Hey there,

Welcome to the 19th edition of the Fiat Bridge.

Investor sentiment flips to "greed" for the first time since last October's sharp selloff, driven by strong institutional buying and whale accumulation outpacing retail selling.

In this edition, we cover the top 10 stories shaping the crypto landscape right now, from Bitcoin's rally and regulatory debates to network recoveries, innovative platforms, and the harsh reality of token failures.

Let's dive in.

Market Pulse

Total Crypto Market Cap: ~$3.3 Trillion (up 0.3% in the last 24h)

Bitcoin Dominance: ~57.5% (BTC market share against the rest of the market)

Bitcoin Price: ~$96,264 (up 1.3% in the last 24h)

Ethereum Price: ~$3,317 (down 0.5% in the last 24h)

Solana Price: ~$144 (down 0.4% in the last 24h)

Total Stablecoin Supply: ~$309 Billion

DeFi TVL: ~$129 Billion (down 0.07% in the last 24h)

24h Trading Volume: ~$164 Billion

Fear & Greed Index: 61 (greed)

Top Stories of the Day

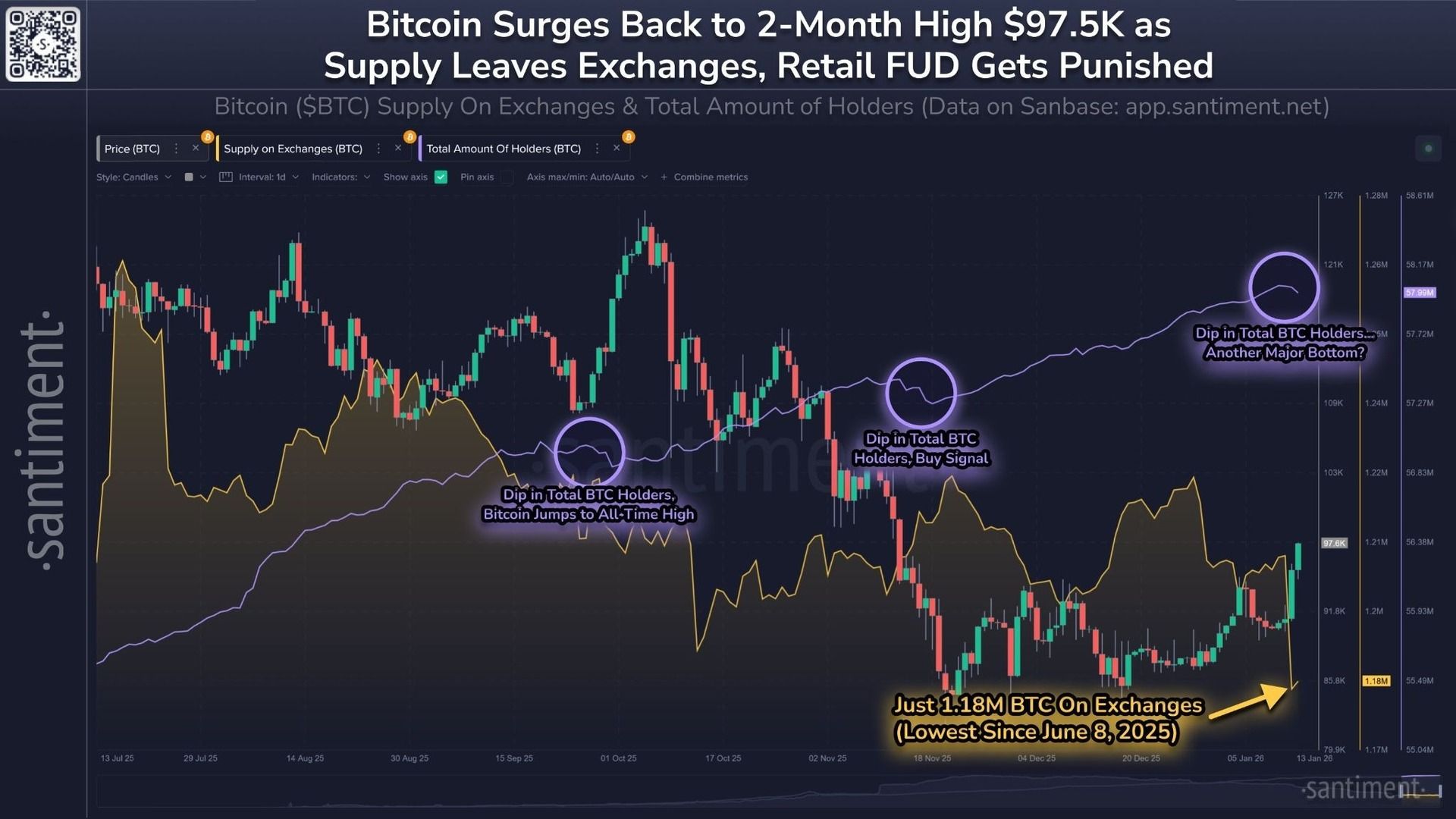

1. Crypto Sentiment Turns Greedy as Bitcoin Hits Two-Month High

The Crypto Fear & Greed Index, a tool that measures investor emotions in the cryptocurrency market by analyzing factors such as price swings, trading volumes, search trends, and social media buzz, had briefly shifted to "greed" with a score of 61, marking the first time since October. This comes after periods of "fear" and "extreme fear," with the index at neutral (48) just yesterday.

Bitcoin, the leading cryptocurrency, rallied from $89,799 to a two-month peak of $97,704 over the past week, currently trading at $96,264 (up 1.3%). This follows a major $19 billion market wipeout in October.

