply: ~$307 Billion (no change)

DeFi TVL: ~$125 Billion (up 4.1% since Friday)

24h Trading Volume: ~$100 Billion

Fear & Greed Index: 26 (fear)

Top Stories of the Day

Market Rebound Sparks Memecoin Frenzy Amid Bitcoin's Rally

Solana Surges Ahead with Record Spot Volume, Outpacing Major Exchanges

Institutional Flows Drive BTC and ETH ETFs; Ethereum Sets Stablecoin Milestone

January Token Unlocks Approach Amid Buyback Debates; VCs Eye 2026 Trends

Today’s edition of the Fiat Bridge Newsletter is brought to you by Attio.

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Now let’s get back to the top stories of the day.

1. Market Rebound Sparks Memecoin Frenzy Amid Bitcoin's Rally

The crypto market has staged a notable recovery since Friday, extending into the weekend and early 2026, with Bitcoin briefly touching $93,000 before settling around $92,500, a 2.88% gain from January 1.

This marks Bitcoin's potential for a five-day winning streak, the longest in three months, driven by renewed safe-haven demand amid geopolitical tensions, including the U.S. capture of Venezuela's president.

The broader market followed suit, with Ethereum up 4.5% to $3,160 and Solana rising 6.41% to $135. However, the standout performers were memecoins, cryptocurrencies often inspired by internet memes and known for their high volatility and community-driven hype, which averaged 31.92% returns, far outpacing other sectors.

Top gainers included Bonk (+55.84%), Pepe (+41.87%), Pengu (+37.96%), Dogwifhat (+32.62%), and Floki (+30.53%), pushing the memecoin market cap from $38 billion on December 29 to $47.7 billion.

This post-holiday surge reflects traders returning to riskier assets, with transaction volumes for memecoins spiking nearly 300% to $8.7 billion. The rally coincided with the Crypto Fear & Greed Index flipping to "neutral" (a score of 40) for the first time since October (now 26), signaling a easing ofinvestor caution after a flash crash that wiped out billions.

From an investment perspective, this rebound highlights crypto's sensitivity to macro events, with $260 million in liquidations (forced closures of leveraged positions) underscoring the risks of overleveraging.

From a learning standpoint, memecoins demonstrate how social momentum can drive short-term gains but often lack fundamental utility, making them speculative bets.

As U.S. debt climbs to $38.5 trillion, Bitcoin's scarcity positions it as a potential inflation hedge, contrasting with unlimited fiat printing. Investors should monitor Bitcoin holding above its 21-day exponential moving average for sustained bullishness, while diversifying to mitigate volatility.

2. Solana Surges Ahead with Record Spot Volume, Outpacing Major Exchanges

Solana, a high-speed blockchain network designed for scalable decentralized applications (often called dApps), has achieved a milestone in 2025 with $1.6 trillion in on-chain spot volume, the value of immediate trades at current prices.

This places it second only to Binance, the world's largest centralized exchange (CEX), and ahead of platforms like Coinbase, Bybit, and Bitget. Just three years ago, Solana captured only 1% of total spot activity; by early 2026, it holds 12%, fueled by its low-cost, fast transactions that appeal to traders and developers.

This growth reflects a shift toward decentralized networks, where liquidity, available funds for trading, moves to efficient blockchains like Solana.

Stablecoin supply on the network has climbed significantly since early 2024, creating a virtuous cycle that boosts trading.

In 2025, Solana stress-tested its infrastructure under high demand, increasing block space by 25% and preparing for the Alpenglow upgrade, which could reduce transaction finality to one second. This positions it as a contender for high-stakes financial apps in decentralized finance (DeFi), where users lend, borrow, and trade without intermediaries.

For investors, Solana's SOL token has rebounded above $130, with technical indicators signaling upside momentum. However, competition from Ethereum (57% stablecoin market share) remains fierce.

This trend illustrates blockchain fragmentation: as CEXes like Binance dominate centralized trading, networks like Solana challenge them by offering transparency and lower fees.

With memecoins thriving on Solana, it could benefit from altcoin rallies, but investors should watch for network congestion risks. Overall, this signals maturing infrastructure, making Solana a must-include addition for those eyeing DeFi growth.

