Hello,

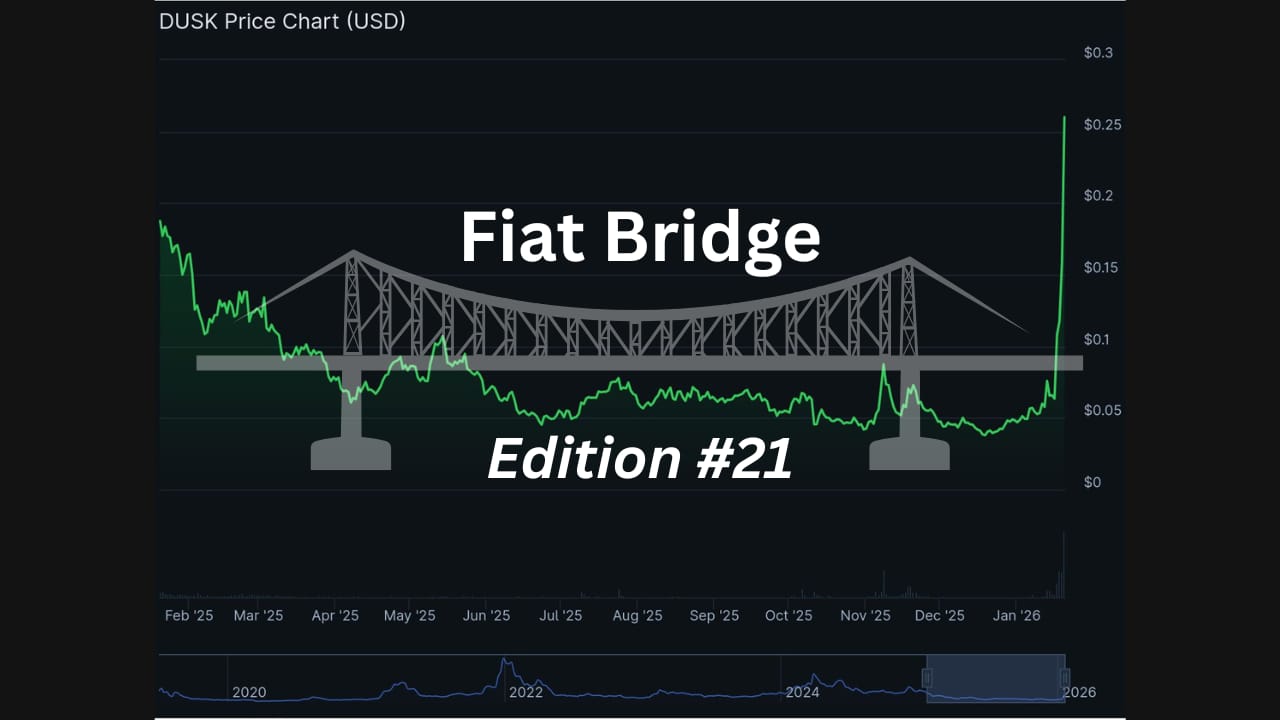

Welcome to the 21st edition of Fiat Bridge.

Happy Monday, everyone. I hope you feel inspired and pumped up for the week ahead.

