Dear Readers,

Welcome to the 13th edition of the Fiat Bridge Newsletter.

Bitcoin, often dubbed "digital gold," holds steady above $90,000 amid fresh institutional inflows, while precious metals like gold and silver reclaim their dominance in global asset rankings.

This edition covers four key stories: the surge in precious metals and its echoes in crypto; the robust start for Bitcoin ETFs; advancements in U.S. crypto regulation; and major institutional moves in ETFs, indexes, and stablecoins.

Whether you're eyeing portfolio diversification or seeking deeper market insights, these developments highlight opportunities and risks in bridging fiat (traditional government-issued currency) and digital assets.

Let’s dive in.

Market Pulse

Total Crypto Market Cap: ~$3.2 Trillion (down 0.3% in the last 24h)

Bitcoin Dominance: ~56.7% (BTC market share against the rest of the market)

Bitcoin Price: ~$92,636 (down 1% in the last 24h)

Ethereum Price: ~$3,253 (up 0.6% in the last 24h)

Solana Price: ~$138 (up 0.1% in the last 24h)

Total Stablecoin Supply: ~$308 Billion (no change)

DeFi TVL: ~$127 Billion (up 0.08% in the last 24h)

24h Trading Volume: ~$147 Billion

Fear & Greed Index: 49 (neutral)