Analytics firm Santiment reports a 47,244 Bitcoin holder drop in three days due to panic selling, but the low supply on exchanges (1.18 million BTC, a seven-month low) suggests reduced selling pressure. This greedy sentiment could fuel further price gains if buying continues, but it also risks over-optimism leading to corrections.

2. Coinbase Pulls Support from Senate Crypto Bill

Coinbase, one of the largest U.S. platforms for buying and selling cryptocurrencies, has withdrawn its backing from the Senate's Clarity Act, a proposed law aimed at clarifying federal rules for the crypto industry, including oversight by agencies like the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC).

It covers stablecoins (digital currencies pegged to stable assets like the dollar), decentralized finance (DeFi, peer-to-peer financial services without banks), and requirements for registration and transparency.

CEO Brian Armstrong cited problems like a potential ban on tokenized stocks (digital versions of shares), DeFi restrictions, and CFTC approaches, calling it worse than no regulation at all. The Senate Banking Committee will debate and vote on January 16, with over 75 amendments.

Reactions are mixed: groups like the Digital Chamber seek fixes, while Ripple's CEO sees it as progress for clarity and protection. Traditional banks oppose parts allowing stablecoin rewards, fearing fund shifts. This split could delay clear rules, prolonging uncertainty for crypto growth and investor safeguards.