3. Institutional Flows Drive BTC and ETH ETFs; Ethereum Sets Stablecoin Milestone

The new year opened strongly for crypto exchange-traded funds (ETFs), investment products traded on stock exchanges that track underlying assets like Bitcoin and Ethereum without requiring direct ownership.

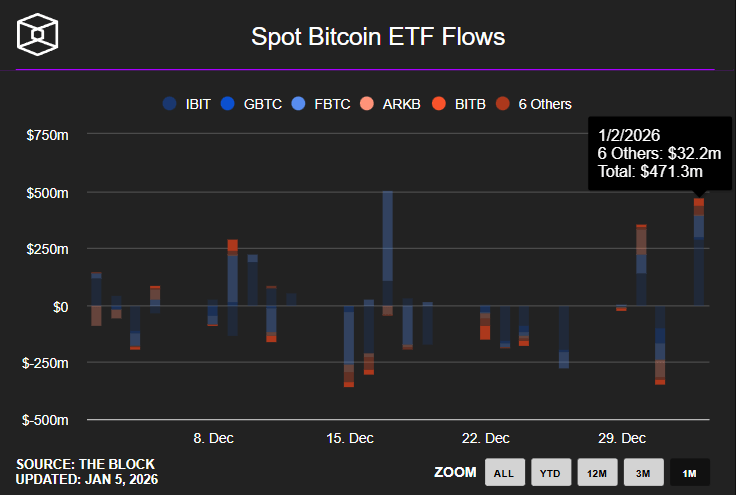

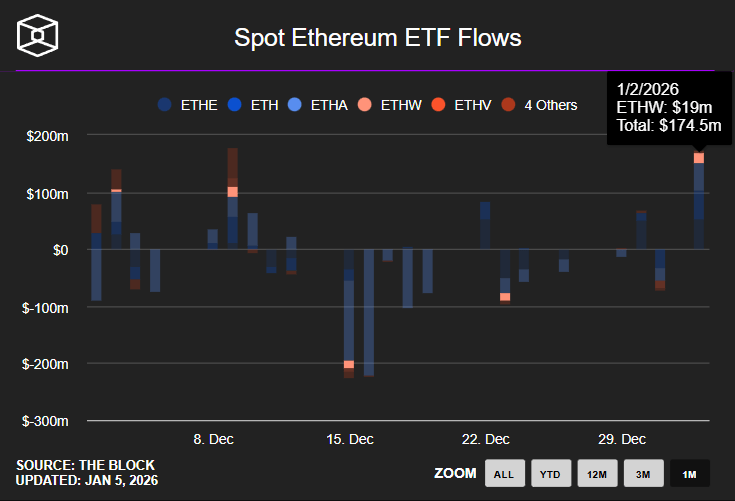

On January 2, U.S.-based spot Bitcoin ETFs saw $471.3 million in net inflows, while Ethereum ETFs attracted $174.5 million, totaling $646 million, the largest combined daily haul in weeks. This "January effect" follows $6 billion in outflows late 2025, attributed to tax-loss harvesting, and signals rebounding institutional demand.

