Dear Readers,

Welcome to the tenth edition of Fiat Bridge.

As we step into 2026, the crypto markets are whispering tales of caution mixed with opportunity. Bitcoin, the leading cryptocurrency, has entered what analysts describe as a bear market, a prolonged period of declining prices, since October 2025. Yet, amid this uncertainty, subtle shifts in sentiment and emerging investment themes suggest potential pathways for growth.

In today's edition, we'll explore four key stories: the evolving market sentiment and projections for the year ahead, Ethereum's strategic roadmap as outlined by its co-founder, promising investment trends like tokenized assets and privacy tools, and critical security lessons from recent hacks and platform challenges.

Let’s dive in.

Market Pulse

Total Crypto Market Cap: ~$3.09 Trillion (up 1.4% in the last 24 hours)

Bitcoin Dominance: ~57.29% (BTC market share against the rest of the market)

Bitcoin Price: ~$88,667 (up 1.3% in the last 24 hours)

Ethereum Price: ~$3,013 (up 1.3% in the last 24 hours)

Solana Price: ~$127 (up 1.8% in the last 24 hours)

Total Stablecoin Supply: ~$306 Billion (down 0.1% in the last 24 hours)

DeFi TVL: ~$120 Billion (up 2.05% in the last 24 hours)

24h Trading Volume: ~$68 Billion

Fear & Greed Index: 28 (fear)

Top Stories of the Day

Shifting Sentiments: From Extreme Fear to Cautious Outlook in a Bear Market

Ethereum's Roadmap: Vitalik Buterin's Push for Usability and True Decentralization

Emerging Investment Themes: Tokenization, Privacy, and Institutional Momentum

Security Realities: Hacks, Withdrawals, and Platform Backlash

1. Shifting Sentiments: From Extreme Fear to Cautious Outlook in a Bear Market

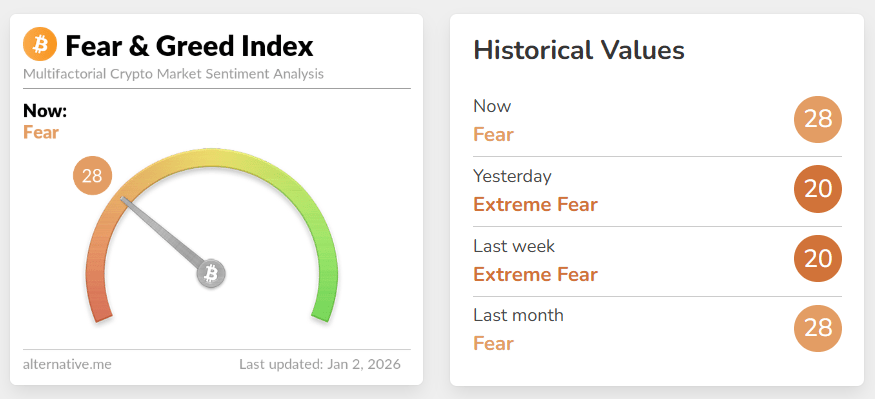

The crypto market's emotional pulse, captured by the Crypto Fear and Greed Index, a metric that gauges investor sentiment on a scale from 0 (extreme fear) to 100 (extreme greed) based on factors like volatility and social media activity, has edged up from "extreme fear" to a "fear" score of 28.

This marks the highest level in three weeks and ends an eight-week streak of fearful territory, longer than the dip following U.S. President Donald Trump's tariff announcements in April 2025.

For context, this index helps traditional investors understand market psychology, similar to the VIX in stocks, signaling potential buying opportunities when fear is high.

This shift comes as Bitcoin (BTC) trades around $88,500, down over 30% from its October 2025 all-time high of $126,080. Analysts from CryptoQuant confirm the bear market began in early November 2025, when BTC fell below its one-year moving average, a technical indicator often used to confirm trend reversals.

Historical patterns suggest a potential price bottom between $56,000 and $60,000 in 2026, representing a 55% drawdown from the peak, milder than past cycles' 70-80% drops. Unlike previous bears, this one lacks major collapses like the FTX implosion in 2022, bolstered by steady institutional buying through exchange-traded funds (ETFs).

Adding to the nuance, prediction markets on Polymarket, a decentralized platform where users bet on real-world outcomes using stablecoins (cryptocurrencies pegged to fiat like the U.S. dollar), give BTC just a 21% chance of hitting $150,000 in 2026, with higher odds (80%) for $100,000.

This contrasts with bullish forecasts from firms like Standard Chartered and Fundstrat, predicting $150,000 to $250,000, driven by potential U.S. rate cuts and regulatory clarity from bills like the GENIUS Act.