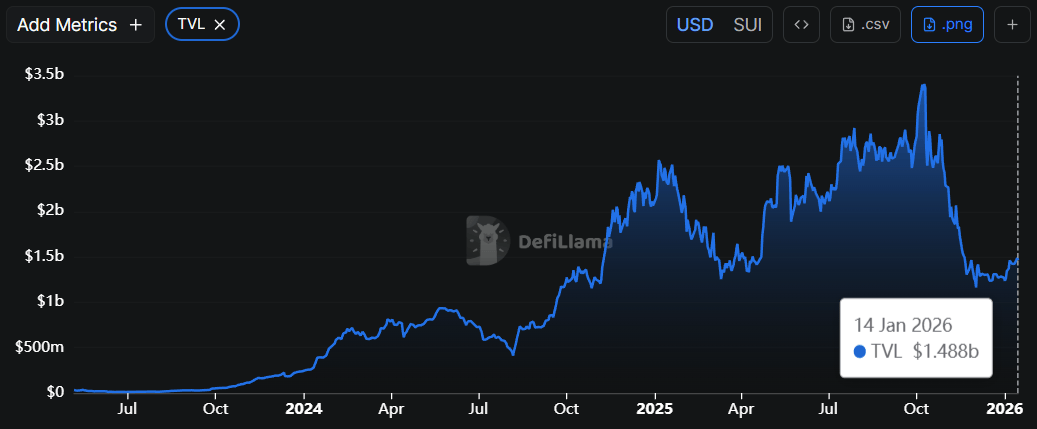

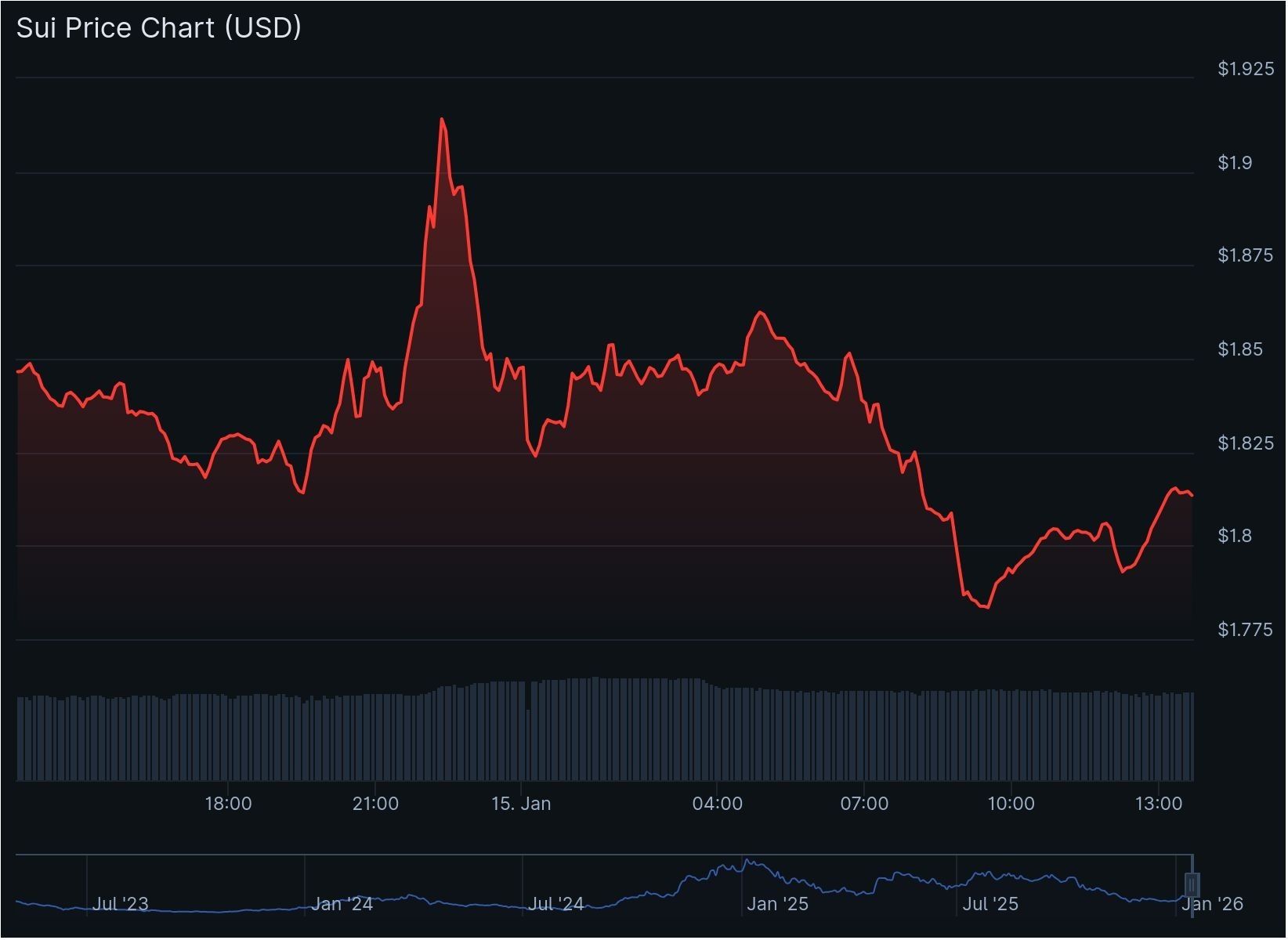

3. Sui Network Back Online After Six-Hour Downtime

Sui, a layer 1 blockchain network built for fast and efficient transactions, experienced a six-hour outage that stopped all activity. Starting at 2:52 pm UTC on Wednesday and fixed by 8:44 pm UTC, the "consensus outage" locked over $1 billion in assets, preventing users from sending or receiving funds.

