Dear Readers,

Wish you all a very happy new year, and welcome to the ninth edition of Fiat Bridge.

As we turn the page to 2026, cryptocurrency has firmly moved from the fringes of finance into the mainstream portfolio conversation. Last year delivered a powerful reminder: regulated investment vehicles attracted tens of billions in fresh capital, stablecoin issuers diversified into digital assets, and policymakers signaled a more constructive era ahead.

For professionals rooted in traditional finance and technology, these developments are not just headlines; they are actionable signals of how digital assets are reshaping money, markets, and infrastructure.

In today’s edition, we examine four pivotal stories from 2025 that set the stage for the year ahead.

Let’s dive in.

Market Pulse

Total Crypto Market Cap: ~$3.05 Trillion (down 0.9% in the last 24 hours)

Bitcoin Dominance: ~56.7% (BTC market share against the rest of the market)

Bitcoin Price: ~$87,809 (down 1.1% in the last 24 hours)

Ethereum Price: ~$2,972 (down 0.4% in the last 24 hours)

Solana Price: ~$124 (down 1.1% in the last 24 hours)

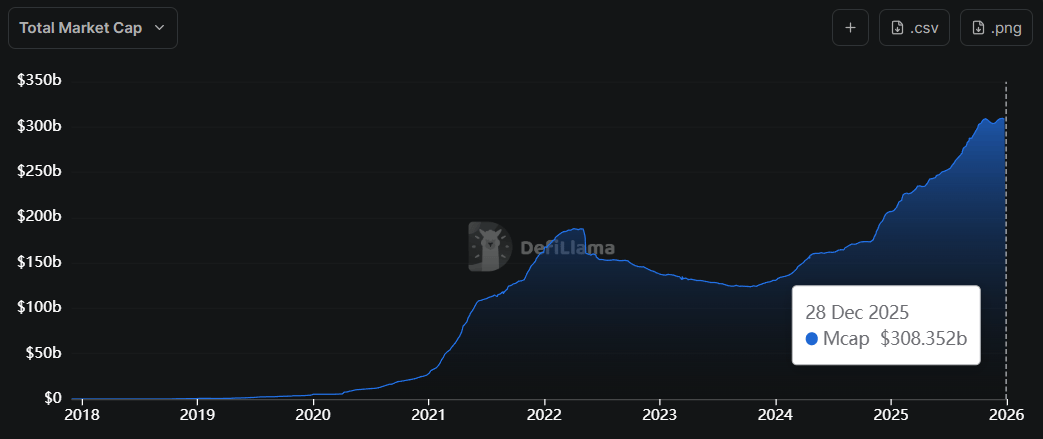

Total Stablecoin Supply: ~$306 Billion (down 0.3% in the last 24 hours)

DeFi TVL: ~$118 Billion (up 1.1% in the last 24 hours)

24h Trading Volume: ~$81 Billion

Fear & Greed Index: 20 (extreme fear)