Looking broader, signals hint at an "altcoin season" in 2026, where alternative cryptocurrencies (altcoins) outperform BTC. Bitcoin dominance, the share of total crypto market cap held by BTC, faces rejection from a multi-year trendline, potentially dropping to 40%, as seen in 2021's altcoin boom.

Altcoin trading volumes are higher than in past cycles, with whales (large holders) driving momentum, despite weak prices and low retail involvement. For finance pros, this resembles sector rotations in stocks, offering diversification plays.

2. Ethereum's Roadmap: Vitalik Buterin's Push for Usability and True Decentralization

Ethereum, the second-largest blockchain by market cap known for enabling smart contracts (self-executing agreements coded on the chain), is charting a course to become the "world computer", a resilient, neutral platform for global applications.

Co-founder Vitalik Buterin, in recent statements, stresses two key goals for 2026: enhancing usability for worldwide access and ensuring genuine decentralization beyond just the blockchain layer.

Buterin highlights decentralized applications (dApps), apps running on blockchain without central control, as solutions to centralized failures, like Cloudflare's November 2025 outage that downed 20% of websites.

He envisions dApps for finance, identity, and governance that "pass the walkaway test," functioning even if creators vanish or providers fail. This counters "convenience drift" toward trust-dependent systems, as noted in a co-authored manifesto.

2025 upgrades like Pectra (increasing data throughput) and Fusaka (streamlining scalability) laid the groundwork, making Ethereum faster and more node-friendly without sacrificing decentralization.

For tech-savvy readers, think of this as evolving from cloud computing's vulnerabilities to a distributed system resilient to hacks or outages. Buterin warns against chasing short-term trends like memecoins (fun, viral tokens) or artificial boosts, urging focus on core missions. This positions Ethereum for institutional appeal, where privacy and reliability matter, potentially driving adoption in 2026.

