Dear Readers,

Happy Monday, and welcome to the sixth edition of Fiat Bridge.

As we approach the end of 2025, the cryptocurrency markets continue to show resilience amid holiday-season volatility. Bitcoin remains slightly down year-to-date but has outperformed traditional assets like gold and silver over longer horizons.

Today's key developments highlight maturing infrastructure, institutional adoption, and mechanisms that could influence long-term asset scarcity and yields, factors directly relevant to portfolio allocation decisions in this space.

Let’s dive in.

Market Pulse

Total Crypto Market Cap: ~$3.12 Trillion (up 2.4% in the last 24 hours)

Bitcoin Dominance: ~55.99% (BTC market share against the rest of the market)

Bitcoin Price: ~$89,958 (up 2.5% in the last 24 hours)

Ethereum Price: ~$3,040 (up 3.4% in the last 24 hours)

Solana Price: ~$128 (up 3.8% in the last 24 hours)

Total Stablecoin Supply: ~$308 Billion (no change in the last 24 hours)

DeFi TVL: ~$118 Billion (up 0.33% in the last 24 hours)

24h Trading Volume: ~$74 Billion

Fear & Greed Index: 24 (extreme fear)

Top Stories of the Day

Uniswap Executes Historic $600 Million UNI Token Burn, Initiating a Deflationary Mechanism

Coinbase Identifies Three Areas Set to Dominate Crypto Markets in 2026

BitMine Immersion Begins Staking Ethereum Holdings to Generate Yields

Mirae Asset Group in Talks to Acquire Korean Exchange Korbit for Up to $100 Million

Today’s edition of Fiat Bridge is brought to you by Masterworks.

But what can you actually DO about the proclaimed ‘AI bubble’? Billionaires know an alternative…

Sure, if you held your stocks since the dotcom bubble, you would’ve been up—eventually. But three years after the dot-com bust the S&P 500 was still far down from its peak. So, how else can you invest when almost every market is tied to stocks?

Lo and behold, billionaires have an alternative way to diversify: allocate to a physical asset class that outpaced the S&P by 15% from 1995 to 2025, with almost no correlation to equities. It’s part of a massive global market, long leveraged by the ultra-wealthy (Bezos, Gates, Rockefellers etc).

Contemporary and post-war art.

Masterworks lets you invest in multimillion-dollar artworks featuring legends like Banksy, Basquiat, and Picasso—without needing millions. Over 70,000 members have together invested more than $1.2 billion across over 500 artworks. So far, 25 sales have delivered net annualized returns like 14.6%, 17.6%, and 17.8%.*

Want access?

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

Now let’s get back to the top stories of the day.

1. Uniswap Executes Historic $600 Million UNI Token Burn, Initiating a Deflationary Mechanism

Uniswap, the leading decentralized exchange (DEX, a non-custodial platform where users trade cryptocurrencies directly via smart contracts), has permanently removed approximately 100 million UNI tokens (its governance token) from circulation. This "burn" is valued at around $600 million and follows the community's approval of a "fee switch" proposal.

The fee switch redirects a portion of protocol fees (generated from trades on Uniswap versions 2 and 3, as well as revenue from its layer-2 network Unichain) toward purchasing and burning more UNI tokens over time. This creates a deflationary loop: as platform usage grows, fees increase, leading to more token burns, which reduce supply and potentially support price appreciation if demand holds steady.

Investment implication: This shift makes UNI more akin to a scarce digital asset with built-in buy pressure, similar to stock buybacks in traditional companies. UNI's price rose 5% following the announcement, reflecting market approval. For investors, this strengthens the case for governance tokens in high-utility protocols, although sustained benefits depend on continued growth in trading volume.

2. Coinbase Identifies Three Areas Set to Dominate Crypto Markets in 2026

In its institutional outlook, Coinbase highlights three segments expected to drive the majority of activity and innovation next year:

Perpetual futures (derivatives contracts without expiration dates, allowing leveraged bets on price movements): These already dominate trading volumes and influence price discovery through funding rates and liquidity dynamics.

Prediction markets (platforms for betting on real-world event outcomes, functioning like efficient information aggregators): Growing liquidity and participation from sophisticated traders signal their evolution into core financial infrastructure.

Stablecoins and payments (dollar-pegged digital assets used for settlements and transfers): These provide the most consistent real-world utility, supporting cross-border flows, automated trading, and emerging AI-driven applications.

Investment implication: These areas underscore crypto's shift toward derivatives, event-driven speculation, and practical payment rails, mirroring evolutions in traditional finance (e.g., futures dominance on CME or stablecoin parallels to money market funds). Investors may consider exposure to platforms or tokens tied to these themes for 2026 outperformance.

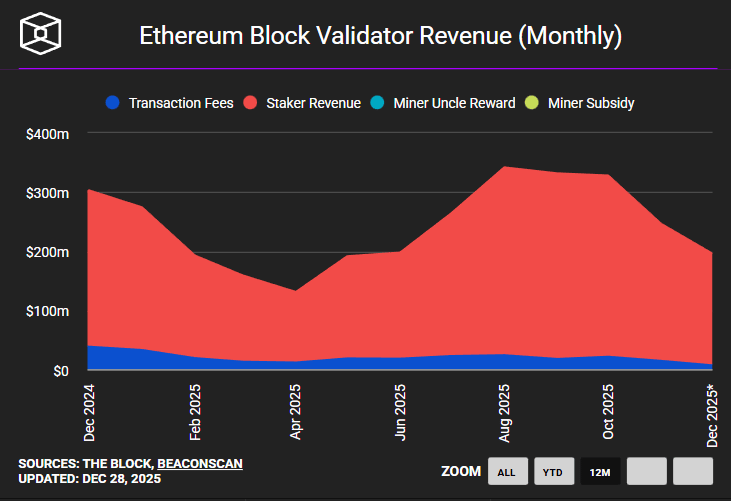

3. BitMine Immersion Begins Staking Ethereum Holdings to Generate Yields

BitMine, a major Bitcoin mining company expanding into Ethereum, has initiated staking (locking up ETH to secure the network and earn rewards) by depositing approximately 74,880 ETH worth $219 million initially. This is part of a broader strategy involving its large ETH treasury (over 4 million ETH total).

At current ~3.1% annual yields, full staking could generate substantial recurring revenue (estimates suggest hundreds of millions annually if scaled). Notably, analyst Tom Lee has cited institutional moves like this in forecasting Ethereum prices of $7,000–$9,000 by early 2026.

Investment implication: Staking signals long-term conviction from institutions, reducing potential sell pressure (staked ETH has withdrawal delays) and adding yield to holdings, comparable to dividend strategies in equities. This could bolster Ethereum's narrative as a productive asset in portfolios diversified beyond Bitcoin.

4. Mirae Asset Group in Talks to Acquire Korean Exchange Korbit for Up to $100 Million

Mirae Asset, a major South Korean financial conglomerate (managing trillions in traditional assets), is negotiating to buy Korbit, South Korea's fourth-largest cryptocurrency exchange and its oldest (founded in 2013). The deal is reportedly valued at $100 million, with a memorandum of understanding already signed.

Investment implication: This represents further mainstream financial integration, as traditional firms seek regulated on-ramps into crypto amid strict local policies separating banking and digital assets. Such acquisitions often validate the sector's maturity and can improve liquidity/access in key markets like Asia, indirectly supporting broader market confidence.

Meme Corner

Closing Note

These stories collectively point to institutional deepening, supply-reducing mechanics, and utility-focused growth, themes likely to shape 2026. As always, crypto remains volatile; position sizing and due diligence are essential.

Thank you for reading, and I will see you tomorrow.