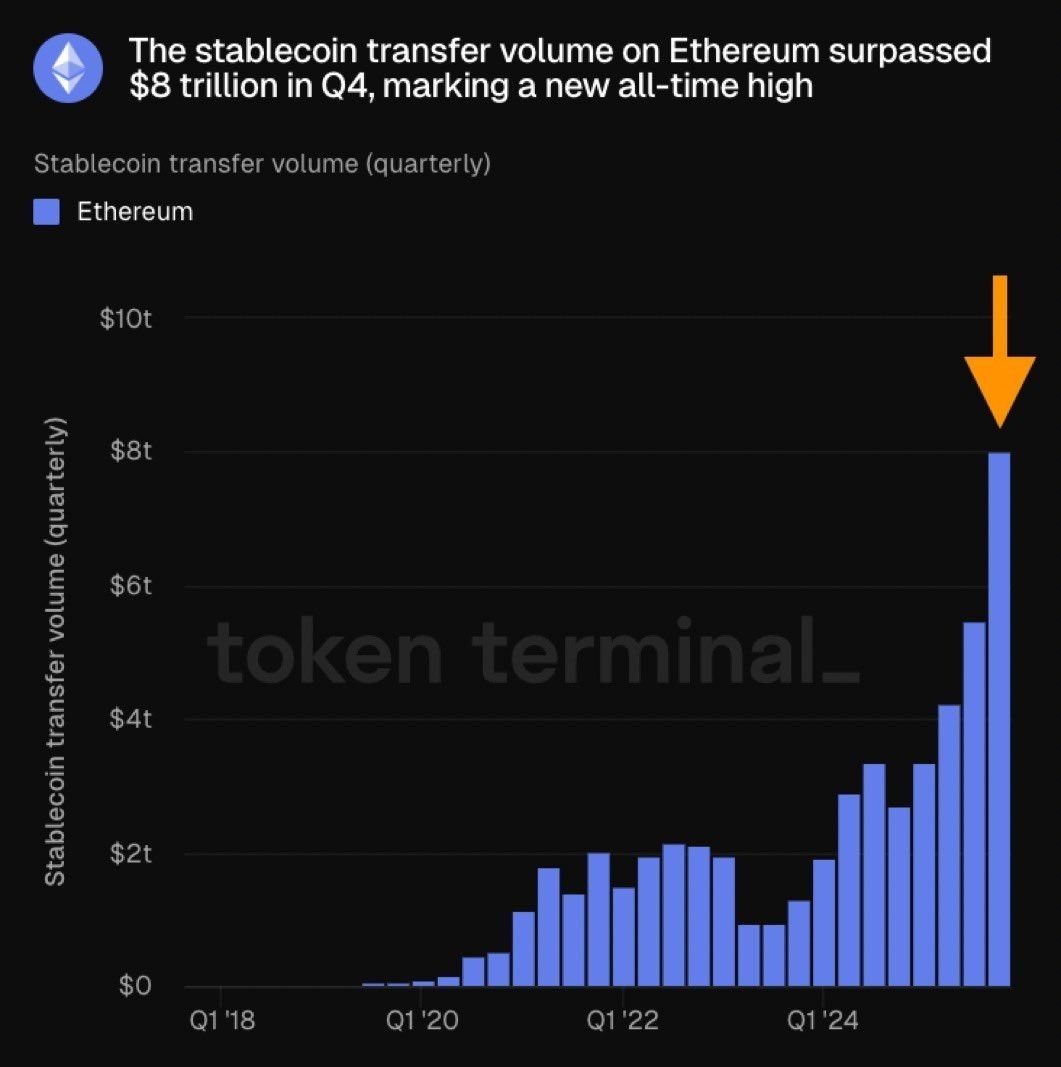

Complementing this, Ethereum hit a record $8 trillion in stablecoin transfers, cryptocurrencies pegged to assets like the U.S. dollar for stability, in Q4 2025, nearly double Q2's volume.

