Hey there,

Welcome to the 18th edition of the Fiat Bridge.

A newsletter focused on bridging the gap between traditional finance and the world of digital assets, while explaining key concepts for those new to this space.

Like in each edition, today we are covering the top 10 stories shaping the market. Each includes a brief overview, an explanation of crypto-native terms, and potential market impact.

Let's dive in.

Market Pulse

Total Crypto Market Cap: ~$3.3 Trillion (up 3.1% in the last 24h)

Bitcoin Dominance: ~56.9% (BTC market share against the rest of the market)

Bitcoin Price: ~$94,743 (up 3.1% in the last 24h)

Ethereum Price: ~$3,326 (up 6.3% in the last 24h)

Solana Price: ~$144 (up 2.8% in the last 24h)

Total Stablecoin Supply: ~$308 Billion

DeFi TVL: ~$129 Billion (up 4.7% in the last 24h)

24h Trading Volume: ~$173 Billion

Fear & Greed Index: 52 (neutral)

Today’s edition of Fiat Bridge is brought to you by beehiiv.

A big 2026 starts now

Most people treat this stretch of the year as dead time. But builders like you know it’s actually prime time. And with beehiiv powering your content, world domination is truly in sight.

On beehiiv, you can launch your website in minutes with the AI Web Builder, publish a professional newsletter with ease, and even tap into huge earnings with the beehiiv Ad Network. It’s everything you need to create, grow, and monetize in one place.

In fact, we’re so hyped about what you’ll create, we’re giving you 30% off your first three months with code BIG30. So forget about taking a break. It’s time for a break-through.

Now, let’s get to the top stories of the day.

Top Stories of the Day

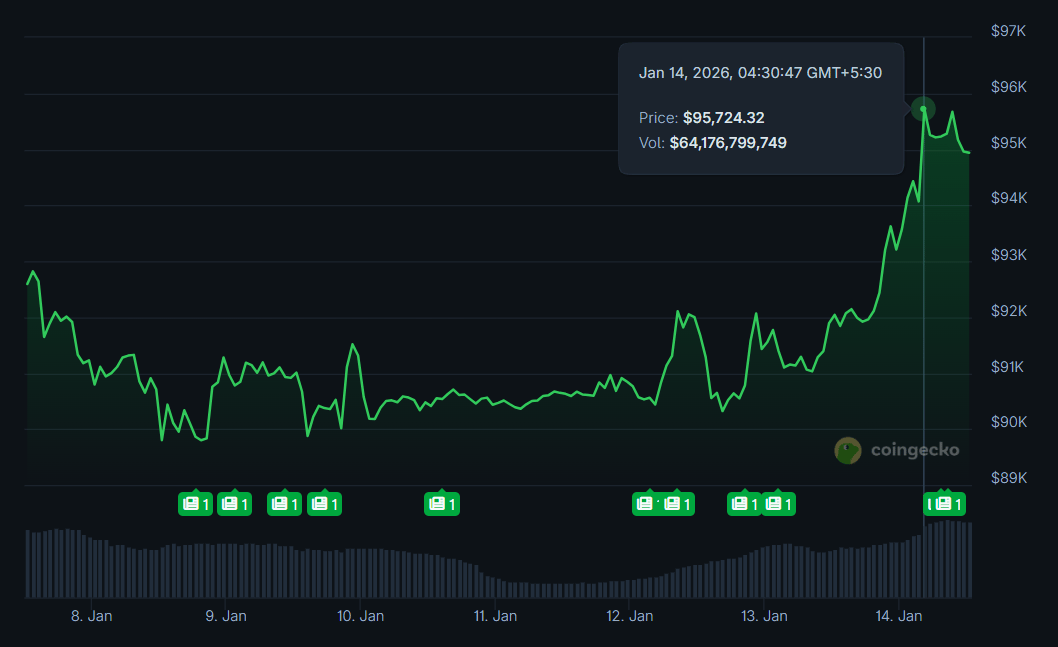

1. Bitcoin Surges Above $95,000 on Geopolitical Tensions and Stable Inflation

Bitcoin, the leading digital asset often viewed as a store of value like digital gold, climbed past $95,000, its highest in over 50 days, driven by fears of U.S.-Iran conflict and U.S. inflation data holding steady at 2.7% for December 2025.

The U.S. warned citizens to leave Iran amid protests, boosting Bitcoin's appeal as a hedge against uncertainty, much like gold during crises. Combined with lower-than-expected core inflation, this eased worries about interest rate hikes by the Federal Reserve, encouraging investment in riskier assets.

Bitcoin rose about 5% in a day, with the total crypto market cap reaching $3.34 trillion. This could signal renewed confidence, potentially pushing prices toward $100,000 if tensions persist, but volatility remains high due to fragile sentiment.

