Dear Readers,

Welcome to the 12th edition of the Fiat Bridge Newsletter.

The broader cryptocurrency markets are signaling a comeback, with Bitcoin reclaiming key levels and institutional interest reigniting after a volatile close to 2025.

In today's edition, we'll dive into four pivotal stories shaping the crypto landscape: Bitcoin's bullish trajectory fueled by strategic accumulations, Ethereum's evolving staking dynamics, the rally in U.S. crypto-related stocks, and innovative developments in prediction markets alongside ecosystem surges and security reminders.

These insights aim to equip you with actionable knowledge for informed investing and a deeper understanding of the rapidly evolving digital currency space.

Let’s dive in.

Market Pulse

Total Crypto Market Cap: ~$3.3 Trillion (up 2.1% in the last 24h)

Bitcoin Dominance: ~56.742% (BTC market share against the rest of the market)

Bitcoin Price: ~$93,752 (up 1.4% in the last 24h)

Ethereum Price: ~$3,240 (up 2.6% in the last 24h)

Solana Price: ~$139 (up 2.6% in the last 24h)

Total Stablecoin Supply: ~$308 Billion (no change)

DeFi TVL: ~$127 Billion (up 1.86% in the last 24h)

24h Trading Volume: ~$137 Billion

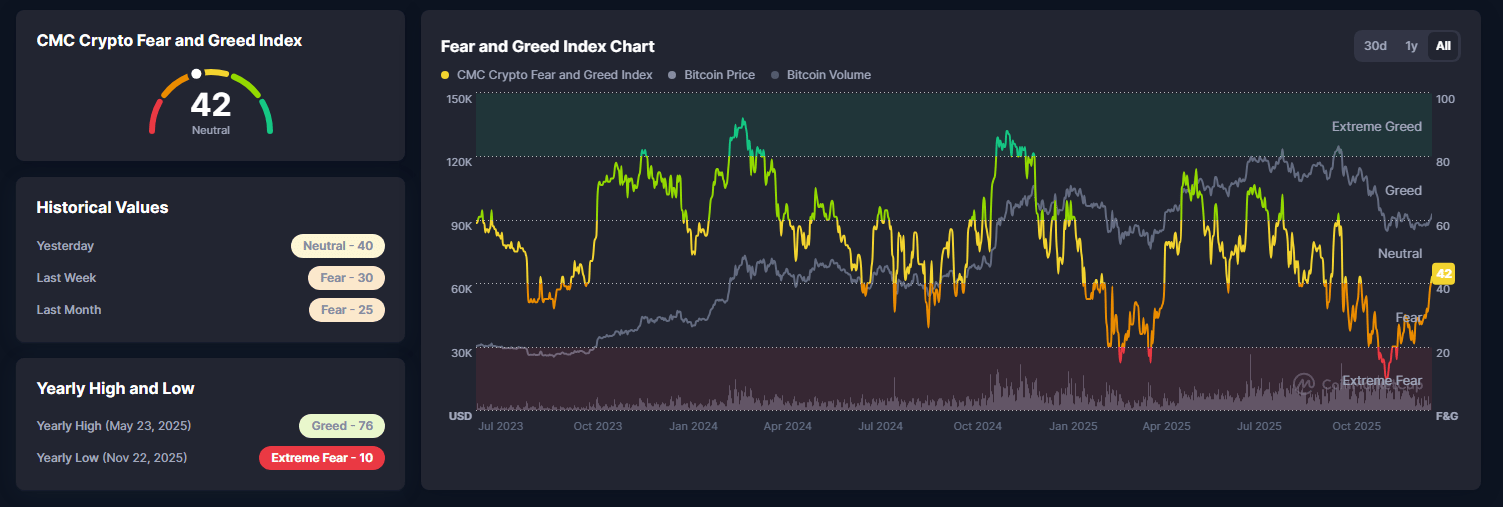

Fear & Greed Index: 44 (fear)