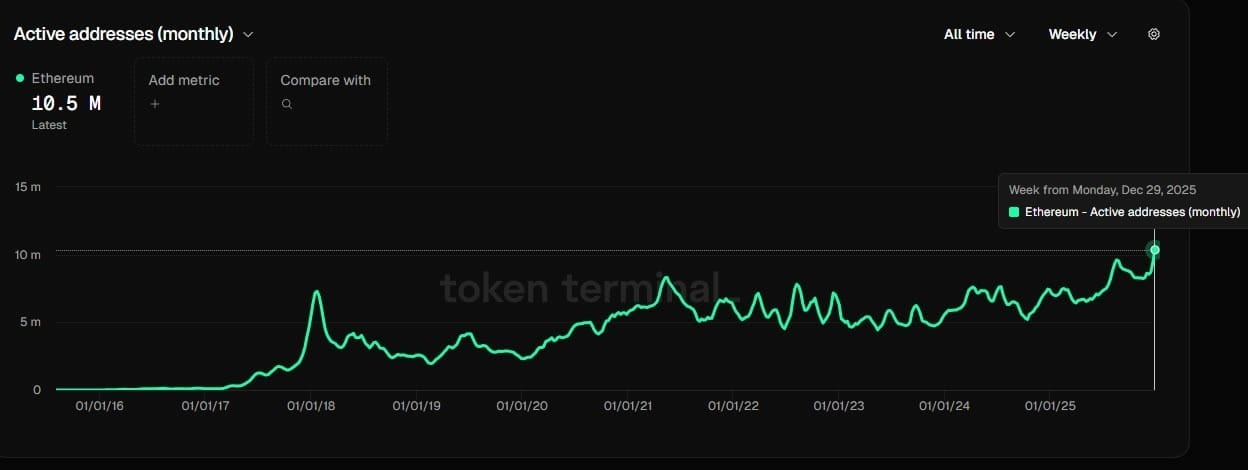

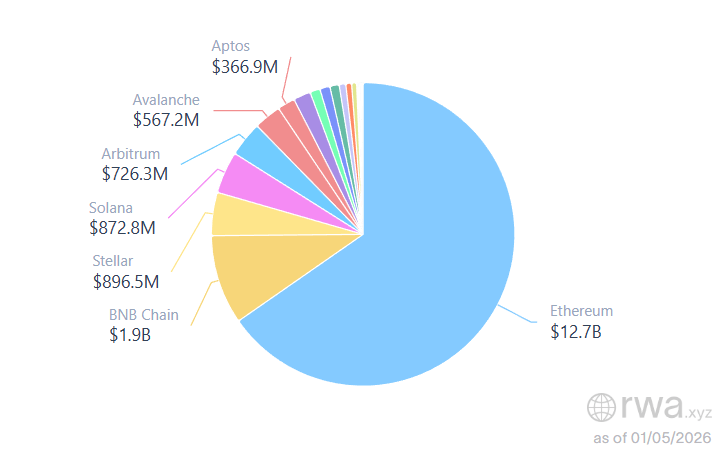

Ethereum holds 57% of stablecoin issuance, with Tether (USDT) at $187 billion, half on its network. This underscores Ethereum's role as a settlement layer for DeFi and real-world asset (RWA) tokenization, digitizing traditional assets like bonds on blockchain. Daily transactions peaked at 2.23 million, with 10.4 million monthly active addresses.

Additionally, Visa crypto card spending jumped 525% in 2025, from $14.6 million in January to $91.3 million in December, led by cards from projects like EtherFi. These cards allow users to spend crypto or stablecoins via Visa's network, bridging fiat and digital payments.

Investment-wise, these inflows indicate institutions loading up post-2025 volatility, with 2025's total crypto ETF inflows at $31.77 billion. Stablecoins facilitate low-volatility transfers, enabling DeFi's growth, while ETFs democratize access for traditional portfolios.

Risks include regulatory shifts, but with Ethereum's 65% RWA market share, it offers exposure to tokenized assets. Consider allocating to ETFs for diversified entry, monitoring inflows as sentiment indicators.

4. January Token Unlocks Approach Amid Buyback Debates; VCs Eye 2026 Trends

January 2026 brings $657 million in crypto token unlocks, scheduled releases of previously restricted tokens into circulation, potentially increasing supply and pressuring prices.

Key projects include Hyperliquid (HYPE), unlocking 12.46 million tokens ($330.51 million) on January 6, Ethena (ENA) with 171.88 million ($42.91 million) on January 5, and Aptos (APT) releasing 11.31 million ($21.94 million) on January 11. These allocations go to contributors, investors, and communities, risking sell-offs in a fragmented market.

This comes amid discussions on buybacks, where projects repurchase tokens to reduce supply and bolster prices. Solana-based Jupiter spent $70 million on buybacks in 2025 but saw its JUP token drop 89% from its peak, overwhelmed by $1.2 billion in unlocks and 150% supply growth.

Founder Siong proposed pausing them for growth incentives, drawing mixed reactions. Solana co-founder Anatoly Yakovenko advocated staking rewards, locking tokens for yields, to align long-term holders, while critics argue buybacks offer only short-term optics in high-emission ecosystems.

