Hello everyone,

Welcome to the 25th edition of the Fiat Bridge Daily Crypto Newsletter.

Over the last week, the crypto markets have pulled back meaningfully. The global cryptocurrency market cap declined from approximately $3.23 trillion to $3 trillion.

Bitcoin, which was trading around $95,516 last Friday, has retreated to $88,963, representing a weekly decline of nearly 6.8%. Ethereum faced steeper headwinds, dropping from $3,296 to $2,920, a loss of approximately 11%.

The broader market sentiment has shifted into "extreme fear" territory, with the Crypto Fear and Greed Index sitting at 24. Despite this pullback, institutional adoption stories continue to dominate the narrative.

Let’s begin.

Market Pulse

Total Crypto Market Cap: ~$3.09 Trillion (down 1.3% in the last 24h)

Bitcoin Dominance: ~57.5% (BTC market share against the rest of the market)

Bitcoin Price: ~$88,963 (down 1.1% in the last 24h)

Ethereum Price: ~$2,920 (down 2.6% in the last 24h)

Solana Price: ~$127 (down 2.2% in the last 24h)

Total Stablecoin Supply: ~$305 Billion

DeFi TVL: ~$119 Billion (down 0.69% in the last 24h)

24h Trading Volume: ~$110 Billion

Fear & Greed Index: 24 (extreme fear)

Ad Break!

Please, check out my sponsor for the day: 1440 Media.

Receive Honest News Today

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

… back to the article 👇

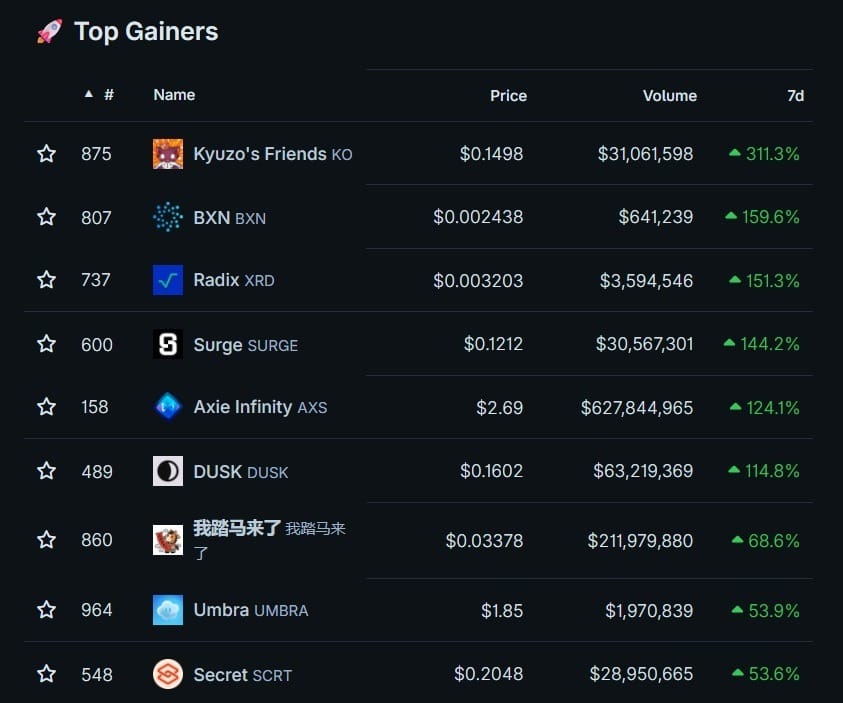

Top 10 Best Performing Tokens in the Last 7 Days:

Top Stories of the Day

1. BitGo Completes First Crypto IPO of 2026 with Strong NYSE Debut

BitGo became the first cryptocurrency company to go public on the New York Stock Exchange in 2026, pricing its IPO at $18 per share, above its guided range of $15 to $17.

Shares opened at $22.43 (a 24.6% jump) and closed at $18.69, valuing the company between $2.1 and $2.59 billion.

The company raised $212.8 million selling 11.8 million shares, with strategic investment from YZi Labs (backed by former Binance CEO Changpeng Zhao).

This matters because BitGo is the custody backbone for institutional crypto investors. Its successful IPO validates that regulated custody providers, companies that securely store crypto assets, can generate stable, defensible revenue models.

The 24.6% first-day pop signals traditional investor appetite for crypto infrastructure exposure without the volatility of trading platforms or direct coin holdings.

2. Ledger Preparing $4 Billion US IPO as Custody Trend Accelerates

Following BitGo's success, Paris-based hardware wallet maker Ledger is in advanced talks with Goldman Sachs, Jefferies, and Barclays about a New York Stock Exchange listing valued at over $4 billion, a 167% premium from its $1.5 billion 2023 valuation.

Ledger posted record revenues in 2025, reaching "triple-digit millions" of euros, and now protects over 20% of the world's circulating cryptocurrency.

The timing reflects surging demand for security solutions: over $3.4 billion in cryptocurrency was stolen in 2025. Ledger's hardware wallets, physical devices that keep private keys offline, are now viewed as essential institutional infrastructure. CEO Pascal Gauthier noted that crypto capital is consolidating in New York, making a US IPO strategically critical.

3. Coinbase Unlocks Staked ETH as Collateral, Enabling $1 Million Loans

Coinbase launched a new lending feature allowing U.S. users to borrow up to $1 million in USDC using cbETH (Coinbase Wrapped Staked ETH) as collateral. Ethereum stakers can now access liquidity without selling or unstaking their holdings, and they keep earning staking rewards while borrowing dollars against their position.

Powered by the Morpho protocol, the feature transforms staked ETH from a locked, illiquid asset into productive financial infrastructure. Users must maintain a loan-to-value ratio below 86% to avoid liquidation. This is significant because it addresses a core pain point: previously, stakers who needed capital had to unstake (losing rewards) or sell (realizing losses). This advancement accelerates institutional adoption of Ethereum staking and positions staking yield as a real alternative to traditional fixed income.

Meme Corner

Closing Note

Custody infrastructure is becoming institutional-grade, staked assets are becoming productive, and capital is flowing toward security and real-world asset infrastructure rather than speculation.

While the market pullback of the past week created fear, the structural trend is unmistakable: this is the foundation layer that institutions require before adopting crypto at scale, and it's where the next phase of capital accumulation will be concentrated.

Follow these infrastructure plays closely over the coming weeks. They define which blockchain networks become the backbone of global finance and which crypto narratives will drive institutional adoption in 2026.

If you want to support my work, you can buy me a coffee here. Thank you.