Dear Readers,

Welcome to the 14th edition of the Fiat Bridge Newsletter.

As Bitcoin slips below the $90,000 mark amid fresh market jitters, it's a stark reminder of the highs and lows that define investing in cryptocurrencies. This volatility isn't just noise; it's often tied to broader economic signals, like expectations of Federal Reserve rate cuts, which can sway risk assets like crypto.

Drawing from my background in traditional finance and crypto venture funds, I've seen how these swings create opportunities for informed investors.

In today's edition, we cover: U.S. advancements in stablecoins, governance and regulatory hurdles globally, recent market movements, and exciting investments plus partnerships shaping the ecosystem.

Let’s dive in.

Market Pulse

Total Crypto Market Cap: ~$3.1 Trillion (down 2.7% in the last 24h)

Bitcoin Dominance: ~56.9% (BTC market share against the rest of the market)

Bitcoin Price: ~$89,710 (down 2% in the last 24h)

Ethereum Price: ~$3,097 (down 3.1% in the last 24h)

Solana Price: ~$134 (down 1.8% in the last 24h)

Total Stablecoin Supply: ~$307 Billion

DeFi TVL: ~$123 Billion (down 3.5% in the last 24h)

24h Trading Volume: ~$120 Billion

Fear & Greed Index: 43 (neutral)

Top Stories of the Day

U.S. Pushes Forward with Stablecoin Innovations

Governance Shakeups and Regulatory Warnings in Crypto

Market Dips and Upgrades Signal Caution Ahead

Fresh Funding and Partnerships Strengthen Crypto Infrastructure

1. U.S. Pushes Forward with Stablecoin Innovations

This week, Wyoming, a state in the U.S., made history by launching FRNT, the first stablecoin issued by a U.S. public entity. Backed fully by U.S. dollars and short-term Treasurys, FRNT operates on the Solana blockchain, a high-speed network known for quick, low-cost transactions.

Users can buy it on exchanges like Kraken, and it promises fees as low as $0.01 for peer-to-peer transfers, available 24/7. The state aims to use interest from reserves to fund schools and cut taxpayer costs, potentially saving counties thousands in processing fees.

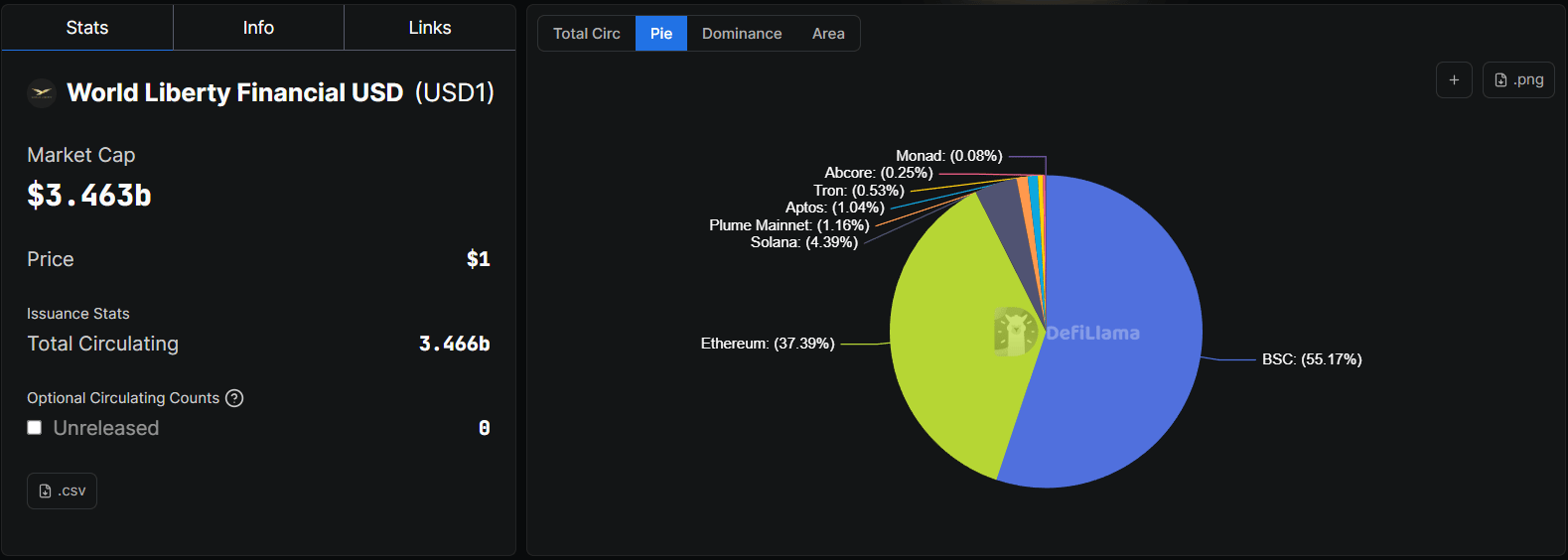

Meanwhile, World Liberty Financial (WLFI), a crypto platform linked to President Trump and his family, applied for a federal bank charter through its subsidiary. If approved by the Office of the Comptroller of the Currency, it would allow in-house issuance of the USD1 stablecoin, enabling fee-free minting and conversions.