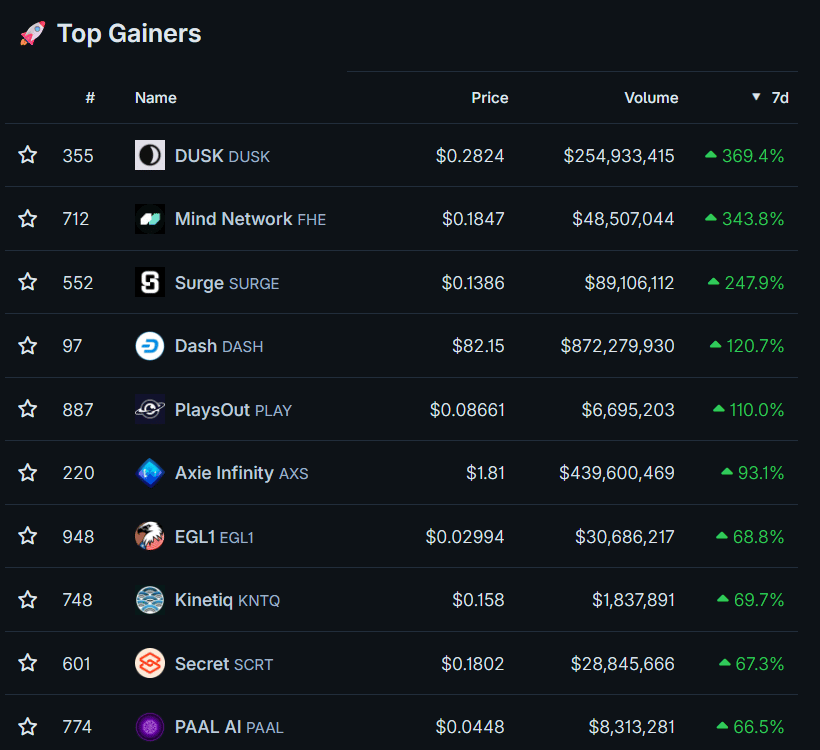

Every week, I iterate on the newsletter format based on the feedback you provide. So starting this week, I’m including a section called “Top 10 best performing cryptocurrencies in the last 7 days”. To give you an idea of what the market is rewarding at any given point in time, and to allow enough time to spot early narratives and make adjustments to the portfolio.

Since my last newsletter on Friday, January 16, the crypto market has taken a hit.

The total market capitalization (the combined value of all cryptocurrencies) dropped from about $3.3 trillion to around $3.2 trillion, a roughly 1.7% decline amid broader risk-off sentiment in global markets.

Bitcoin (BTC), the original cryptocurrency often seen as digital gold, fell from near $95,000 to about $92,500, down 2.7%. Ethereum (ETH), the second-largest crypto known for enabling smart contracts (self-executing agreements on the blockchain), slipped from around $3,300 to about $3,200, a 2.7% drop. Solana (SOL), a fast and low-cost blockchain popular for decentralized apps, declined from $145 to $133, about 7.6% lower.

This pullback was driven by fears of new U.S. tariffs on European countries, sparking a shift away from riskier assets like crypto, while gold hit record highs.

In today's edition, I'll cover the top 10 stories shaping the crypto landscape, focusing on market moves, regulatory shifts, token insights, buzzing discussions on X (formerly Twitter), and key events like token generation events (TGEs, where new tokens are created and distributed).

Let's dive in.

Today’s edition of the Fiat Bridge newsletter is brought to you by Elite Trade Club.

The headlines that actually moves markets

Tired of missing the trades that actually move markets?

Every weekday, you’ll get a 5-minute Elite Trade Club newsletter covering the top stories, market-moving headlines, and the hottest stocks — delivered before the opening bell.

Whether you’re a casual trader or a serious investor, it’s everything you need to know before making your next move.

Join 200K+ traders who read our 5-minute premarket report to see which stocks are setting up for the day, what news is breaking, and where the smart money’s moving.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

Now let’s get to the Market Pulse and 7-Day Best Performers.

Market Pulse

Total Crypto Market Cap: ~$3.26 Trillion (down 1.7% since Friday)

Bitcoin Dominance: ~57.5% (BTC market share against the rest of the market)

Bitcoin Price: ~$92,930 (down 2.7% since Friday)

Ethereum Price: ~$3,206 (down 2.7% since Friday)

Solana Price: ~$133 (down 7.6% since Friday)

Total Stablecoin Supply: ~$311 Billion

DeFi TVL: ~$126 Billion (down 2.3% since Friday)

24h Trading Volume: ~$121 Billion

Fear & Greed Index: 44 (fear)

Top 10 best performing cryptos in the last 7 days:

This newsletter edition is also supported by The Daily Upside.

Wall Street’s Morning Edge.

Investing isn’t about chasing headlines — it’s about clarity. In a world of hype and hot takes, The Daily Upside delivers real value: sharp, trustworthy insights on markets, business, and the economy, written by former bankers and seasoned financial journalists.

That’s why over 1 million investors — from Wall Street pros to Main Street portfolio managers — start their day with The Daily Upside.

Invest better. Read The Daily Upside.

Now let’s get to the top stories of the day.

Top Stories of the Day

1. Crypto Markets Tumble: Is a U.S.-EU Trade War Brewing?

Crypto prices slid sharply today, with over $110 billion wiped from the total market cap in 24 hours. Bitcoin dipped below $93,000, Ethereum under $3,200, and altcoins (alternative cryptocurrencies beyond Bitcoin) like Solana fell 6-8%.

The trigger can be attributed to the U.S. President Trump's proposed 10-25% tariffs on eight European nations starting in February, fueling risk aversion.

This highlights how global trade tensions can impact crypto, often treated as a "risk-on" asset like stocks. Watch for rebounds if tariff talks ease.