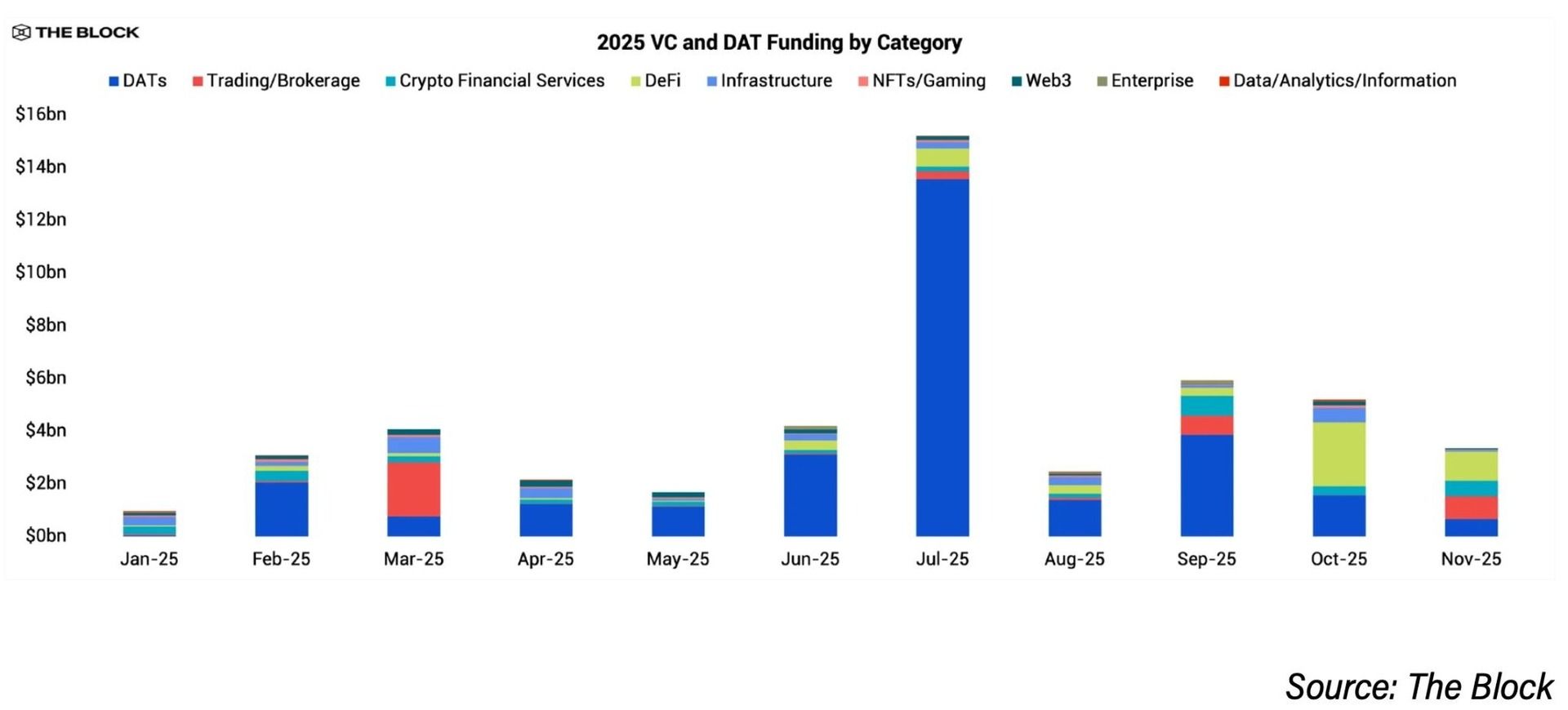

Looking ahead, top venture capitalists (VCs) forecast disciplined funding in 2026, building on 2025's $18.9 billion (up from $13.8 billion in 2024), with a focus on stablecoins, payments, institutional infrastructure, and RWA tokenization.

M&A and IPOs surged in 2025 (265 deals worth $8.6 billion; 11 IPOs raising $14.6 billion) and are expected to continue, targeting exchanges, custodians, and stablecoin firms. Trends include AI-crypto intersections and prediction markets, with hybrid VC-token models for fundraising.

For investors, unlocks pose dilution risks; monitor projects with high emissions. Learning from this, buybacks highlight tokenomics (economic models) importance; sustainable designs like staking may prevail. VCs advise prioritizing traction over hype, making 2026 ripe for selective bets in regulated, revenue-focused areas.

Meme Corner

Closing Note

In summary, 2026 starts with market optimism tempered by volatility, spotlighting Solana's rise, institutional adoption, and supply dynamics. As a bridge between fiat and crypto, these trends emphasize education and caution.

Share this newsletter with colleagues exploring digital assets, or reach out for tailored insights on portfolio strategies.

Thank you for reading, and I will see you all tomorrow.