Top Stories of the Day

Bitcoin's Bullish Outlook Kicks Off 2026 with Strategic Accumulations

Ethereum's Staking Validator Queue Clears, Signaling Reduced Pressure

U.S. Crypto Stocks Rally, Spotlight on Coinbase Upgrade

Prediction Markets Expand to Real Estate Amid Sui Surge and Ledger Leak Caution

1. Market Rebound Sparks Memecoin Frenzy Amid Bitcoin's Rally

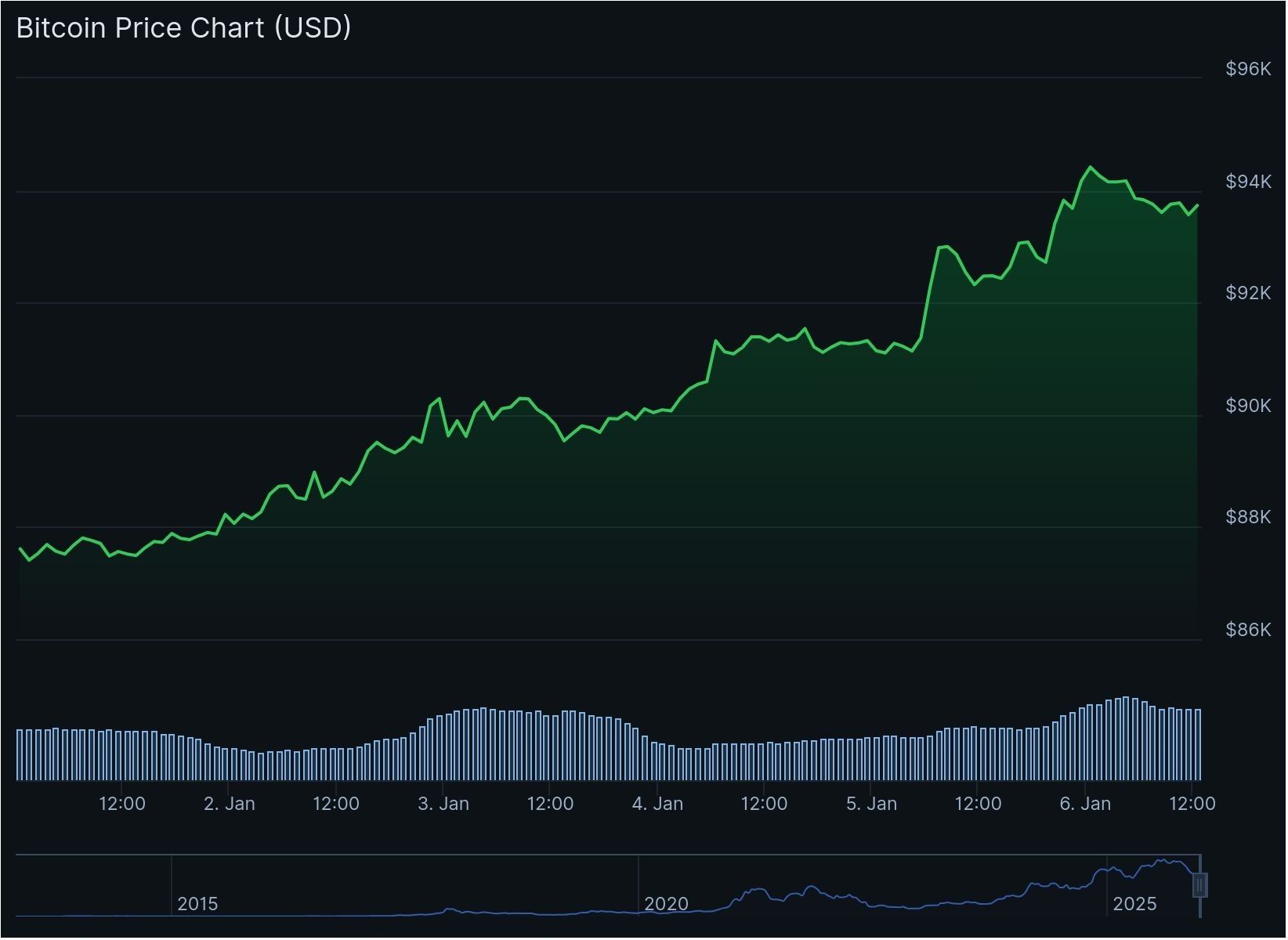

Bitcoin, often dubbed "digital gold" for its store-of-value properties, has started 2026 on a strong note, trading around $93,700 after touching a three-week high of $94,800.