Top Stories of the Day

The Surge in U.S. Spot Crypto ETFs: A Gateway for Institutional Investors

Tether's Bitcoin Accumulation: Strengthening Stablecoin Reserves

Regulatory Shifts: Balancing Innovation and Oversight

Looking Ahead: Compounding Forces for Crypto Adoption in 2026

1. The Surge in U.S. Spot Crypto ETFs: A Gateway for Institutional Investors

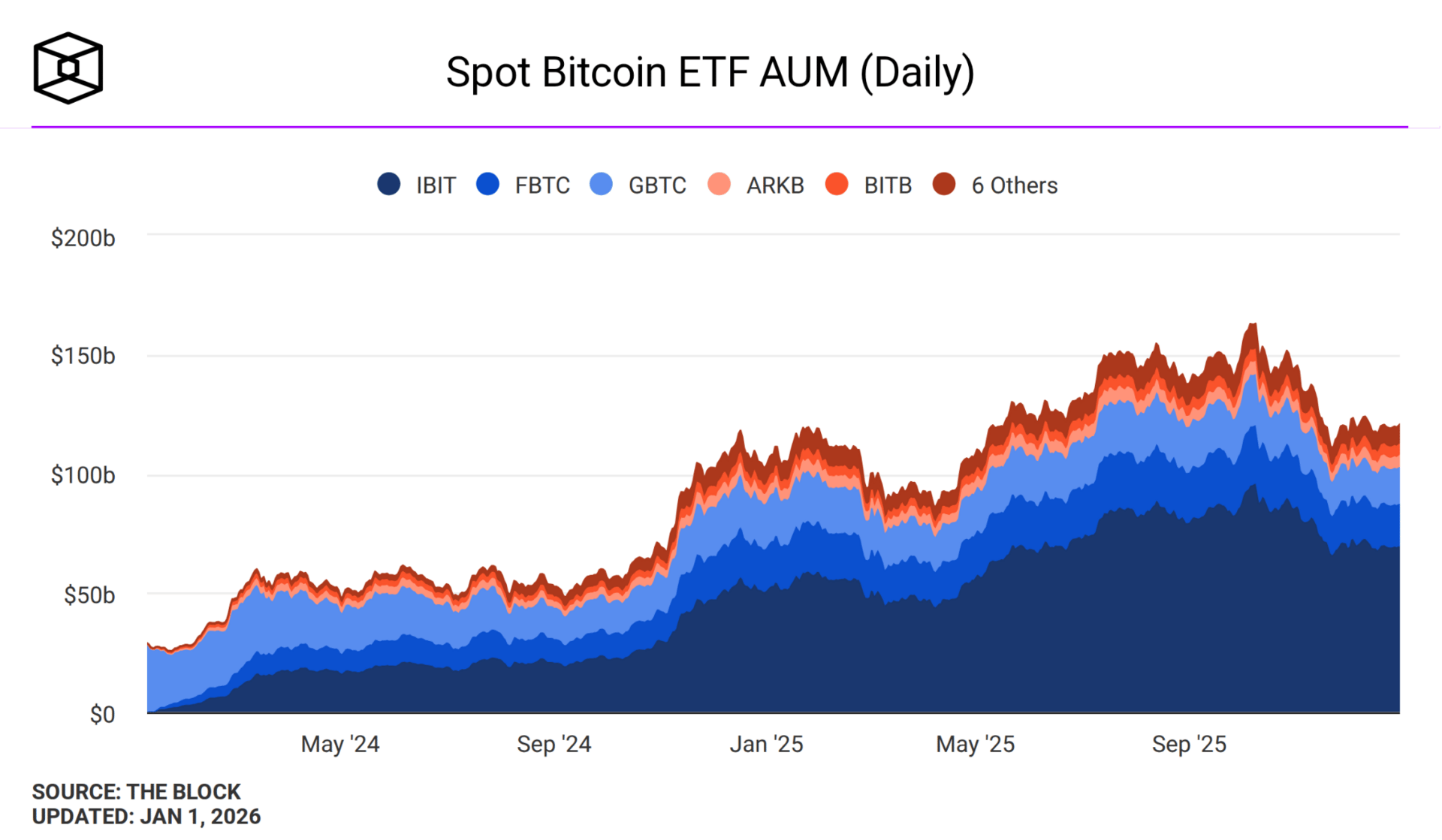

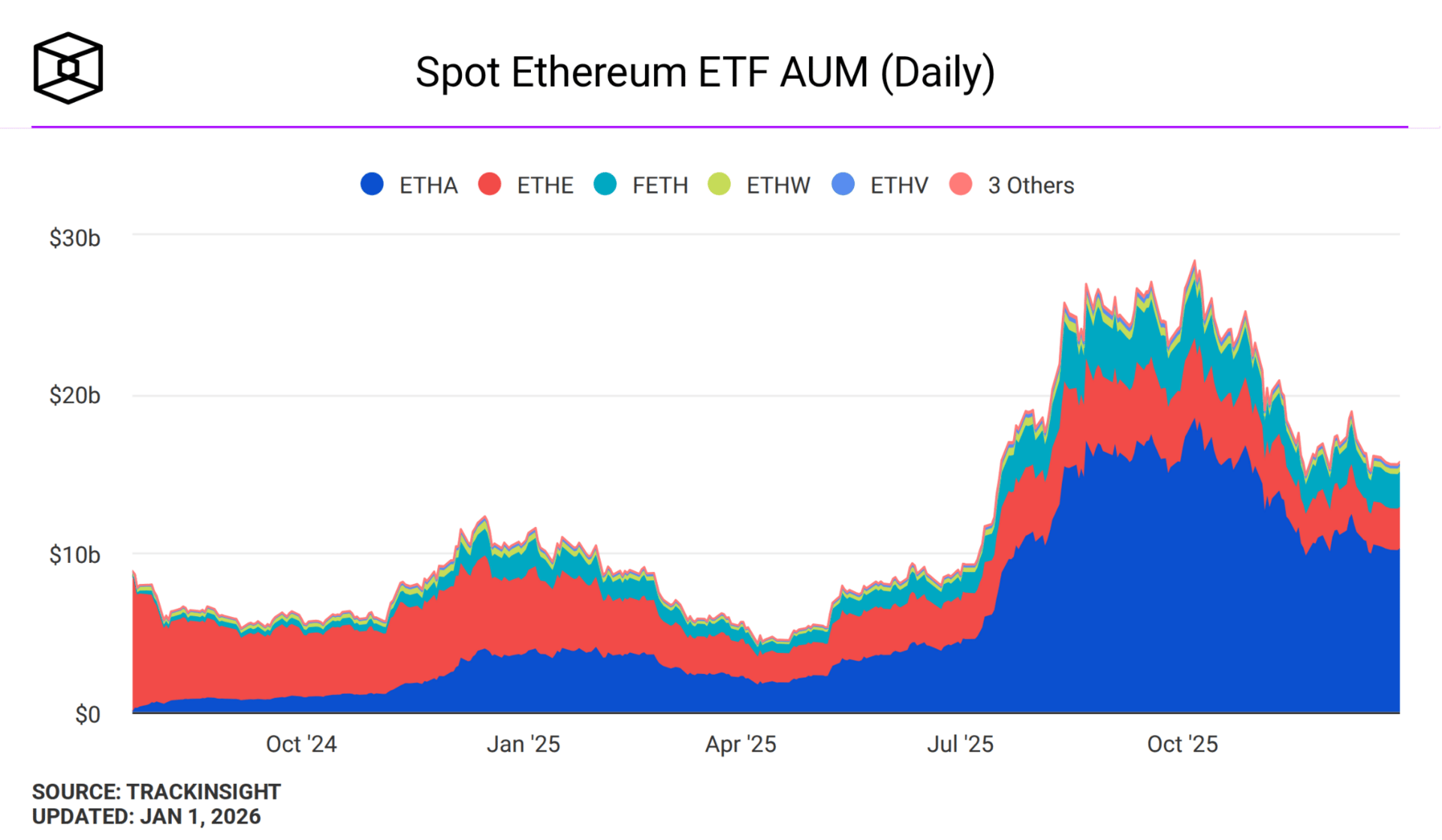

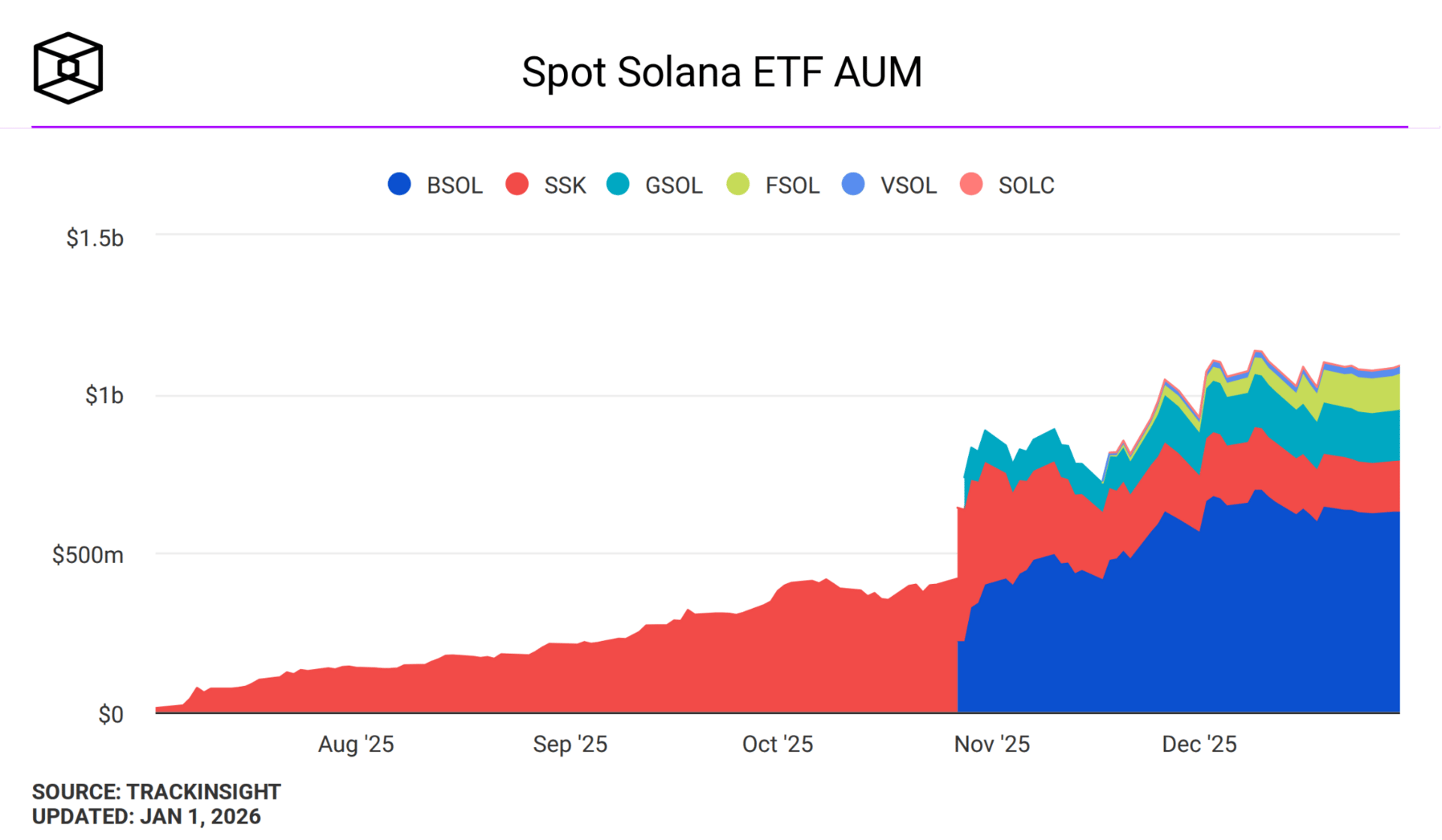

Exchange-traded funds (ETFs) that directly hold cryptocurrencies, known as spot crypto ETFs, saw remarkable growth in 2025, attracting billions in investments and signaling deeper integration with traditional finance. These products allow investors to gain exposure to digital assets like Bitcoin without directly owning them, much like how stock ETFs track company shares.