2. Senate Pushes Forward Crypto Regulation Bill with Stablecoin Limits

The U.S. Senate is advancing the Digital Asset Market Clarity Act (CLARITY Act), a proposed law to clarify rules for digital assets, dividing oversight between regulators like the SEC (for securities) and CFTC (for commodities).

The 278-page draft, released January 12, restricts "yields" or rewards on stablecoins, digital currencies pegged to stable assets like the U.S. dollar for steady value, banning passive earnings on idle holdings but allowing them for active uses like transactions. This compromise addresses banks' concerns about losing deposits while protecting crypto innovation.

A committee vote is set for January 16, with another in late January. If passed, it could reduce uncertainty, attracting more institutional money and stabilizing the market, though critics say it favors big firms and adds costs for smaller players.

3. Crypto Scams Hit Record $4 Billion in Losses During 2025

Scams in the digital asset space reached an all-time high of $4.04 billion in stolen funds last year, up 34% from 2024, according to security firm PeckShield. Key drivers included advanced hacks on centralized platforms and social engineering tricks like phishing, where fraudsters trick people into revealing private info.

AI amplified impersonation scams, which surged 1,400%, with average thefts up 600%.

A notable case: scammers posing as Coinbase stole $16 million. While incidents dropped, losses per event rose, with only $335 million recovered. This underscores the need for caution, always verify sources, and avoid sharing keys.

Rising fraud could erode trust, slowing adoption, but it may spur better security tools and regulations to protect users.

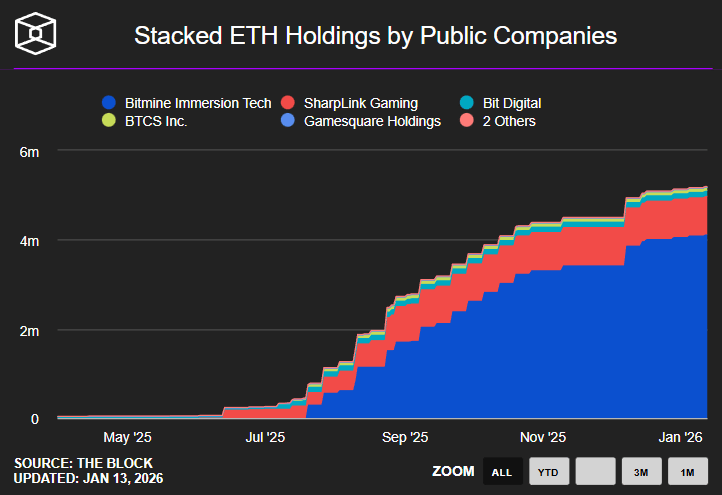

4. BitMine Boosts Ethereum Holdings with Massive Stake Increase

BitMine Immersion Technologies, a company treating digital assets as treasury reserves like corporate cash, added 186,560 Ether (ETH), Ethereum's native token, used for transactions on its blockchain, to its staked holdings, reaching 1.53 million ETH worth $5.13 billion.

Staking involves locking assets to secure the network and earn rewards, similar to earning interest on savings. This represents 4% of all staked ETH globally.

A shareholder vote on January 15 could expand shares for more acquisitions. Ethereum's staking queue hit 2.3 million ETH, signaling high demand. This institutional move could enhance network security and signal growing confidence, potentially supporting ETH prices (up 7% to $3,375) amid broader recovery.