This move seeks to bring stablecoin operations fully under U.S. oversight, targeting institutions for payments and treasury needs. Under the Trump administration, regulators have greenlit similar charters for firms like Circle and Ripple, signaling a friendlier environment for crypto banking.

For non-crypto natives, this could mean more secure, regulated entry points into digital assets, reducing reliance on offshore providers and boosting adoption. However, ties to political figures raise questions about potential conflicts, though the firm insists on independent operations.

These developments highlight how state and federal governments are integrating crypto into traditional finance, potentially stabilizing the market for investors.

2. Governance Shakeups and Regulatory Warnings in Crypto

Privacy coins like Zcash, which use advanced tech to shield transaction details for user anonymity, are facing internal turmoil. The entire development team behind Electric Coin Company (ECC), Zcash's key builder, resigned this week after clashing with its nonprofit board, Bootstrap.

The dispute centered on governance misalignments, including changes to employment terms that the team called "constructive discharge." Led by former CEO Josh Swihart, they're forming a new firm to continue advancing "unstoppable private money."

Importantly, Zcash's open-source protocol remains intact and operational, run by a decentralized network of users and miners, not controlled by any single entity. This split underscores the challenges in decentralized projects, where community governance can lead to fractures but also resilience.

On the regulatory front, India's tax authorities are sounding alarms about crypto's risks amid ongoing uncertainty. Offshore exchanges and decentralized finance (DeFi) tools, platforms allowing peer-to-peer lending and trading without banks, make tracking income tough due to anonymous, borderless transfers.

A flat 30% tax on profits and 1% tax deducted at source on transfers apply, with no offsets for losses. Despite allowing trading and welcoming exchanges like Coinbase back in 2025, the government remains cautious, complicating enforcement across jurisdictions.

For investors exploring globally, this highlights the need for compliance tools and awareness of varying rules. Together, these stories show how internal disputes and external regulations can impact asset stability, urging newcomers to prioritize projects with strong, transparent leadership.

