Dear Readers,

Welcome to the fifth edition of the Fiat Bridge Newsletter. This newsletter is designed for those familiar with stocks, bonds, and technology trends, but new to the unique dynamics of crypto. We focus on developments that matter to both institutional and retail investors, explaining key concepts along the way.

The crypto market remains in a period of caution. Bitcoin trades around $88,600, yet sentiment has turned deeply negative amid macroeconomic concerns. This edition covers persistent market fear, security best practices for newcomers, a notable wallet vulnerability, the rise of asset-backed digital tokens, and shifting dynamics in blockchain infrastructure.

These stories highlight both risks and maturing elements in the sector.

Let’s dive in.

Market Pulse

Total Crypto Market Cap: ~$3.06 Trillion (up 0.9% in the last 24 hours)

Bitcoin Dominance: ~56.7% (BTC market share against the rest of the market)

Bitcoin Price: ~$88,613 (up 1.3% in the last 24 hours)

Ethereum Price: ~$2,961 (up 1.2% in the last 24 hours)

Solana Price: ~$122 (up 0.5% in the last 24 hours)

Total Stablecoin Supply: ~$308 Billion (no change in the last 24 hours)

DeFi TVL: ~$119 Billion (up 0.6% in the last 24 hours)

24h Trading Volume: ~$91 Billion

Fear & Greed Index: 20 (extreme fear)