This surge reflects broader bullish sentiments, driven by factors like new-year portfolio allocations, institutional inflows into spot exchange-traded funds (ETFs), and geopolitical tensions boosting safe-haven demand.

Data shows Bitcoin up 7% since January 1, with over $1 billion in net inflows to U.S.-listed spot ETFs in the first two trading days.

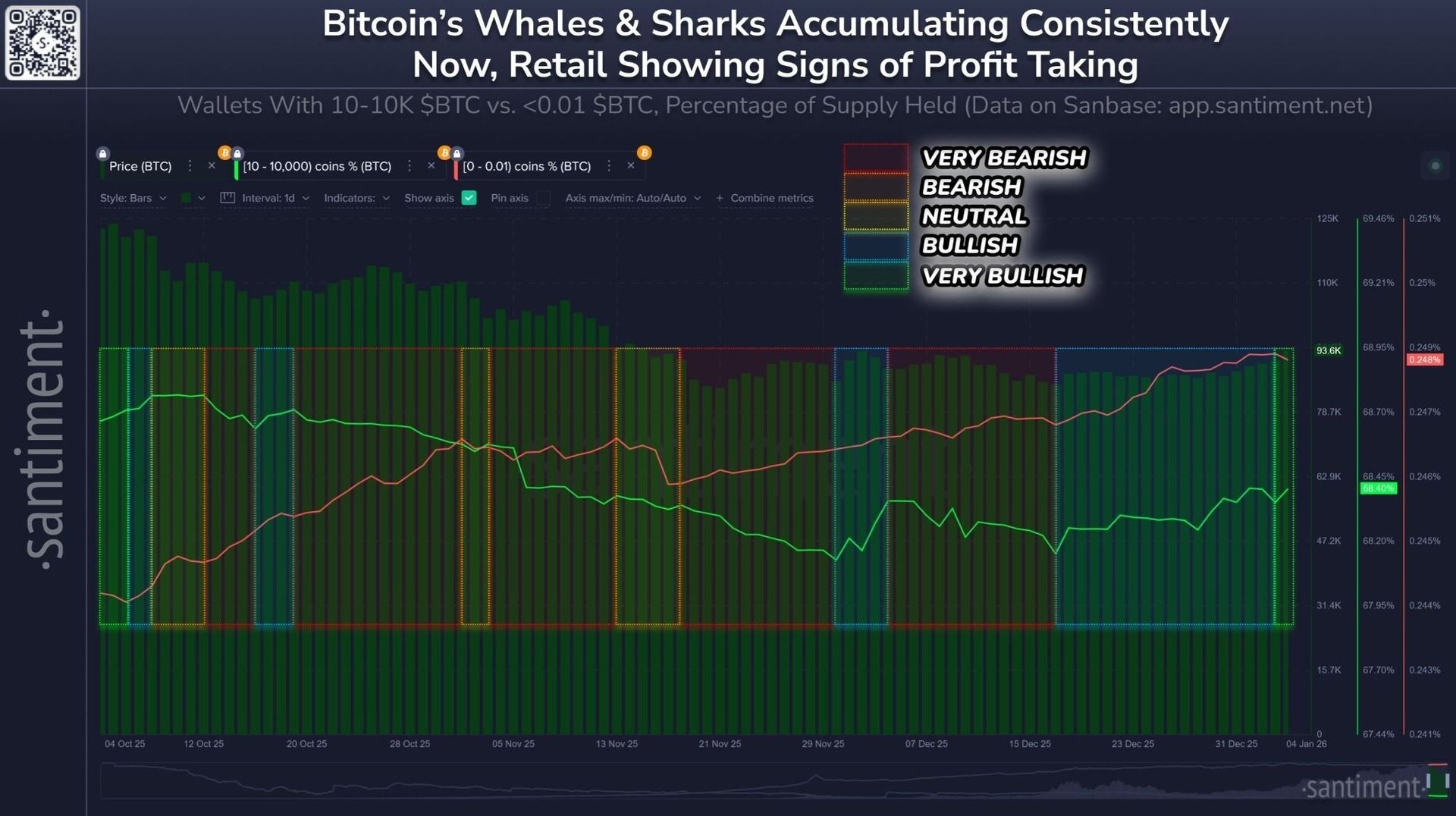

A standout development is the renewed whale accumulation, where "whales" are large holders with 10 to 10,000 BTC, who, alongside mid-tier "sharks," added 56,227 BTC worth over $5.3 billion since mid-December.