Top Stories of the Day

Precious Metals Gold and Silver Reclaim Top Spots

Bitcoin ETFs Inflows Signal Renewed Institutional Demand

Clarity Act Markup and Senate Crypto Bill Progress

MSCI's Reprieve, Morgan Stanley ETFs, New Indexes, and Stablecoin Launch

1. Precious Metals Gold and Silver Reclaim Top Spots

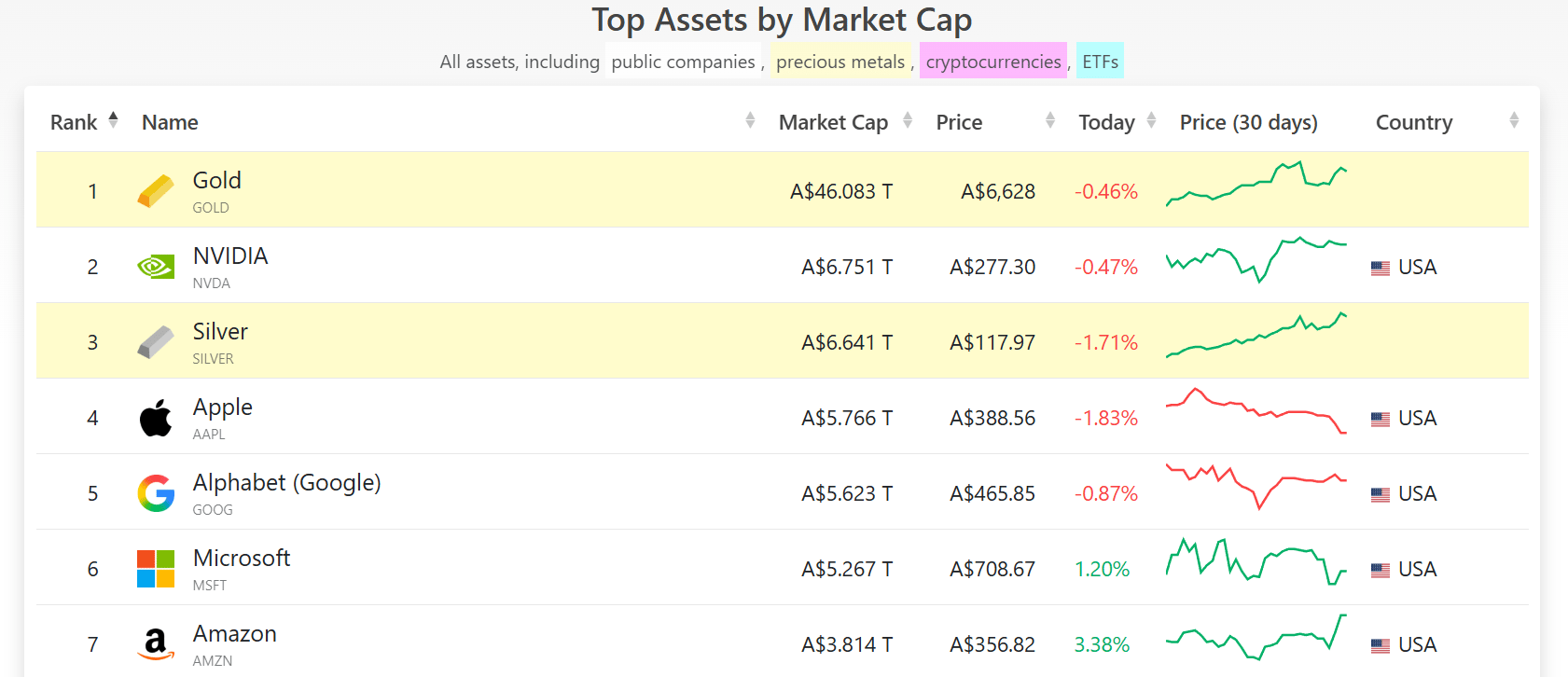

Gold and silver have solidified their positions as premier stores of value, with gold boasting a staggering $31.1 trillion market capitalization, far outpacing all other assets.

Silver briefly overtook NVIDIA to claim the second spot, with both assets hovering around $4.55 trillion in market cap, before NVIDIA edged back ahead.

Gold recently hit an all-time high of around $4,500 per ounce, while silver reached $80, up 12% year-to-date in 2026, driven by industrial demand in sectors like electronics, solar energy, AI, and electric vehicles, which consume about half of global silver supply.

This rally stems from a fifth consecutive annual supply deficit, demand at 1.2 billion ounces versus supply of 1 billion ounces, amid global uncertainties, trade disputes, and anticipated U.S. Federal Reserve rate cuts.

For investors, this flight to safety in precious metals represents a broader risk-off sentiment, potentially catalyzed by lower interest rates boosting commodities. Yet, there are intriguing parallels with Bitcoin, which ranks eighth globally by market cap at around $1.9 trillion.

As momentum builds in metals, it could rotate into crypto if rates fall further, viewing Bitcoin as a digital alternative to gold.

Diversify across traditional and digital stores of value to hedge against volatility; monitor Bitcoin's price, currently at $92,665, for signs of capital inflow from metals.

Investment takeaway: With silver potentially hitting $100 per ounce, consider balanced allocations, but watch for demand destruction at higher prices in industrial uses.

