Dear Readers,

Merry Christmas! I hope you're enjoying the break. The cryptocurrency market, however, rarely pauses, even on holidays.

Today, we'll review some of the year's standout performers, recent market movements, and key developments in major projects.

This newsletter is written for those new to crypto: we'll explain terms clearly and keep things straightforward. This edition covers the top stories making waves as 2025 draws to a close.

Let’s dive in.

Market Pulse

Total Crypto Market Cap: ~$3.03 Trillion (up 0.4% in the last 24 hours)

Bitcoin Dominance: ~57.06% (BTC market share against the rest of the market)

Bitcoin Price: ~$87,428 (up 0.6% in the last 24 hours)

Ethereum Price: ~$2,924 (no change in the last 24 hours)

Solana Price: ~$121 (no change in the last 24 hours)

Total Stablecoin Supply: ~$308 Billion (down 0.1% in the last 24 hours)

DeFi TVL: ~$118 Billion (up 0.27% in the last 24 hours)

24h Trading Volume: ~$69 Billion

Fear & Greed Index: 23 (extreme fear)

Top Stories of the Day

Crypto Winners of 2025: Who Got It Right This Year?

Holiday Outflows Hit Bitcoin and Ethereum ETFs

Aave Faces Internal Governance Drama Amid Price Drop

Hyperliquid Burns $912 Million in HYPE Tokens

Today’s edition of Fiat Bridge is brought to you by beehiiv.

Behold the power of beehiiv

This newsletter? It’s powered by the platform built for growth, monetization, and jaw-droppingly good reader experiences.

From sponsorships that actually pay you fairly to referral programs that grow your list on autopilot, beehiiv gives publishers, creators, and writers the tools to grow their newsletter like never before. And yeah, it is just that easy.

Now let’s get back to the top stories of the day.

1. Crypto Winners of 2025: Who Got It Right This Year?

2025 has been a transformative year for cryptocurrency, marked by regulatory clarity in the United States, technological advancements, and institutional adoption. Several projects, regions, and innovations stood out as clear winners.

The United States and the Trump Administration topped the list by delivering pro-crypto policies, including executive orders supporting digital assets, the GENIUS Act (providing a clear framework for stablecoins, digital currencies pegged to fiat like the US dollar), and establishing a Strategic Bitcoin Reserve.

Spot ETFs (Exchange-Traded Funds that directly hold assets like Bitcoin, Ethereum, and Solana) saw record inflows, with products for newer assets like Solana and XRP launching successfully.

Solana (SOL), a high-speed blockchain network, solidified its position as a leading platform for efficient trading and applications, often outpacing centralized exchanges in volume.

Privacy-focused coins like Zcash rallied strongly amid a regulatory thaw, while real-world asset tokenization (converting traditional assets like bonds into blockchain tokens) grew significantly.

Stablecoins reached a $310 billion market cap, and perpetual decentralized exchanges (platforms allowing leveraged trading without intermediaries, like Hyperliquid) hit record volumes.

Total Stablecoin Supply

Overall, 2025 rewarded innovation, regulatory progress, and user adoption, proving crypto's resilience and growing mainstream integration.