Developers applied a patch, but the cause remains undisclosed. This is Sui's second major disruption since its 2023 launch, following one in November 2024. The native SUI token price stayed steady at $1.84 to $1.86, with a brief 4% jump during the event.

Such incidents could erode confidence in the network's stability, potentially deterring users and developers, though the quick recovery and minimal price impact suggest resilience.

4. Bitcoin Climbs to Eight-Week High Above $97,000

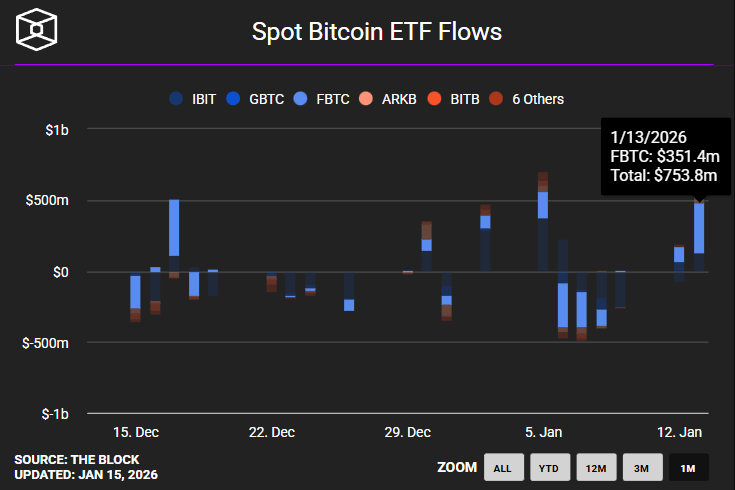

Bitcoin reached an eight-week peak above $97,000 on January 14, currently at $96,264 after a 1.3% daily gain. The broader crypto market cap hit $3.4 trillion amid a rally fueled by institutional investments, including $750 million into U.S. spot Bitcoin ETFs, the highest inflow in nearly three months. This demand focuses on long-term holdings rather than risky borrowing.

Short positions, bets that prices will fall, were unwound through forced sales (liquidations) totaling over $680 million in 24 hours.

Betting platform Polymarket gives over 60% odds for Bitcoin reaching $100,000 by month-end. This momentum could stabilize prices and reduce swings if institutions keep buying, signaling a maturing market.