According to data, U.S. spot crypto ETFs recorded net inflows of $31.77 billion in 2025. This included $21.4 billion for Bitcoin ETFs, $9.6 billion for Ether ETFs, and $765 million for Solana ETFs, which launched late in the year.

BlackRock dominated, with its iShares Bitcoin Trust ETF pulling in $24.7 billion, five times more than its closest rival, and its Ethereum ETF attracting $12.6 billion. This dominance mirrors how major asset managers like BlackRock have historically shaped traditional ETF markets.

The year also brought new filings, such as Bitwise's proposal for 11 strategy ETFs tracking tokens from decentralized finance (DeFi, which refers to blockchain-based financial services without intermediaries) and artificial intelligence projects, including AAVE for lending, ZEC for privacy-focused transactions, and TAO for decentralized machine learning. These ETFs would allocate up to 60% directly to the tokens, with the rest in derivatives like futures contracts.

This trend represents a regulated bridge to crypto, driven by a more supportive U.S. administration and SEC leadership. However, recent outflows, $1.3 billion from Bitcoin ETFs in the last quarter, highlight volatility tied to broader market sentiment.

As investors, you might view these as tools for portfolio diversification, but remember: crypto's price swings can amplify risks compared to standard equity ETFs.

2. Tether's Bitcoin Accumulation: Strengthening Stablecoin Reserves

Stablecoins, digital assets pegged to stable fiat currencies like the U.S. dollar to minimize volatility, play a crucial role in crypto transactions. Tether (USDT), the largest stablecoin, made headlines by significantly increasing its Bitcoin holdings in 2025, using profits to bolster reserves.