This on-chain activity contrasts with retail investors taking profits, creating a bullish divergence that often precedes market cap growth.

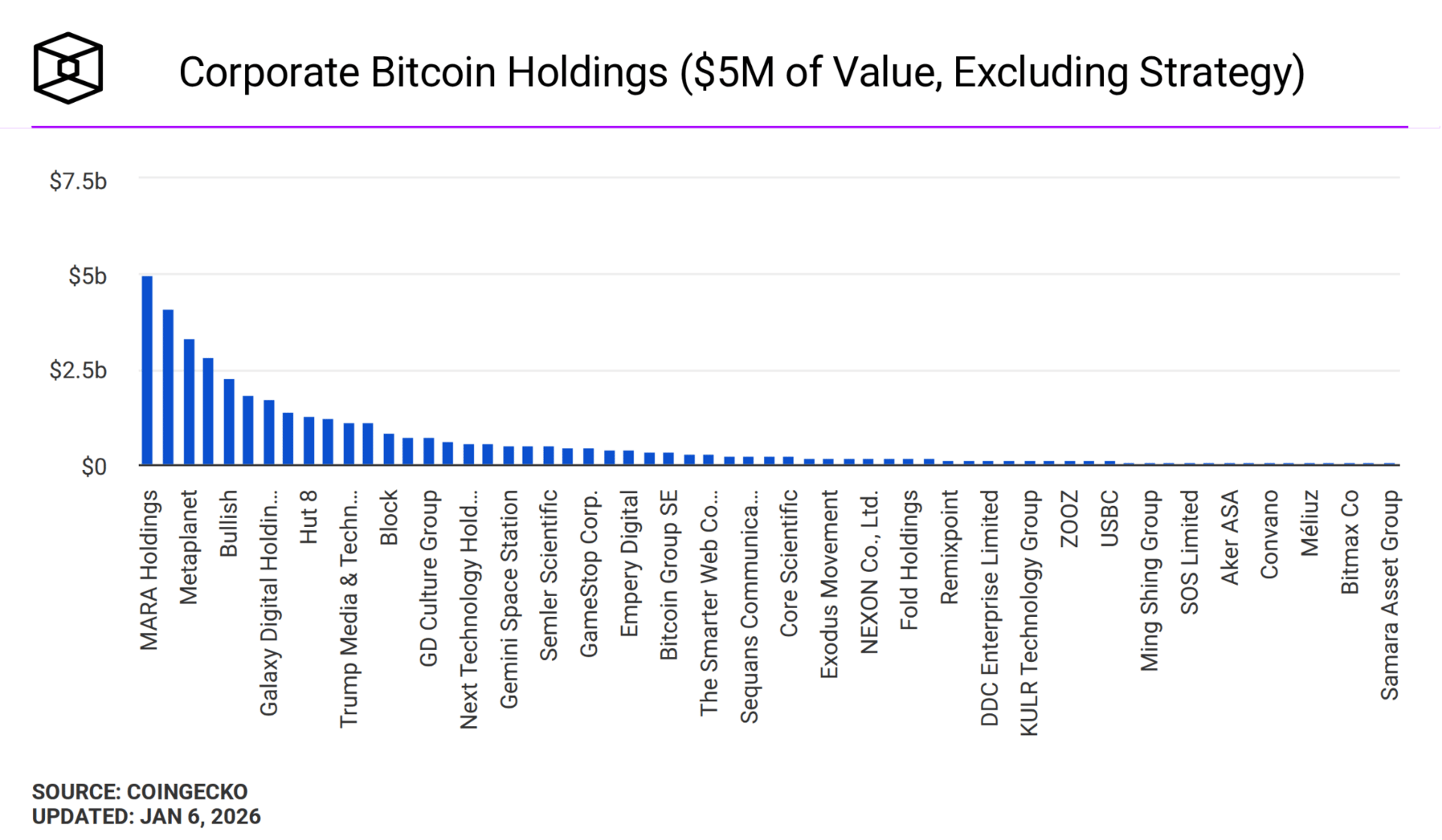

Adding fuel, Strategy, the world's largest corporate Bitcoin holder, kickstarted the year by buying 1,283 BTC for $116 million at an average of $90,000 each, boosting its total to 673,783 BTC valued at $62.6 billion. Despite a $17.4 billion unrealized loss in Q4 2025 from Bitcoin's 23% price dip, this move underscores long-term confidence.

From an investment perspective, this points to potential upside, $100,000 or higher, supported by regulatory tailwinds like expected U.S. crypto bills. However, the fragile liquidity of low spot volumes warns of volatility risks.

Investors should monitor the Crypto Fear and Greed Index, now in the low 40s, as a sentiment gauge; neutral phases can precede rallies, but demand caution against pre-breakout liquidity traps.

2. Ethereum's Staking Validator Queue Clears, Signaling Reduced Pressure

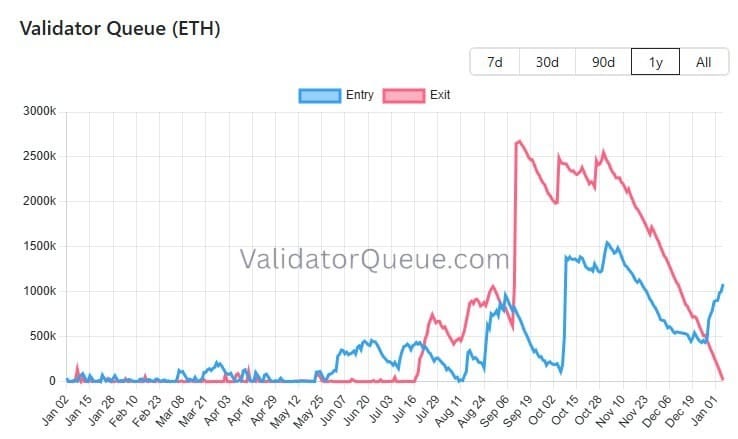

Ethereum, the second-largest cryptocurrency by market cap and a platform for smart contracts (self-executing code on the blockchain), is showing signs of network strength as its validator exit queue has cleared to near zero for the first time since July.

Staking involves locking up ETH to validate transactions and secure the network in exchange for rewards, with validators being the participating nodes.