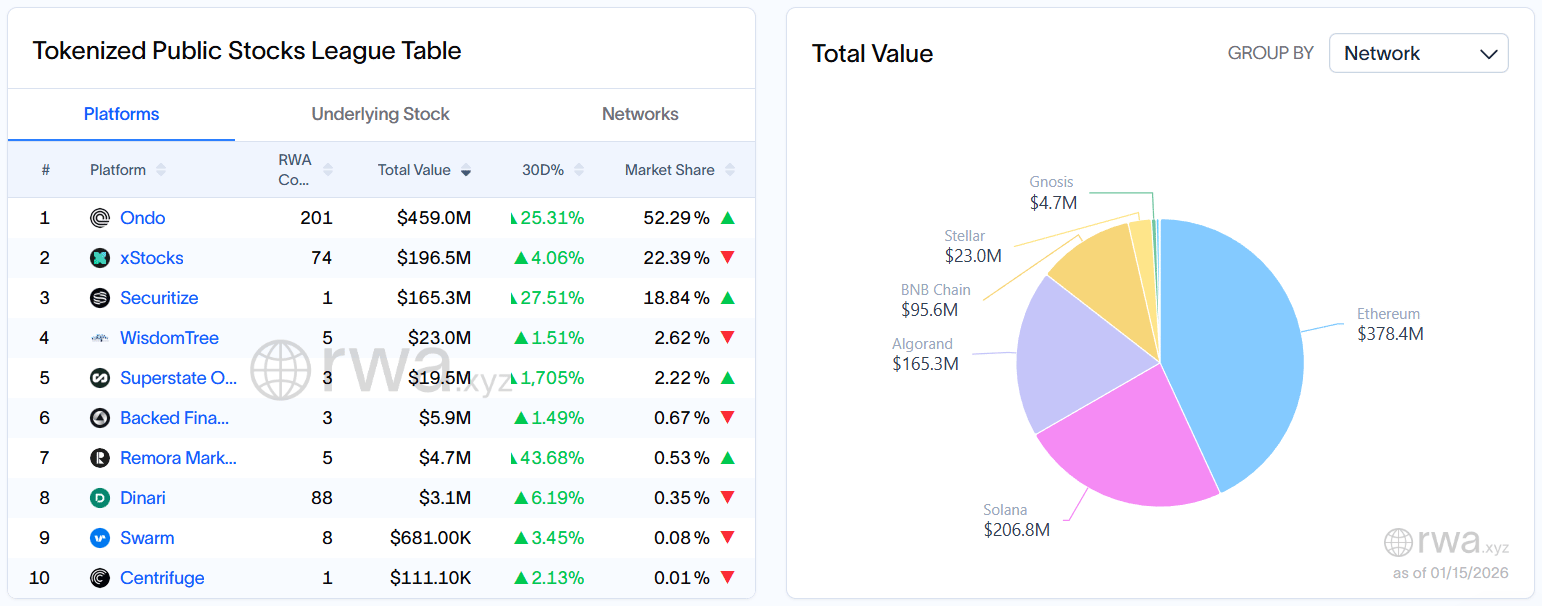

5. Figure Introduces Blockchain Platform for Stock Trading

Figure, a lending firm using blockchain technology, launched the On-Chain Public Equity Network (OPEN) on the Provenance Blockchain. "Onchain" means recording transactions directly on a blockchain for transparency and efficiency.

The platform lets companies issue and trade stocks natively as digital tokens, skipping traditional middlemen like clearinghouses. It supports round-the-clock trading via order books and enables lending/borrowing against holdings in a decentralized finance style.

Partners include BitGo for secure storage and Jump Trading for liquidity. Figure plans to list its own Nasdaq shares on OPEN after a secondary offering.

The tokenized stocks sector is worth $870 million with $2.5 billion monthly volume, mostly repackaged existing shares. This could bridge traditional finance and crypto, making stock markets more accessible and efficient, potentially attracting more investors.

6. Backpack Launches Beta for Unified Prediction Markets

Backpack, a crypto exchange started by ex-employees of now-defunct firms Alameda Research and FTX, rolled out an invite-only beta for its Unified Prediction Portfolio.

Prediction markets are platforms where people buy and sell contracts betting on real-world event outcomes, like elections or economic data, to forecast probabilities.

Backpack's version integrates these with a single account for hedging (protecting against losses) and trading perpetual contracts (ongoing bets without expiration).

It tokenizes assets and uses risk profiling, addressing issues like locked funds in traditional setups. CEO Armani Ferrante highlighted inefficiencies in current markets.

This follows entries by Coinbase and MetaMask, amid regulatory scrutiny on platforms like Polymarket. It could expand accessible betting tools, but faces risks from gambling classifications and insider trading probes.