2. Bitcoin ETFs Inflows Signal Renewed Institutional Demand

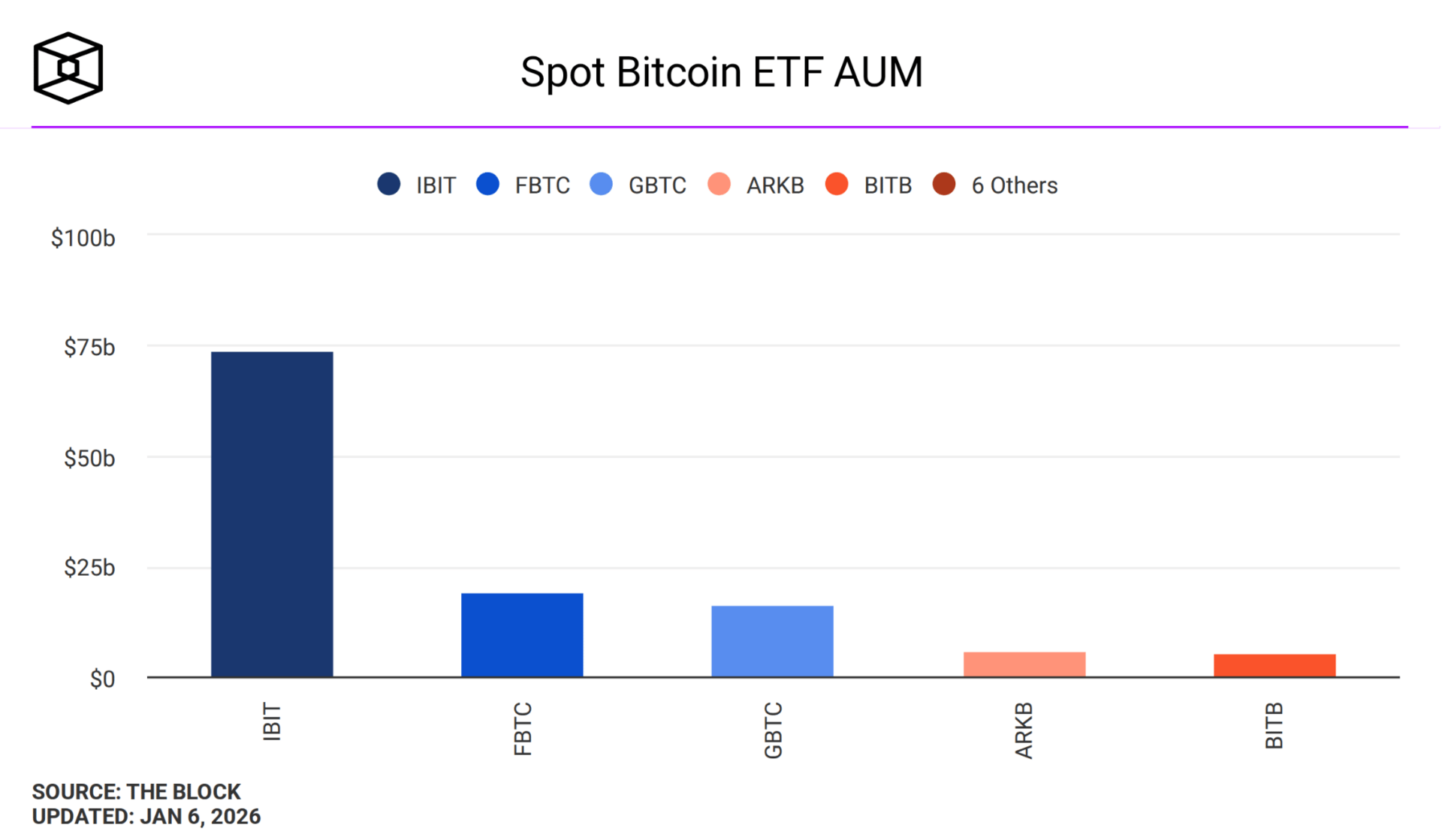

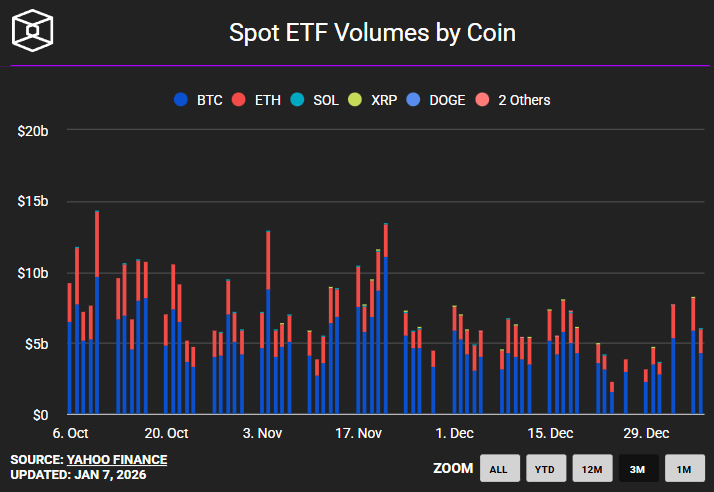

U.S. spot Bitcoin ETFs, exchange-traded funds that track Bitcoin's price and allow investors to gain exposure without directly holding the cryptocurrency, kicked off 2026 with over $1.2 billion in net inflows during the first two trading days, a pace that could extrapolate to $150 billion annually if sustained.