3. Market Dips and Upgrades Signal Caution Ahead

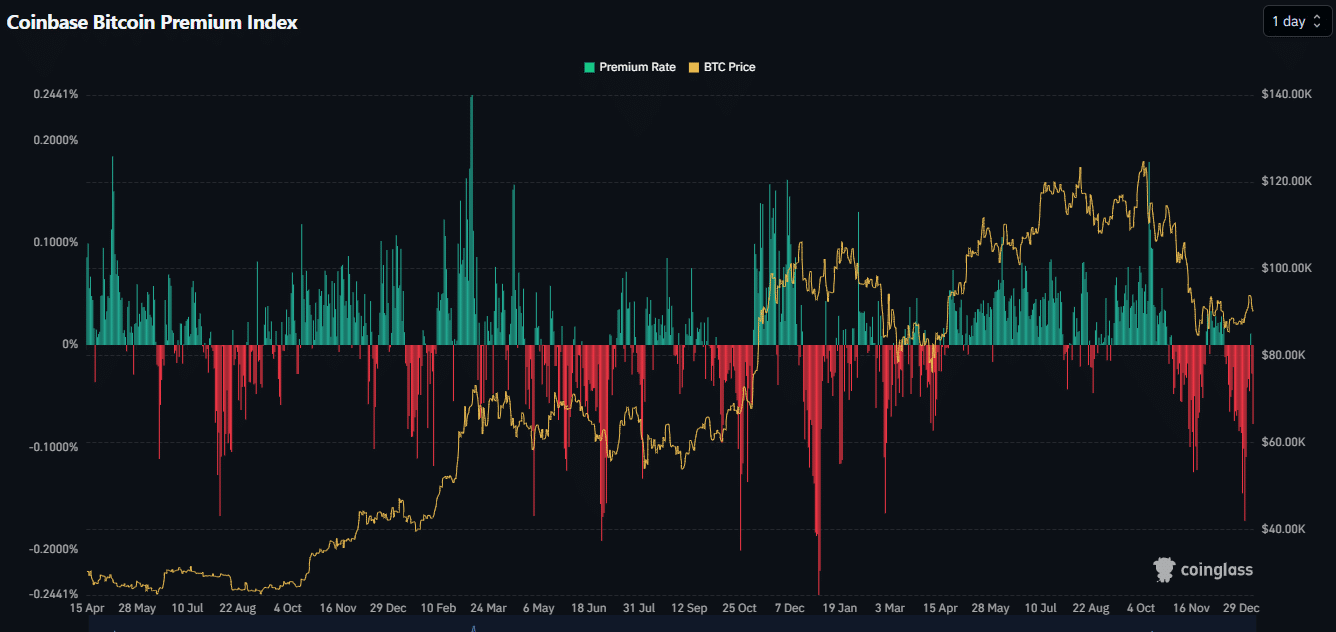

Bitcoin, the original cryptocurrency often seen as digital gold, dipped below $90,000 on January 8, easing from an early-year rebound. This 2% daily drop, despite a 3% weekly gain, came amid U.S. Bitcoin ETFs seeing $486 million in outflows, the second straight day of losses in 2026.

Factors include thinning liquidity post-holidays and macro shifts, like bond rallies signaling bets on Fed rate cuts amid weak job data. On-chain metrics, such as a negative Coinbase Premium Index, point to softer demand, fueling "fear" sentiment and liquidations.

This isn't panic-selling but a reminder: Bitcoin's price ties to broader markets, so dips can signal caution rather than buying opportunities without deeper analysis.

Ethereum, the second-largest crypto enabling smart contracts, bumped its "blob" capacity in preparation for the Fusaka upgrade. Blobs are data packets used by layer-2 networks, scaling solutions that handle transactions off the main chain for speed and lower fees.

The tweak raised the target from 10 to 14 blobs per block, with a max of 21, to ease congestion as activity grows on rollups like Arbitrum and Optimism.

This gradual scaling aims to stabilize fees and boost throughput without big overhauls, preserving decentralization. Ether fell 3% daily but held 6% weekly gains.

Overall, these moves reflect crypto's maturation: volatility persists, but upgrades like this could enhance usability for investors seeking efficient networks.