Top Stories of the Day

Persistent Extreme Fear in Crypto Markets

Security Essentials: Protecting Against Social Engineering

Gold-Backed Stablecoins Gain Traction

Layer 1 Blockchains: Prices Fall, Fundamentals Endure

1. Persistent Extreme Fear in Crypto Markets

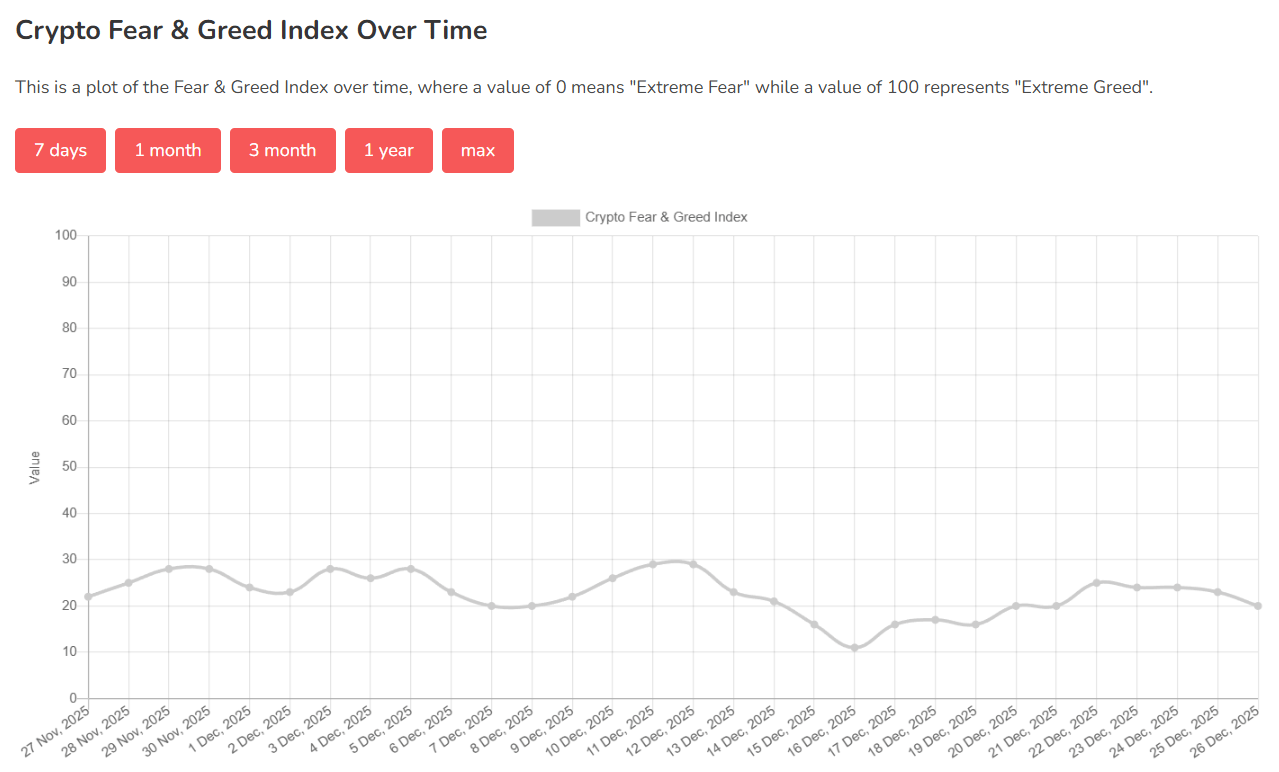

The Crypto Fear & Greed Index, a sentiment gauge similar to volatility measures in traditional markets (like the VIX for stocks), has remained in "extreme fear" territory for 14 consecutive days as of today.

The index currently sits at 20 out of 100, marking one of the longest such streaks since its inception in 2018. This level is notably lower than during the FTX collapse in 2022, despite Bitcoin's price being nearly five times higher now.

Several factors contribute to this downturn. Sentiment began declining in early October following US-China trade tensions that wiped out significant market value. Additional pressure comes from expectations of paused US Federal Reserve rate cuts in early 2026, with some analysts warning of potential Bitcoin declines to $70,000 if rates hold steady. Retail interest has waned, with Google searches and forum activity dropping to bear-market levels.

Despite the gloom, institutional inflows remain robust; US Bitcoin ETFs saw over $25 billion in net inflows this year. This divergence suggests that while individual investors are hesitant, larger players view current levels as attractive for accumulation.

For traditional finance readers, this mirrors periods of stock market pessimism where fundamentals eventually drive recovery.

2. Security Essentials: Protecting Against Social Engineering

In crypto, the biggest risks often come not from technical flaws but from human manipulation, known as social engineering (tactics that trick people into revealing secrets or approving harmful actions).

Experts warn that most breaches start with a conversation, not code, and AI tools like deepfakes are making these attacks more sophisticated heading into 2026.

For newcomers entering crypto, start with basics: Never share your seed phrase (the master recovery key for your wallet) or private credentials; legitimate services never ask for them. Use hardware wallets (physical devices that keep keys offline) for significant holdings, enable multi-factor authentication with hardware tokens, and verify every link or message independently.

Veterans should go further: Automate defenses where possible, segment funds across hot (online), warm, and cold (offline) wallets, and use anomaly detection for unusual activity.

Against deepfakes, consider cryptographic proof-of-personhood for key interactions. Always apply radical skepticism, assume unsolicited messages are tests, and avoid discussing holdings publicly to deter targeted attacks.

A recent incident underscores these risks: On-chain investigator ZachXBT flagged unauthorized fund drains from multiple Trust Wallet users following a Chrome extension update. Affected users reported outflows without approval, prompting warnings to revoke permissions and move funds to new wallets. Investigations continue, highlighting the need for vigilance even with established tools.

These practices align with traditional cybersecurity but are critical in crypto's permissionless environment, where transactions are irreversible.

3. Gold-Backed Stablecoins Gain Traction

Stablecoins (digital tokens designed to maintain a steady value, often pegged to fiat currencies) have long appealed to traditional investors for their stability. A subset, gold-backed stablecoins, redeemable for physical gold, has seen explosive growth in 2025, with total market capitalization nearly tripling to around $4 billion.

One dominant token now holds about half the market, while the top two combined represent nearly 90%. This surge ties directly to rising gold prices amid global uncertainties, geopolitical tensions, and sustained demand. Notably, a major issuer has become one of the largest non-government gold holders worldwide, with reserves rivaling smaller central banks.