BlackRock's iShares Bitcoin Trust (IBIT) led with $888 million in early 2026 inflows, capturing the bulk of demand, while Monday alone saw $697 million net inflows, the largest in three months.

However, flows turned negative on January 7 with $243 million in outflows, driven by exits from Fidelity's FBTC ($312 million) and Grayscale's GBTC ($83 million), offset partially by IBIT's $228 million inflow.

ETFs democratize crypto access, reducing barriers like wallet management, but track spot prices without owning underlying assets.

Investment insight: With Bitcoin up 6% in January, monitor inflows as a barometer for price support; sidelined capital indicates high buying power, potentially offsetting December losses. Consider allocating to ETFs for regulated exposure, but brace for volatility from rebalancing.

3. Clarity Act Markup and Senate Crypto Bill Progress

The Digital Asset Market Clarity Act (Clarity Act), a bipartisan bill aiming to provide a structured regulatory framework for cryptocurrencies by clarifying jurisdictions between agencies like the SEC (Securities and Exchange Commission) and CFTC (Commodity Futures Trading Commission), is set for a Senate Banking Committee markup and vote on January 15, 2026.

Already passed by the House in July 2025, the bill introduces terms like "ancillary assets" for non-security cryptos and addresses illicit finance, stablecoins (digital currencies pegged to assets like the USD for stability), and developer protections.

Key disputes linger on DeFi (Decentralized Finance, peer-to-peer financial services on blockchain without intermediaries), ethics concerns tied to officials' crypto ties (e.g., President Trump's ventures), and the Treasury's role in policing.

Clear rules could reduce volatility by defining cryptos as commodities or securities, fostering innovation. Passage might boost market confidence, democratizing access and spurring growth; monitor the vote for sentiment shifts, as delays could prolong outflows and price pressure. Position for long-term holds if clarity emerges, but hedge against political risks.

4. MSCI's Reprieve, Morgan Stanley ETFs, New Indexes, and Stablecoin Launch

MSCI, a major index provider, opted to retain digital asset treasury companies (DATs), firms holding significant crypto like Bitcoin on balance sheets, in its global indexes, citing the need for further consultation on distinguishing investment from operating entities.

This paused exclusion for firms like MicroStrategy, sparking a 5-6% stock rally. Analysts caution it's temporary, with no increases in index weights, potentially limiting inflows.

Morgan Stanley filed for spot Bitcoin and Solana ETFs, but not Ethereum, signaling deeper institutional commitment amid client demand from its 19 million users. The Solana fund includes staking (earning rewards by validating network transactions). Bank of America recommends up to 4% portfolio allocations to digital assets.

MarketVector launched indexes for stablecoins and RWA tokenization, with Amplify ETFs tracking them for regulated exposure. Jupiter debuted JupUSD, a Solana-based stablecoin backed by BlackRock's BUIDL fund and USDC, enabling efficient onchain settlements.

These tools expand access to crypto infrastructure without direct holdings, with RWAs bridging traditional finance. MSCI's decision sustains liquidity for DAT stocks; ETF filings could attract billions, boosting prices, and watch approvals for entry points.

Meme Corner

Closing Note

The year begins with momentum in both traditional and digital assets, from precious metals' stability to crypto's institutional embrace and regulatory strides.

These trends represent the maturing bridge between fiat and crypto, offering savvy investors tools for diversification amid uncertainty.

Share this newsletter with your network to spark informed discussions, or reach out (reply to this email) for tailored insights or collaboration ideas.

Thank you for reading, and I will see you all tomorrow.