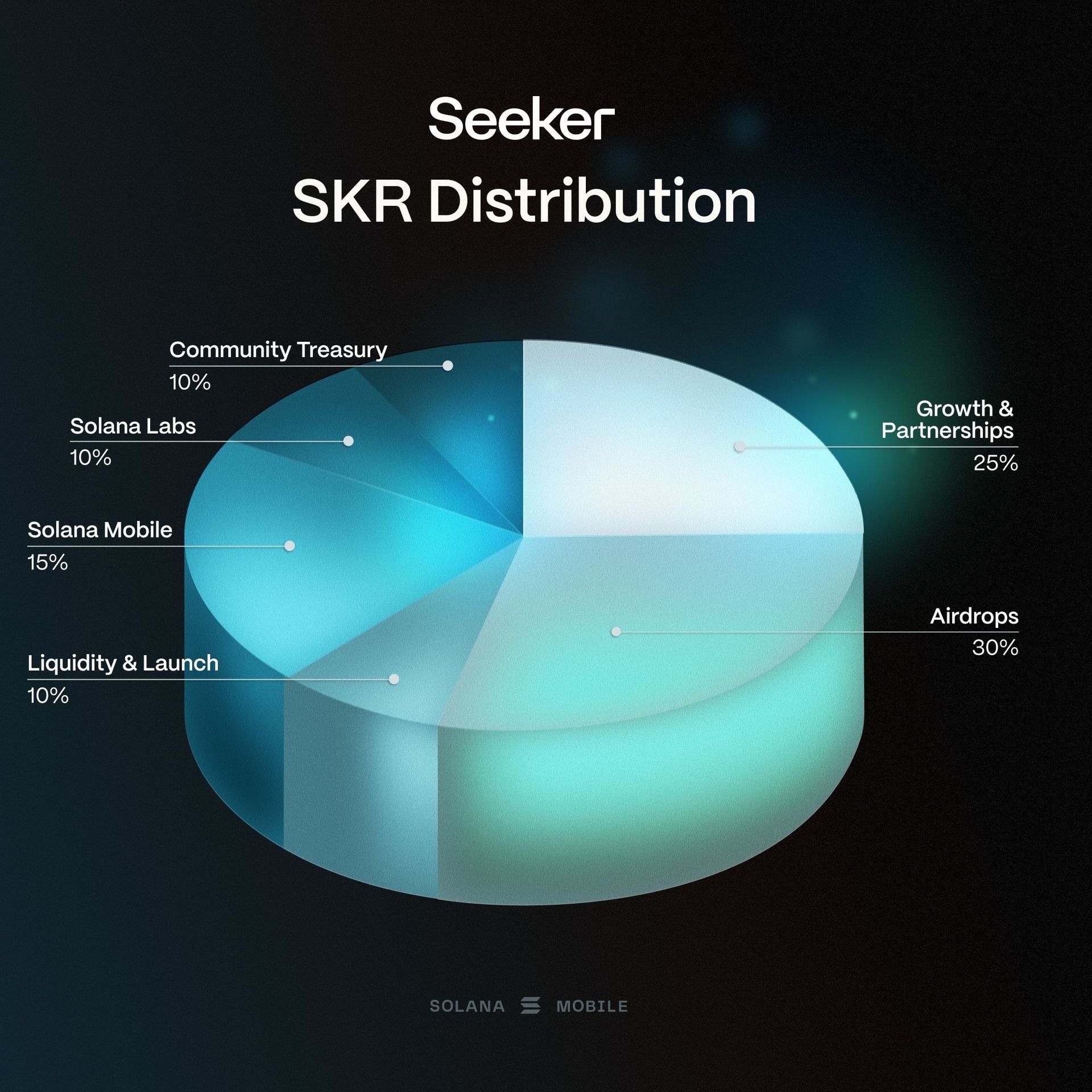

7. Solana Seeker Mobile Plans $2 Billion Token Airdrop

Solana Mobile, part of the Solana blockchain ecosystem, announced an airdrop of nearly 2 billion Seeker (SKR) tokens starting January 21. An airdrop distributes free digital tokens to encourage usage.

SKR is the native token for Solana's mobile devices, linked to the $500 Seeker phone shipped since August 2025. Over 100,908 users get 1.82 billion tokens based on activity tiers (up to 750,000 each), and 188 developers receive 141 million.

This is 20% of the 10 billion total supply. Users can stake (lock tokens for rewards) immediately. Targeting phone owners and app builders, this could drive more adoption of Solana's mobile tech and ecosystem growth.

8. Bitpanda Targets $5.5 Billion IPO in Frankfurt

Bitpanda, a European platform for trading cryptocurrencies and other investments founded in 2014, serves over 7 million users with digital assets and fintech services.

It plans an initial public offering (IPO, when a company sells shares to the public) in Frankfurt, Germany, in the first half of 2026, aiming for a valuation of $4.7 billion to $5.5 billion.