For finance professionals, this represents a bridge to tokenized real-world assets: digital representations of traditional holdings that offer 24/7 transferability and fractional ownership. While still niche compared to fiat-pegged stablecoins, gold-backed variants provide inflation-hedging similar to physical bullion or ETFs, but with blockchain efficiency.

4. Layer 1 Blockchains: Prices Fall, Fundamentals Endure

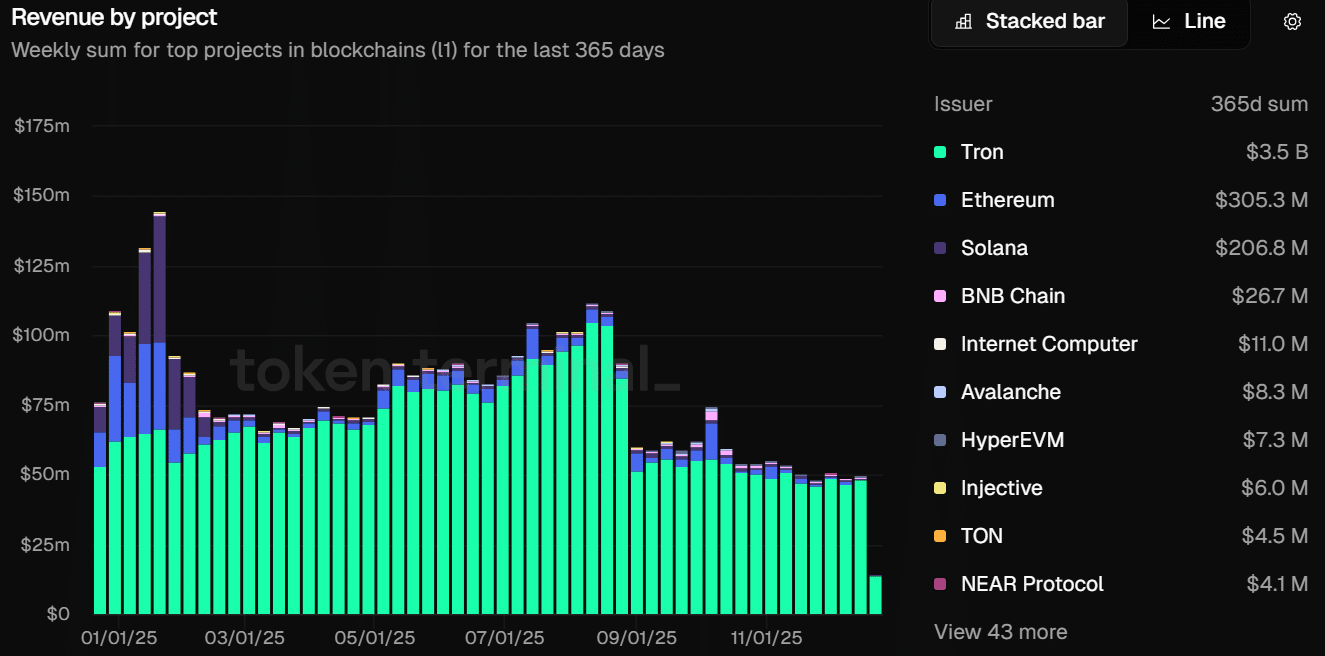

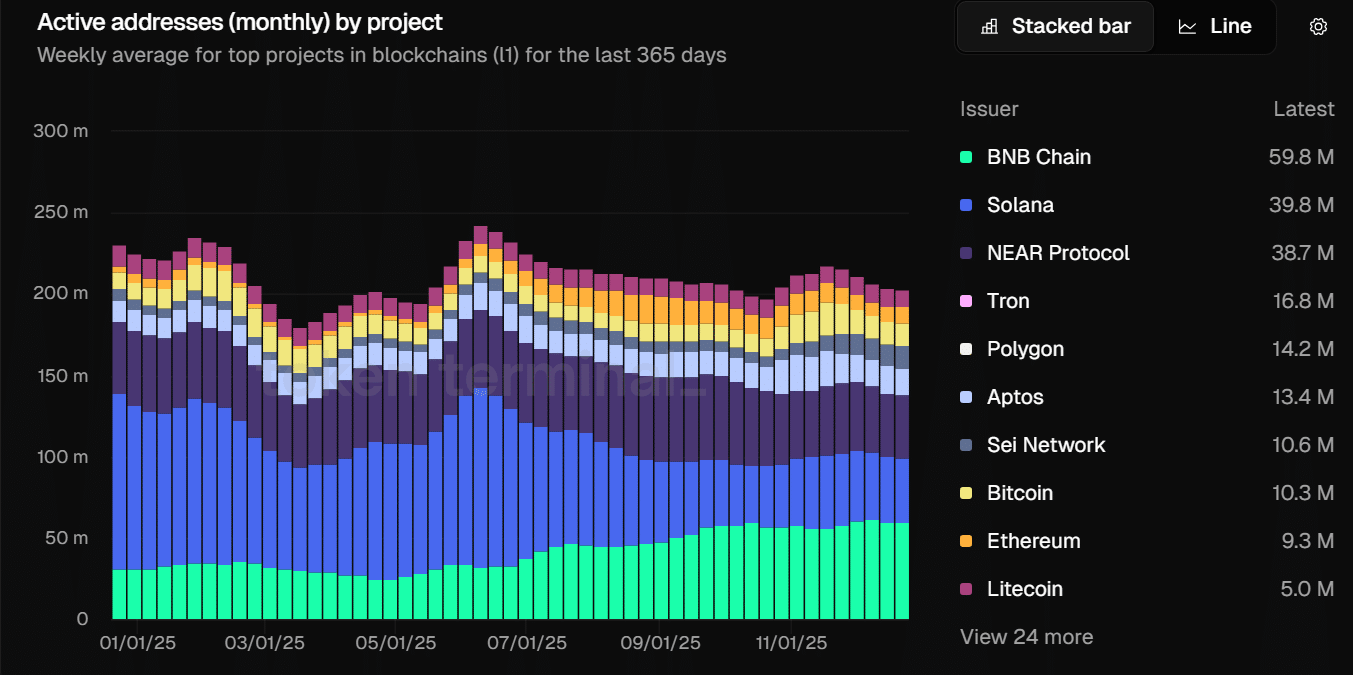

Layer 1 (L1) blockchains (base-layer networks like Ethereum or Solana that process transactions directly) saw sharp token price declines in 2025. Major examples include Ethereum down over 15%, Solana down 36%, and others like Avalanche and Sui dropping 67-73%. Bitcoin dominance rose to nearly 58%, reflecting capital rotation toward the original cryptocurrency.

However, underlying fundamentals, user activity, revenue, and fees held steady or grew. Networks like Tron generated billions in revenue, while Solana and BNB Chain led in fees and active addresses (tens of millions monthly).

This price-fundamentals disconnect suggests a market repricing: Speculative premiums evaporated after early-year highs, but real usage consolidated around proven networks.

Derivatives markets underscore institutional engagement: Crypto derivatives volume hit $85.7 trillion in 2025, with daily averages of $264 billion and Binance capturing 29% share. This growth reflects hedging and sophisticated trading, akin to futures in commodities or equities.

For traditional investors, this signals maturation; prices may fluctuate, but adoption metrics point to long-term viability.

Meme Corner

Closing Note

As 2025 ends in extreme fear, remember that sentiment extremes often precede turning points in markets, both traditional and crypto. The persistence of strong fundamentals amid price weakness, coupled with innovations like gold-backed tokens and robust derivatives, suggests the sector is evolving beyond speculation.

For those considering entry, prioritize security habits and view crypto as a complementary asset class. Risks remain, as seen in ongoing fraud probes (e.g., India's raids on a long-running Ponzi scheme) and vulnerabilities, but so do opportunities for diversified portfolios.

Thank you for reading. Stay informed, stay safe, and we'll reconnect in the new week.