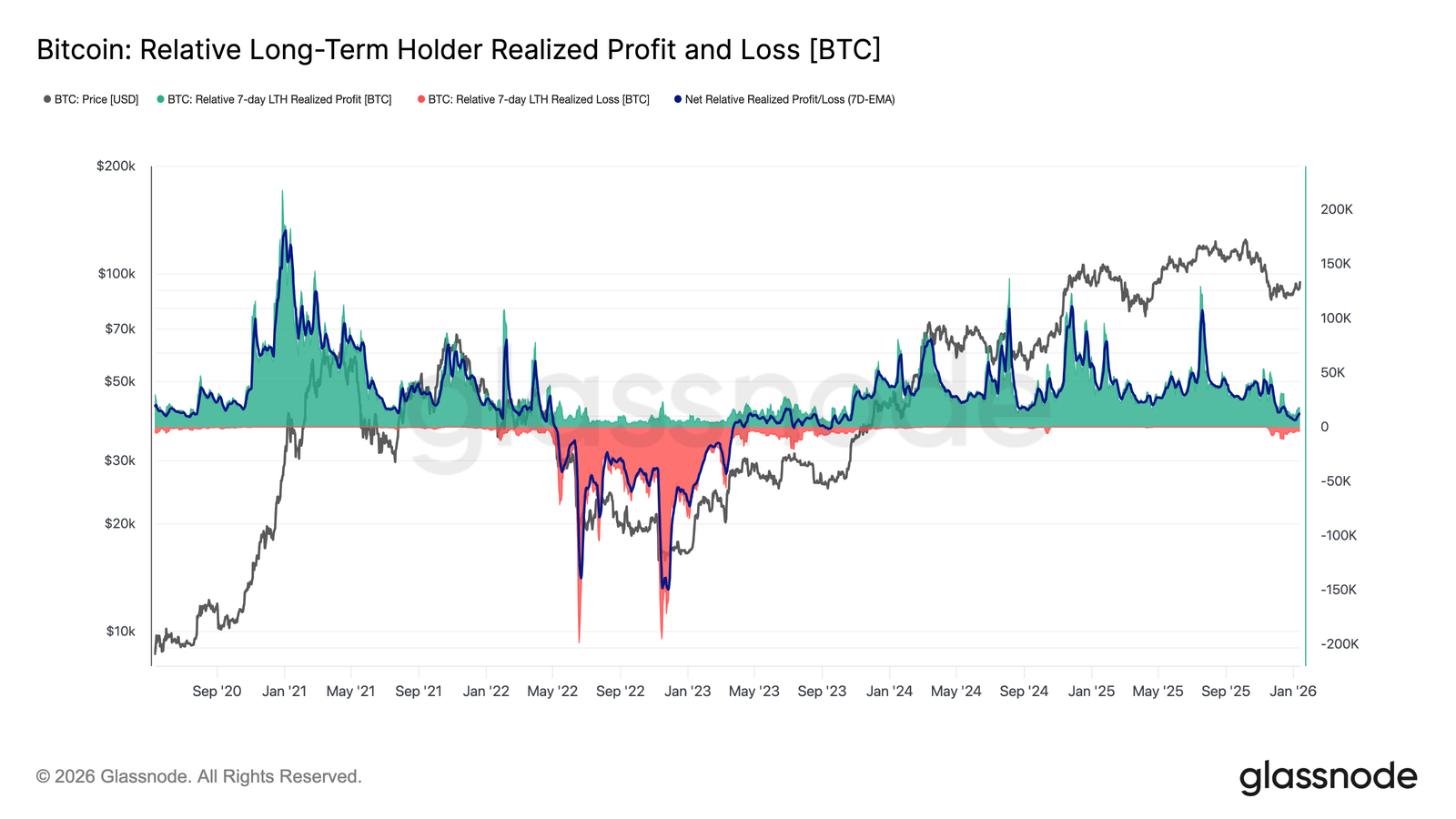

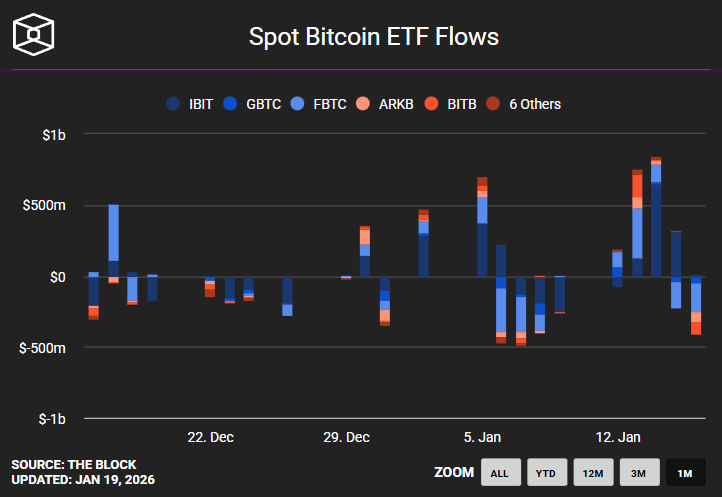

2. Bitcoin and Ether ETFs Shine: $2 Billion Inflows Signal Institutional Comeback

Spot Bitcoin and Ether exchange-traded funds (ETFs, investment vehicles that track crypto prices and trade like stocks) in the U.S. saw their best week since October, pulling in nearly $2 billion.

This institutional demand, big players like funds buying in, pushed Bitcoin up 6% and Ether 8% month-to-date before today's dip.

ETFs make crypto accessible without direct ownership, ideal for beginners.

In India, where direct crypto trading faces tax hurdles, this could inspire similar products via mutual funds, boosting adoption.

3. Trove's Sudden Pivot to Solana: Investors Demand Refunds Ahead of Token Launch

Trove Markets, a decentralized exchange (DEX, a platform for peer-to-peer crypto trading without intermediaries), shocked users by pivoting to Solana-based perpetual futures (perps, contracts betting on price without owning the asset) just hours before its token generation event.

This shift from its original plan led to HYPE token dumps and fraud probes, with investors seeking refunds.

TGEs are critical as they introduce new tokens, often via airdrops (free distributions).

For non-native users, this underscores the risks of early-stage projects; always research before investing.

4. Anchorage Digital Eyes $400M Raise: IPO Rumors Heat Up Crypto Banking

Anchorage Digital, a crypto custody bank (secure storage for digital assets), is reportedly raising up to $400 million amid whispers of a 2026 IPO.

This would make it a public company, allowing everyday investors to buy shares. As a regulated entity, it appeals to institutions wary of hacks.

5. BitGo Set for Crypto's First Big IPO of 2026: What It Means for Custody

Crypto custodian BitGo is gearing up for an IPO soon, potentially valued at $2 billion.

As the first major crypto IPO this year, it highlights maturing infrastructure.

Custodians like BitGo safeguard assets for big players, reducing theft risks.

For Indian audiences, this could boost confidence, especially with local exchanges like CoinSwitch pushing secure storage amid rising cyber threats.