The exit queue dropped 99.9% from a mid-September peak of 2.67 million ETH, now at just 32 ETH with a one-minute wait time. Meanwhile, the entry queue hit 1.3 million ETH, its highest since mid-November, indicating rising demand to stake.

This shift reduces unstaking pressure, as fewer validators exit, minimizing potential sell-offs from unlocked ETH. Major player BitMine staked 659,219 ETH worth $2.1 billion, holding over 4.1 million ETH (3.4% of supply, valued at $13 billion).

ETH exchange reserves are at ten-year lows, further curbing selling. Price-wise, ETH surged to $3,226, up 9% since January 1, aligning with Bitcoin's rally. Grayscale began distributing staking rewards ($0.083178 per share) to its Ethereum ETF investors for Q4 2025.

For investors, this suggests lower downside risk from supply floods, with bullish technicals like RSI above 60 pointing to momentum. However, pre-breakout risks loom, such as liquidity sweeps dropping ETH to $2,700-$2,800 before uptrends.

Ethereum's "trilemma" solution, balancing decentralization, security, and scalability via upgrades like PeerDAS, highlights its evolution into a high-bandwidth network.

With spot ETH ETFs seeing $168.13 million inflows, including BlackRock's $100.2 million ETH buy, this reinforces institutional adoption. Watch for regulatory reforms to amplify yields from staking in ETFs.

3. U.S. Crypto Stocks Rally, Spotlight on Coinbase Upgrade

U.S.-listed crypto stocks are experiencing a double-digit surge, mirroring the broader market rally where total crypto capitalization rose 2% to $3.3 trillion in 24 hours.