Reports show Tether acquired nearly 10,000 Bitcoin in Q4 2025, including 8,888 BTC valued at about $780 million on New Year's Eve. This brought its total to over 96,000 BTC, worth around $8.42 billion, making Tether the fifth-largest Bitcoin wallet globally. The company allocates up to 15% of quarterly earnings to Bitcoin, alongside diversifying into gold (adding 26 tons in Q3 for a total of 116 tons). This strategy aims to enhance reserve stability, though it drew scrutiny: S&P downgraded USDT's rating due to transparency concerns.

In Asia, stablecoin focus shifted toward local currencies, with Japan and South Korea launching yen and won pegged options for payments and remittances. Non-USD stablecoins remain small at $679.8 million for euro-denominated and $16.4 million for yen-pegged, compared to the $312 billion total market dominated by USD-backed ones.

From a traditional finance perspective, Tether's approach resembles corporate treasury management, treating Bitcoin as a hedge similar to gold. This could signal growing confidence in crypto as a reserve asset, but risks like concentration in U.S. Treasurys and Bitcoin echo portfolio diversification challenges in conventional investing. For tech audiences, stablecoins' expansion into real-world payments, beyond trading, highlights their potential in efficient cross-border settlements, potentially rivaling systems like SWIFT.

3. Regulatory Shifts: Balancing Innovation and Oversight

Regulatory developments in 2025 shaped crypto's path toward mainstream adoption, with key appointments and debates on central bank digital currencies (CBDCs, government-issued digital versions of fiat money) versus private stablecoins.

In the U.S., CFTC Chair Michael Selig appointed Amir Zaidi as chief of staff, citing Zaidi's role in approving Bitcoin futures in 2017, contracts allowing price speculation without owning the asset. This move aligns with pending legislation expanding CFTC oversight of digital assets, potentially fostering pro-innovation policies.

India's Reserve Bank pushed for prioritizing CBDCs over stablecoins for stability, noting only three global CBDC launches (Nigeria, Bahamas, Jamaica) and 49 pilots underway. Stablecoin market cap grew from $205 billion to $307 billion in 2025, underscoring their efficiency in settlements.

These shifts imply a maturing framework where crypto aligns with traditional regulations like anti-money laundering (AML). This mirrors how derivatives markets evolved under CFTC rules, potentially reducing risks while enabling growth. It is important to note privacy risks, as CBDCs could track transactions more than decentralized crypto, contrasting with Bitcoin's permissionless design.

4. Looking Ahead: Compounding Forces for Crypto Adoption in 2026

As 2025 closed, experts highlighted macro conditions, regulation, and infrastructure as drivers for crypto's 2026 evolution, moving beyond speculation toward practical integration.

Global crypto adoption hovered around 10%, but forces like ETFs, stablecoins, and tokenization (digitizing real-world assets on blockchains) are compounding. Executives predict the stablecoin market cap doubling from $300 billion and tokenized assets growing tenfold.

Privacy advancements, including zero-knowledge proofs (verifying data without revealing it), are expected to industrialize, with private stablecoins enabling compliant, anonymous payments.

Bitcoin's four-year cycle, tied to halvings that halve mining rewards, appears disrupted, ending 2025 down 6% despite a $126,080 peak, influenced by macro factors like interest rates. A $19 billion liquidation in October turned year-end optimism into a downturn.

This suggests crypto's sensitivity to Fed policies, with resilient U.S. jobs data dimming rate-cut hopes and pressuring prices. Tech audiences may appreciate infrastructure like Ethereum's upgrades, which boosted transaction capacity and privacy.

Overall, 2026 could embed crypto into financial workflows, but success hinges on balanced regulation and economic stability.

Meme Corner

Closing Note

In summary, 2025 was a year of maturation for cryptocurrency: institutional inflows reached new heights, reserve strategies evolved, regulatory frameworks began to clarify, and the building blocks for broader adoption strengthened. While volatility remains a feature of the asset class, the structural trends point toward deeper integration with traditional finance.

If these insights resonate with you, I encourage you to share this newsletter with colleagues navigating the same fiat-to-crypto bridge, or reply directly with topics you’d like us to cover next. Your input helps shape future editions.

Thank you for reading, and here’s to an informed and prosperous 2026.