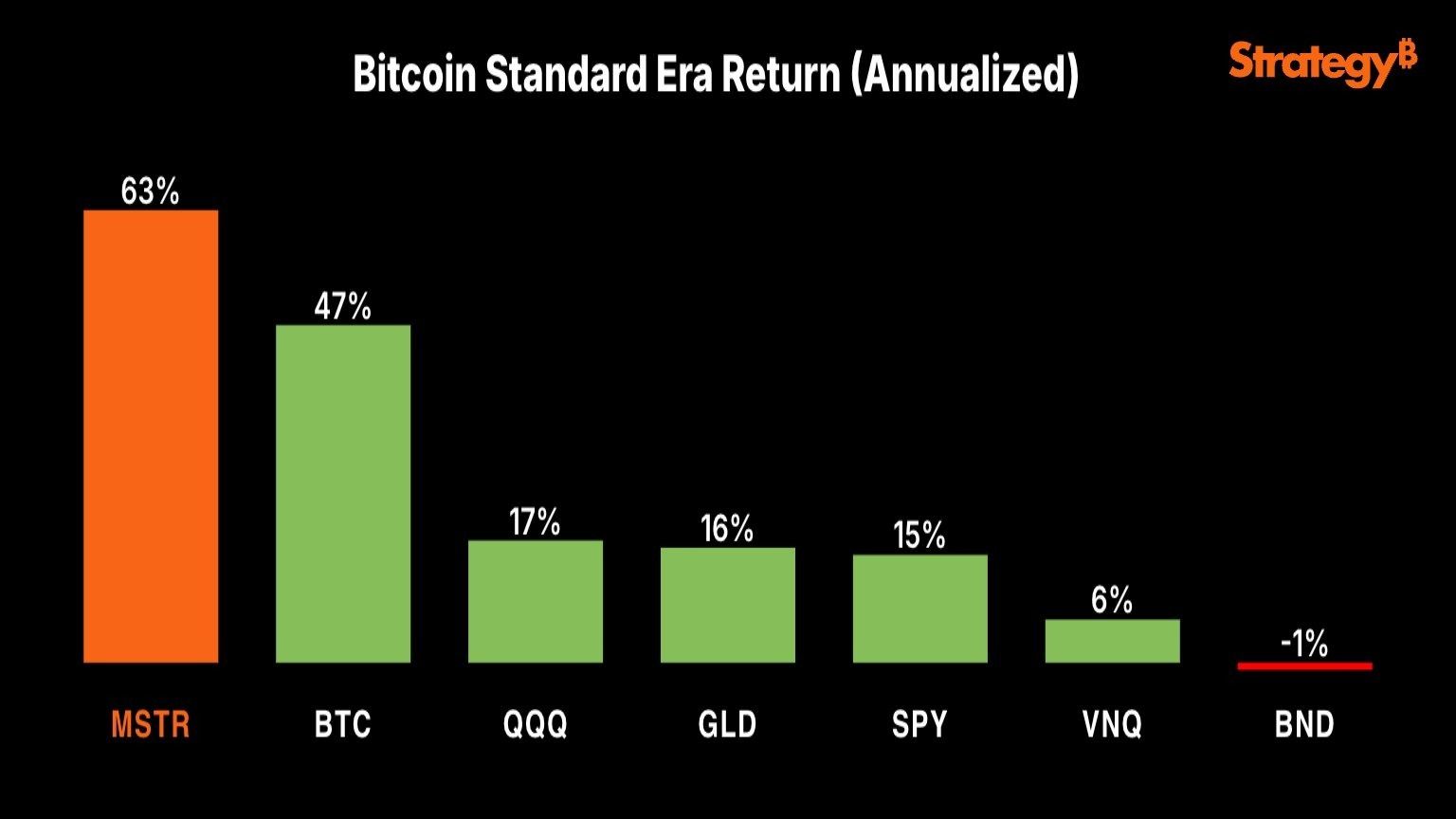

6. Michael Saylor Hints at Mega Bitcoin Buy: MicroStrategy's Treasury Play

MicroStrategy's Michael Saylor teased an even larger Bitcoin purchase after last week's $1.25 billion buy.

The firm treats BTC as a corporate treasury asset (reserves held in crypto instead of cash). This "Bitcoin standard" trend could inspire Indian firms, but remember: volatility is high, so it’s important to diversify.

7. Steak 'n Shake Adds $10M Bitcoin: Fast Food Joins the Crypto Treasury Wave

U.S. burger chain Steak 'n Shake boosted its Bitcoin holdings by $10 million, eight months after adopting Lightning Network (a fast, cheap Bitcoin payment layer).

This shows real-world adoption beyond speculation. In India, where UPI dominates, such integrations could spark crypto payments in retail.

8. Vitalik Buterin Declares 2026 Ethereum's Year of Self-Sovereignty

Ethereum co-founder Vitalik Buterin called 2026 the year to reverse "backsliding" in trustlessness (systems without central control) and self-sovereignty (user control over assets).

He pushed for better DAOs (decentralized autonomous organizations, community-governed entities). For newcomers, this means Ethereum aims to empower users directly, potentially benefiting Indian devs building on it.

9. Hyperliquid Dominates Perp DEX Race: Volumes Fade for Rivals

Hyperliquid, a DEX for perpetual futures, extended its lead with surging volumes while competitors dipped. Perps allow leveraged bets on crypto prices.

This shift to decentralized trading reduces reliance on centralized exchanges like Binance.

10. Privacy Coins Buck the Trend: Monero, Dusk Defy Market Slump

While the market bled red, privacy coins like Monero (XMR, which hides transaction details) hit all-time highs, up 9% in 24h, and DUSK surged 500% in the last 30 days.

These focus on anonymity, appealing amid rising data concerns. But note: regulators often eye them for illicit use. For our audience, they're a niche play, start small if exploring.

Meme Corner

Closing Note

Today's newsletter highlighted a volatile market dip, strong ETF inflows, pivotal shifts like Trove's Solana move, and upcoming IPOs signaling crypto's mainstream push.

Key takeaways: Diversify amid trade fears, and watch TGEs/IPOs for growth plays, but always with caution; crypto is one of the highest risk assets.

Stay informed, subscribe to daily updates, follow me on X @chetankale_ for real-time insights, and share your thoughts by replying to this email.

What story intrigued you most?

Let's bridge fiat and crypto together!