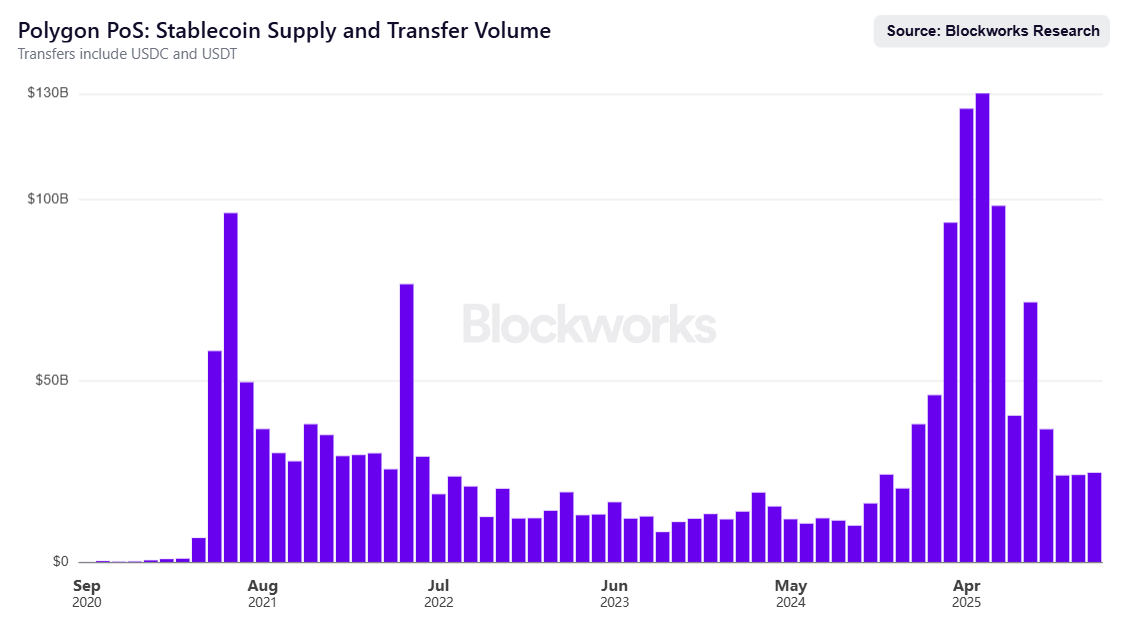

5. Polygon Labs Acquires Firms for $250 Million to Advance Payments

Polygon Labs, developers of a blockchain network for faster, cheaper transactions, bought Coinme (a U.S. crypto exchange with licenses in 48 states) and Sequence (a wallet tech provider) for over $250 million.

This creates the "Open Money Stack," a system for seamless stablecoin payments across blockchains, simplifying global transfers without bridges or swaps. Wallets are digital storage for assets, like online bank accounts.

The move targets enterprises and fintechs, enabling instant, regulated money movement. It positions Polygon in the growing stablecoin market, potentially boosting adoption in everyday payments and reducing costs, though regulatory approvals are pending.

6. Binance Founder's Firm Invests in Privacy-Focused Trading Platform

YZi Labs, run by Binance co-founders including Changpeng Zhao (CZ), invested an eight-figure sum (over $10 million) in Genius Trading, a decentralized platform for trading across blockchains without centralized control.

CZ joins as an advisor. Genius handles spot buys, futures (bets on future prices), and copy trading, with $160 million in volume pre-launch.

It emphasizes privacy by splitting trades to avoid tracking. This could attract privacy-conscious traders, signaling a shift to onchain (blockchain-based) tools, potentially increasing competition and innovation in trading amid regulatory scrutiny.

7. Ethereum Wallet Growth Hits Record High Amid Upgrades

Ethereum, a blockchain for smart contracts (self-executing agreements), saw a record 393,000 new wallets created in a single day, averaging 327,000 weekly.

Wallets are apps or devices for holding and transacting digital assets. This surge follows the Fusaka upgrade in December, which cut costs and improved efficiency for apps and secondary networks (Layer 2s).

Stablecoin transfers, digital dollars for payments, also spiked, drawing new users. Over 172.9 million non-empty wallets exist, with the ETH price up 7.5% to $3,330. This indicates rising adoption in finance and apps, potentially driving more innovation and value if sustained.

8. Corporate Bitcoin Buying Outpaces New Supply Threefold

Companies are adding Bitcoin to their treasuries at a rate three times faster than new coins are mined (created via energy-intensive computing).

Over six months, corporates netted 260,000 BTC ($25 billion), led by MicroStrategy with 687,410 BTC. Mining produces about 450 BTC daily.

This demand-supply gap, plus $22 billion in U.S. Bitcoin ETF inflows last year, could push prices higher as supply tightens. ETFs are investment funds tracking Bitcoin's price. If trends continue, it may lead to scarcity-driven gains, benefiting long-term holders.

9. Prediction Markets Reach Record $702 Million in Trading Volume

Prediction markets, platforms where people bet on real-world events like elections using digital assets, hit a daily record of $701.7 million in trades. Kalshi led with $466 million.

These markets use blockchain for transparent, tamper-proof betting. Growth since 2024 includes integrations with major exchanges. Despite U.S. regulatory pushes to limit them, volumes rose, signaling popularity. This could expand crypto's real-world use, but tighter rules might curb growth and innovation.

10. Franklin Templeton Updates Funds for Blockchain Integration

Asset manager Franklin Templeton modified two money market funds, short-term investment pools like safe savings accounts, to support blockchain use.

One holds only short U.S. Treasuries to back stablecoins under 2025's GENIUS Act; the other adds onchain shares for 24/7 transfers.

This bridges traditional finance with digital assets without changing core rules. It could enable faster settlements and attract institutions to tokenized assets (digital versions of real-world items), fostering hybrid finance growth.

Meme Corner

Closing Note

Today’s newsletter shows a strong crypto market.

Bitcoin is climbing on global uncertainty and steady inflation, big companies are buying more digital assets, Ethereum is seeing record new users, and steps forward in U.S. rules and payments technology.

Scams are still a real risk, but overall signs point to growing trust and wider use.

The digital asset world is moving from experimental to mainstream, faster than many expect.

Stay informed and stay careful out there.

If this helped, please share it with someone new to crypto.

See you tomorrow with the next update.