Banks like Citigroup, Goldman Sachs, and Deutsche Bank are involved, though details may shift. Previously valued at $4.1 billion in 2021 after raising $263 million, Bitpanda holds licenses in Germany and the UK for over 500 cryptos.

This aligns with other crypto firms like tZERO and Kraken eyeing 2026 listings, potentially signaling mainstream acceptance and easier funding for the sector.

9. Visa Tests Stablecoin Payouts in Partnership with BVNK

Visa teamed up with BVNK, a UK firm building stablecoin infrastructure, for pilots using Visa Direct. Businesses pre-fund international payouts in stablecoins, sending digital dollars straight to wallets in select markets, even outside banking hours.

This expands Visa's earlier tests with stablecoins like USDC on blockchains. BVNK received investments from Visa Ventures in May 2025 and Citi in October.

Stablecoins have a $300+ billion market cap and $3-4 trillion annual volume, with active wallets up 50% yearly. Pilots start small, expanding with regulations like the EU's MiCA. This could speed up global transfers, blending traditional cards with crypto for broader financial access.

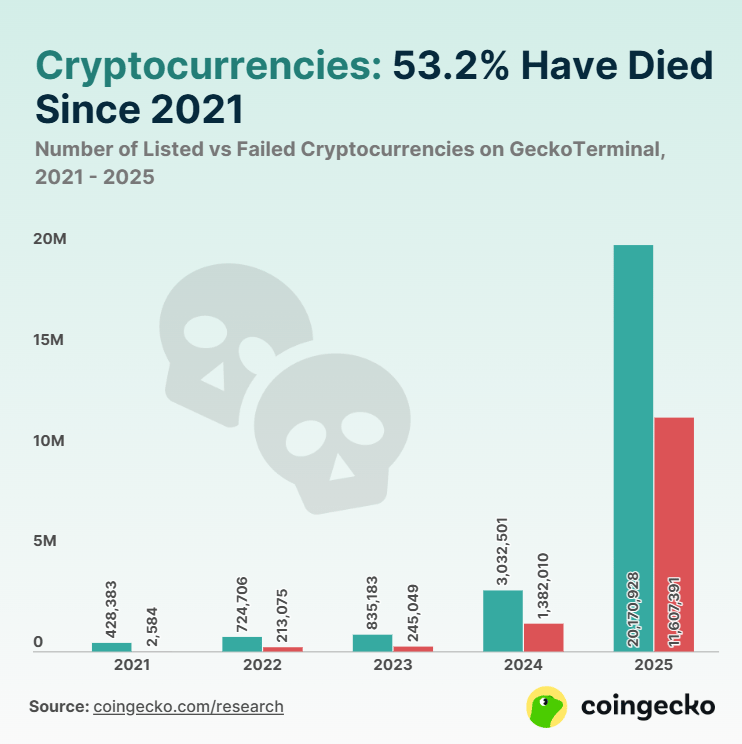

10. Majority of Crypto Tokens Fail, Mostly in 2025

Over 53.2% of nearly 20.2 million crypto tokens launched since mid-2021 are now defunct, meaning they're no longer traded actively. Tokens are digital assets on blockchains, often created for projects but prone to hype without real value.

In 2025 alone, 11.6 million failed, 86.3% of all failures, with earlier years seeing far fewer (e.g., 2,584 in 2021). Blame falls on easy-launch tools like pump. fun enabling speculative "memecoins" (joke-based tokens) and a $19 billion market crash in October, wiping out 7.7 million in three months.

For investors, this underscores high risks in a saturated field, emphasizing due diligence to avoid losses in volatile, unregulated spaces.

Meme Corner

Closing Note

In summary, today's newsletter highlights Bitcoin's strong momentum and greedy market mood, ongoing U.S. regulatory hurdles with the Clarity Act, network stability issues, innovative bridges between traditional finance and crypto, and the sobering stats on token failures.

The space continues to mature amid volatility, with institutional interest and real-world integrations driving progress.

If you'd like deeper dives on any story, questions about getting started in crypto, or suggestions for your portfolio, just reply. I'm here to help.

Stay curious and invest wisely!