3. Emerging Investment Themes: Tokenization, Privacy, and Institutional Momentum

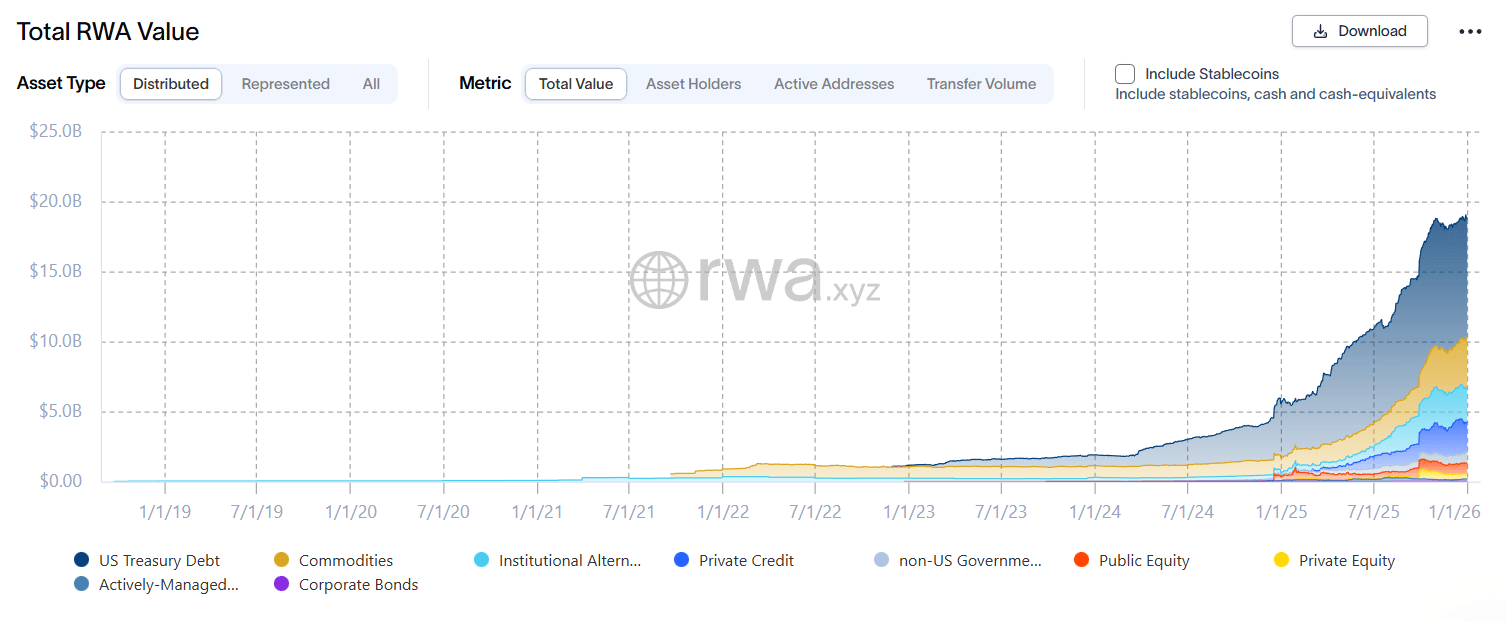

As traditional finance eyes crypto, 2026's playbook spotlights Bitcoin, stablecoins, and tokenized real-world assets (RWAs), digital representations of physical assets like Treasuries or stocks on blockchain for faster settlement and accessibility.

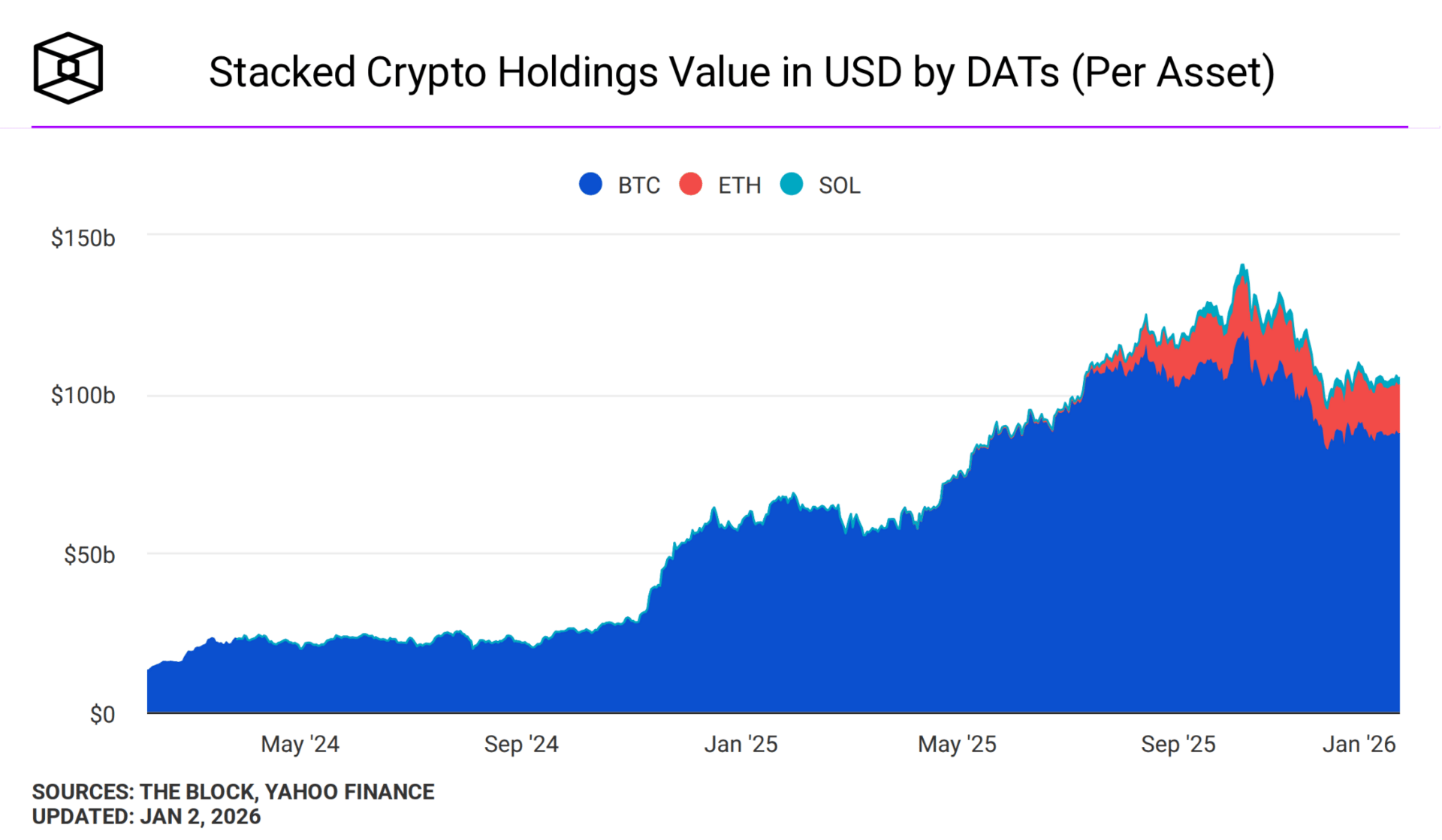

After 2025's volatility, where BTC climbed 600% from 2022 lows but no broad altcoin rally emerged, institutional capital is reshaping dynamics with longer horizons.