2. Holiday Outflows Hit Bitcoin and Ethereum ETFs

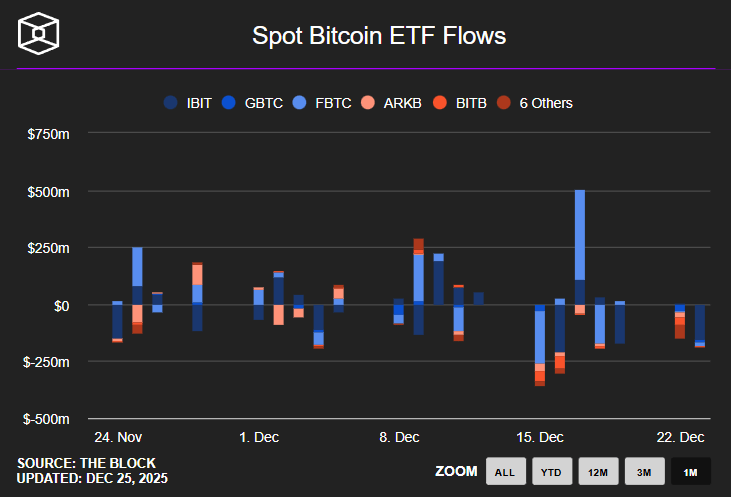

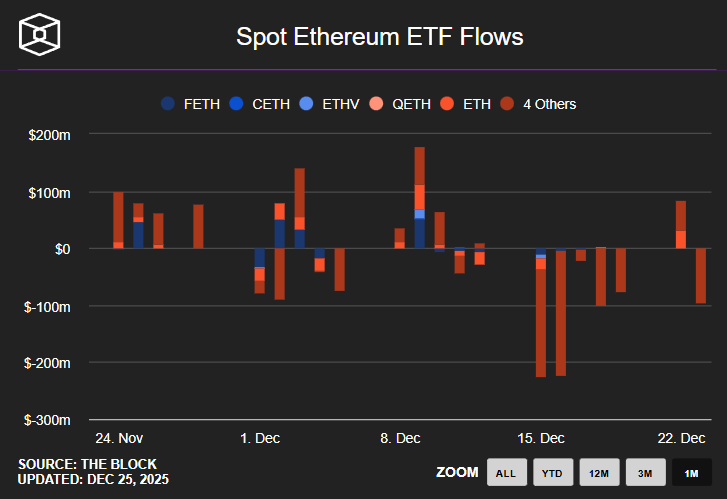

As markets wound down for Christmas, U.S. spot Bitcoin and Ethereum ETFs experienced notable outflows, meaning investors sold shares, leading to net money leaving these funds.

On December 24, Bitcoin ETFs saw approximately $188 million in outflows, led by BlackRock's IBIT fund. Ethereum ETFs recorded around $95 million in outflows, primarily from Grayscale's ETHE.

These movements reflect typical year-end behavior: thinner trading liquidity (fewer buyers and sellers active during holidays), profit-taking after a strong year, portfolio rebalancing, and tax-loss harvesting (selling losing positions to offset taxes).

Despite the short-term dip, with Bitcoin trading around $87,400 and Ethereum near $2,930, this doesn't signal a broader bearish trend. ETFs have been a major success in 2025, bringing billions in institutional money into crypto and making it easier for traditional investors to gain exposure without directly holding digital assets.

Such holiday derisking is common in financial markets and often reverses once normal trading resumes.

3. Aave Faces Internal Governance Drama Amid Price Drop

Aave is one of the largest decentralized finance (DeFi) protocols, a lending platform where users can borrow and lend cryptocurrencies without banks, earning interest or accessing liquidity.

Recently, its governance token AAVE crashed about 20% to around $148 due to an internal dispute. A controversial vote, timed over the holidays, proposes transferring key soft assets (like trademarks and social media handles) from Aave Labs (the development company) to the DAO (Decentralized Autonomous Organization, the community governance body).

Critics, including prominent insiders, call this a "hostile" move that could undermine the protocol's efficiency. Aave's success (holding ~60% market share in DeFi lending) stems from the balance between centralized development speed and decentralized oversight. Transferring control risks disrupting incentives and operations, potentially eroding its dominance.

The vote bypassed usual discussions, raising concerns about fairness during low-participation holidays. While decentralization is a core crypto ideal, rushed changes can introduce risks. This highlights governance challenges in DeFi: balancing community control with effective execution. Investors should monitor the vote outcome closely.

4. Hyperliquid Burns $912 Million in HYPE Tokens

Hyperliquid is a leading perpetual decentralized exchange (perps DEX), allowing traders to bet on price movements with leverage in a non-custodial way (users retain control of their funds).