4. Fresh Funding and Partnerships Strengthen Crypto Infrastructure

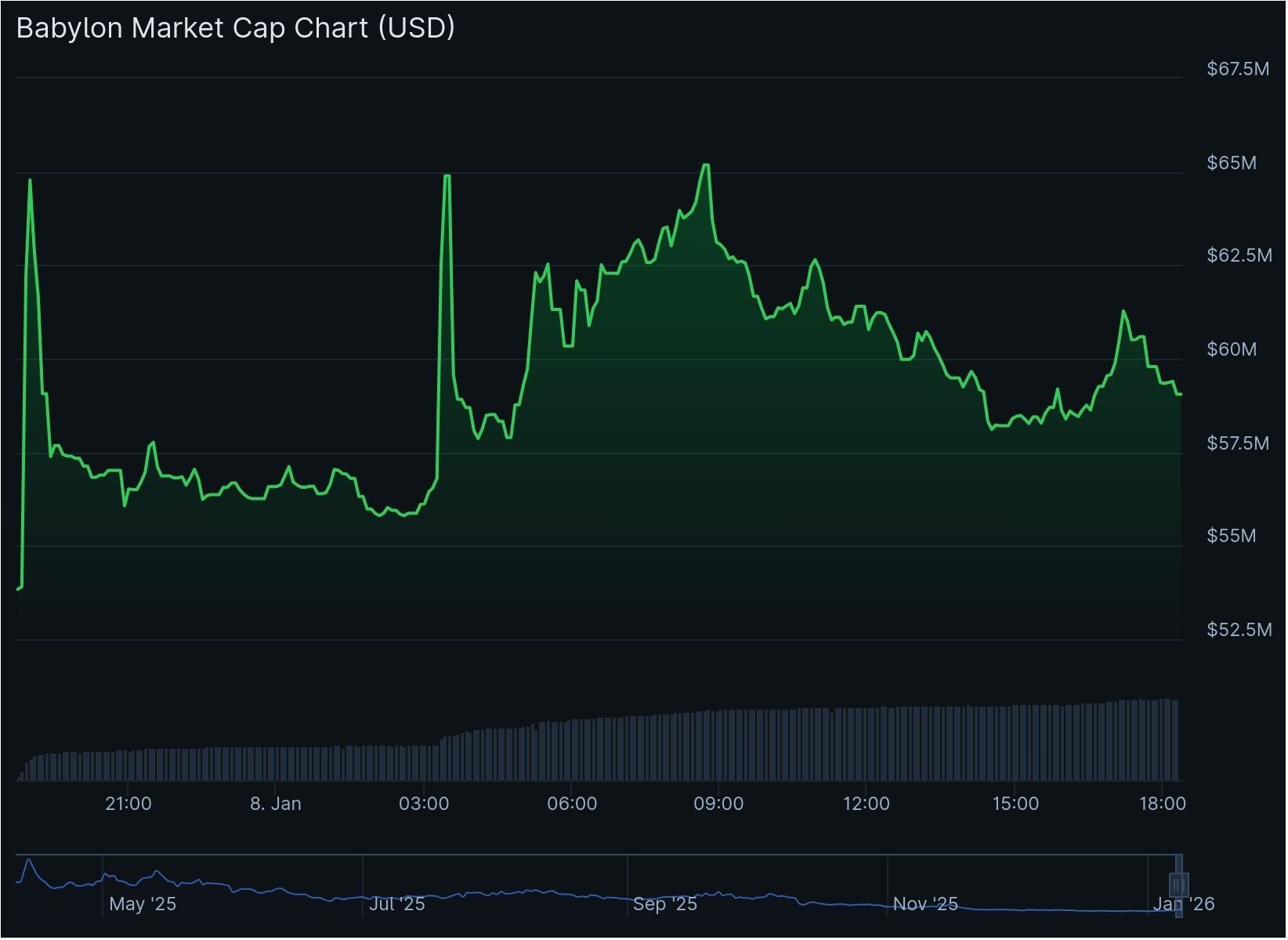

Babylon (BABY), a protocol unlocking Bitcoin for staking, locking assets to earn rewards, and securing networks, raised $15 million from a16z Crypto. Founded in 2022, it lets Bitcoin serve as trustless collateral for onchain lending without wrappers or custodians, keeping it on its native network.

A partnership with Aave, a major DeFi lender, will integrate this into Aave V4 by April 2026, potentially turning idle Bitcoin into productive capital and reducing past risks like over-leveraging.

In acquisitions, Fireblocks, a custody and settlement firm for institutions, bought crypto accounting platform Tres for $130 million. Tres provides audit-ready tax compliance, helping firms track blockchain finances. This bolsters Fireblocks' stack for stablecoin settlements and treasury, aiding compliance in a regulated era.

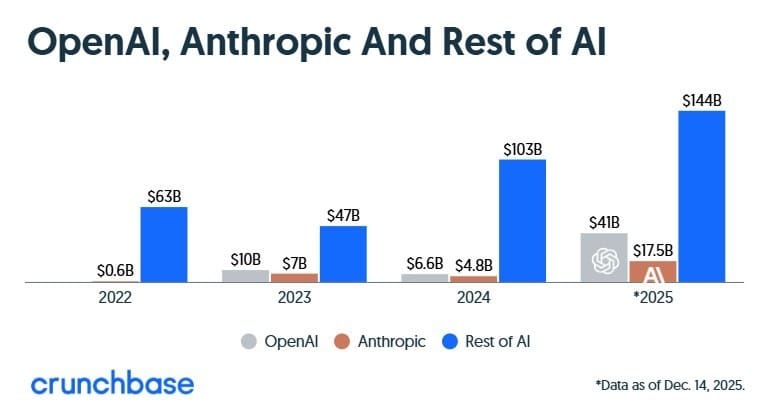

AI giant Anthropic, maker of Claude chatbot, is raising $10 billion at a $350 billion valuation, led by GIC and Coatue, doubling its prior worth amid 2025's AI boom. While not directly crypto, such funding could spur AI-crypto intersections, like smarter trading tools.

Partnerships shine too: Polymarket, a prediction market platform where users bet on real-world outcomes via crypto, teamed with Dow Jones to feed data into outlets like The Wall Street Journal, blending market sentiment with news.

Tether and video platform Rumble launched a non-custodial wallet, users control their keys, for tipping creators in stablecoins or Bitcoin, with fiat ramps via MoonPay. These build user-friendly tools, making crypto more accessible for everyday investing.

Meme Corner

Closing Note

From U.S. stablecoin strides to market tweaks and fresh capital inflows, today's stories illustrate crypto's evolution toward mainstream integration, tempered by regulatory and governance realities.

As a research analyst with roots in both tradfi and crypto, I see these as steps toward a more robust asset class. Stay vigilant on volatility and compliance.

If this adds to your understanding of fiat and crypto, subscribe for daily insights delivered to your inbox. Share with fellow explorers to grow our community.

Thank you for reading, and I will see you tomorrow.