Stablecoins, now over $300 billion in circulation, are evolving into payment infrastructure, with regulations like the GENIUS Act (signed July 2025) enabling bank issuance.

RWAs hit $30 billion onchain in 2025, led by U.S. Treasury products like BlackRock's BUIDL fund ($2 billion). Solana exemplifies momentum, with tokenized RWAs reaching $873 million in December 2025 (up 10% month-over-month) and $765 million in ETF inflows.

Treasury execs forecast mergers and acquisitions (M&A) among digital asset treasuries (DATs), diversification beyond BTC (e.g., into SOL, ETH), and more institutional adoption if clarity acts pass. Over 200 new DATs launched in 2025, holding $100 billion in crypto.

Privacy emerges as a theme, with Zcash up 600% in 2025. Predictions include practical tradeoffs, private stablecoins for compliant payments, and industrialized tools like zero-knowledge proofs (math-based privacy tech). This appeals to finance pros seeking yield without full transparency.

4. Security Realities: Hacks, Withdrawals, and Platform Backlash

Crypto's promise comes with risks, as evidenced by 2025's $2.2 billion in top-10 hacks, matching 2024's total but more concentrated. The largest was Bybit's $1.4 billion loss from compromised keys.

Recently, hundreds of wallets across Ethereum-compatible chains were drained for $107,000 total, with onchain sleuth ZachXBT flagging small thefts under $2,000 each; the cause remains unknown. December 2025 saw 26 exploits for $76 million, down 60% from November.

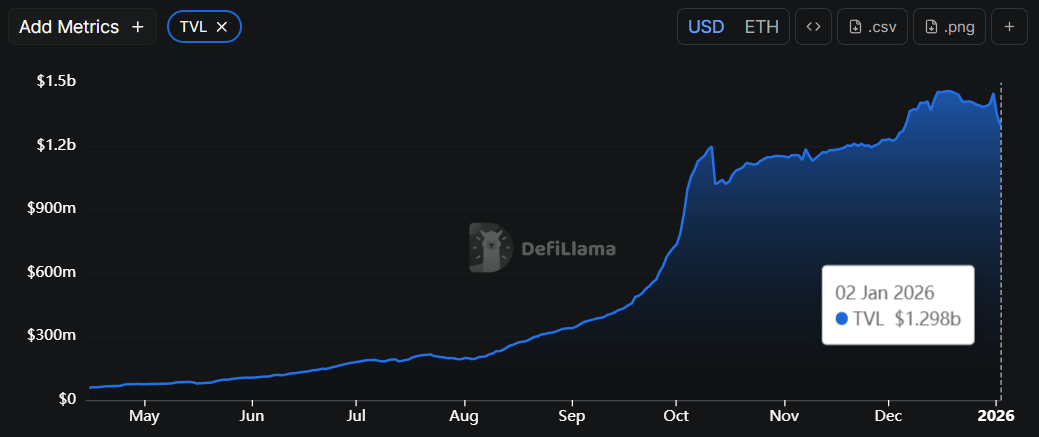

Platform-specific issues include Lighter, a privacy-focused decentralized exchange (DEX), seeing $250 million withdrawn 24 hours after its $675 million LIT token airdrop (free token distribution to early users), representing 20% of its $1.4 billion locked value. This highlights post-airdrop capital flight, often from farmers seeking new opportunities.

Base, Coinbase's layer-2 network (a scaling solution atop Ethereum), faces builder backlash over its creator coin push, tokens tied to creators for monetizing content.

A high-profile launch by YouTuber Nick Shirley spiked to a $9 million valuation before crashing to $3 million, drawing criticism for favoritism toward Zora (an NFT marketplace) and failing to sustain activity.

On X, builders like Jacek voiced disappointment: "If you’re not part of the favored narrative, you effectively don’t exist." Discussions highlight migration risks to rivals like Solana, underscoring ecosystem incentives. Lessons: Prioritize audits, key management, and diversified platforms.

Meme Corner

Closing Note

2026 holds balanced prospects, bearish pressures, with institutional bright spots. Share this edition with colleagues bridging fiat and crypto, and reach out for personalized consultations on portfolio strategies or crypto integration.

Thank you for reading, and I will see you next week.