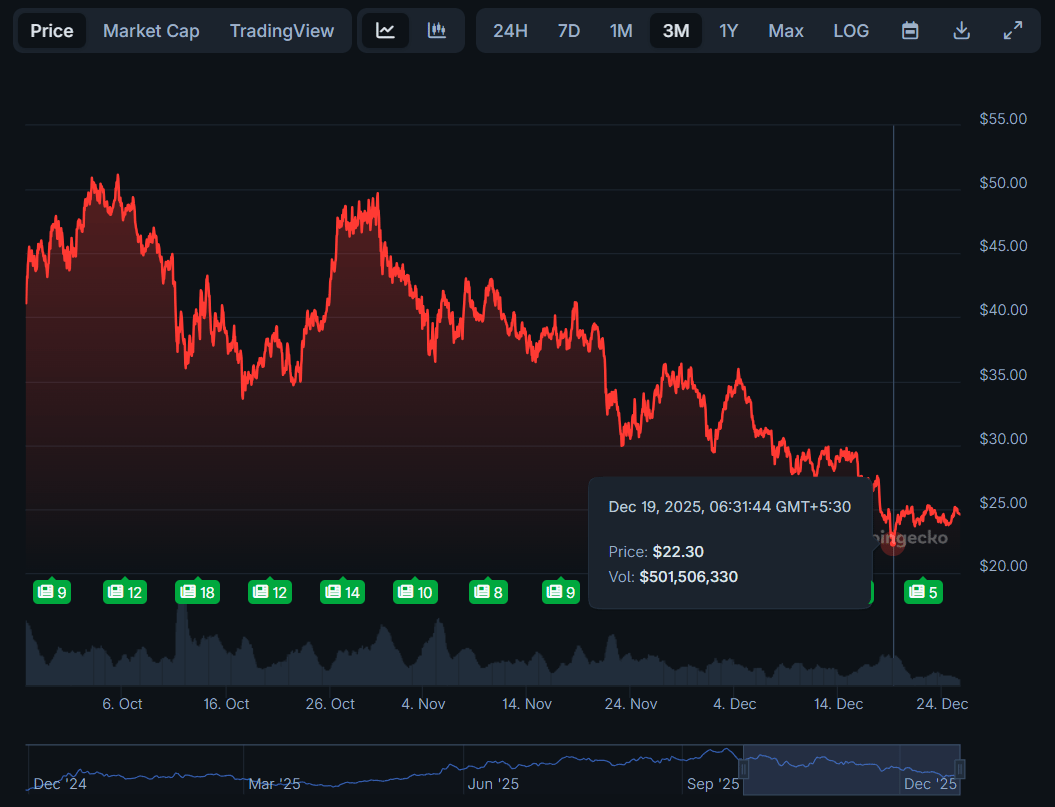

Its native token, HYPE, has seen volatility, dropping from $50 highs to around $24. In a positive development, the Hyper Foundation executed a massive token burn, permanently removing 37.51 million HYPE tokens worth $912 million from circulation. This reduces supply by ~13%, approved by an 85% validator vote (validators are network participants securing the chain).

Token burns are deflationary mechanisms common in crypto to increase scarcity and potentially support prices by reducing sell pressure. Combined with ongoing buybacks, this could help HYPE recover toward $30–40 if buying momentum sustains.

Burns contrast with traditional stocks, where companies rarely destroy shares. This move enhances supply transparency and aligns with community governance, potentially boosting confidence in Hyperliquid's maturing ecosystem.

Meme Corner

Closing Note

2025 has shown impressive growth through regulatory advances, institutional adoption, and innovative projects. Holiday outflows and governance tensions remind us that volatility remains, but the long-term outlook stays positive with stronger fundamentals and mainstream bridges like ETFs.

Thank you for reading. Merry Christmas once again. See you all tomorrow.