Mining firms like American Bitcoin (up 14%), Hut 8, IREN, and Cipher Mining (each up ~12%) led gains, alongside exchanges such as Coinbase (up 8%).

Coinbase's rally followed Goldman Sachs's upgrading its stock from "neutral" to "buy," with a $303 price target implying 18-34% upside.

The upgrade cites Coinbase's diversification into non-trading revenue (now ~40%, from custody and staking) and growth in infrastructure like its Ethereum layer-2 Base network (a scaling solution for faster, cheaper transactions).

Bitcoin treasury companies also gained: Strategy up 4.81%, Metaplanet shares soaring 10.7% in Japan (U.S. shares up 19.17%), holding 35,102 BTC worth $3.29 billion.

Investment-wise, this signals optimism from regulatory drivers, with Goldman noting 71% of institutions planning crypto allocation increases amid potential U.S. bills clarifying SEC/CFTC roles. Risks include competition raising costs and flat margins in 2026.

It is important to observe how crypto stocks act as proxies for direct exposure, amplified by ETF inflows. This underscores crypto's integration into traditional finance, with stablecoins reaching a $300 billion market cap as liquidity bridges.

4. Prediction Markets Expand to Real Estate Amid Sui Surge and Ledger Leak Caution

Prediction markets, platforms where users trade contracts betting on real-world outcomes, settling based on events, are innovating with Polymarket's partnership with Parcl to enable speculation on U.S. housing prices.

Using Parcl's daily indices from public records, markets allow bets on whether city home prices rise/fall over periods or hit thresholds, starting with high-liquidity U.S. metros. This bridges crypto with real estate, offering hedging and price discovery tools.

Meanwhile, Sui, a layer-1 blockchain (base network for apps, rivaling Ethereum/Solana), surged 38% to $1.99 in January, with 14.2% daily gains and $1.7 billion trading volume.

Post-Mysticeti v2 upgrade, it handles 866 transactions per second, absorbing 43.69 million unlocked tokens ($65.10 million) without price dips.

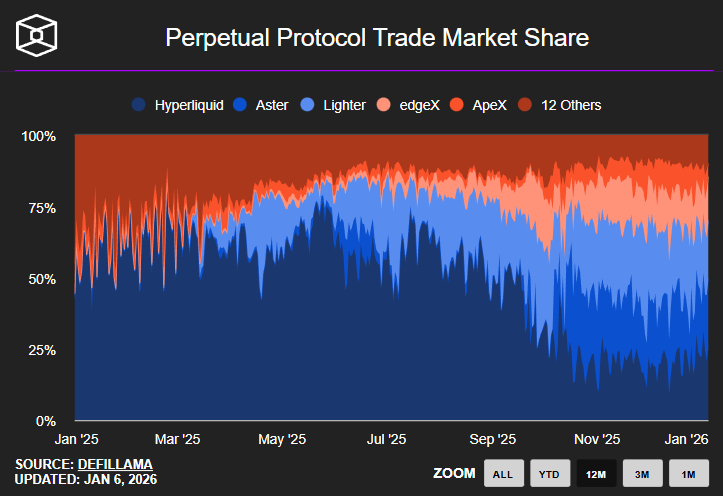

Bullish sentiments extend to projects like Lighter, an Ethereum DEX (decentralized exchange), whose LIT token rose 14% to $3.04 amid buybacks using revenues.

A safety note: Ledger, a hardware crypto wallet (device for secure storage of private keys), suffered a data leak via partner Global-e, exposing names and contacts but not keys or payments. Community alerts highlight phishing risks, urging fake info for purchases.

For investors, Polymarket offers novel exposure to real estate trends, while Sui's rally signals altcoin opportunities, but volatility persists. Lighter's buybacks exemplify value accrual in DeFi (decentralized finance).

Meme Corner

Closing Note

2026's early days paint a picture of optimism in crypto, from Bitcoin's accumulations and Ethereum's stability to stock rallies and innovative markets, tempered by liquidity and security cautions.

As a research analyst, I see regulatory clarity as the linchpin for sustained growth.

Share this newsletter with your network to spread informed insights, or reach out for tailored advice on navigating these opportunities.

Stay vigilant and invest wisely.

Thank you for reading, and I will see you all tomorrow.